Select Language:

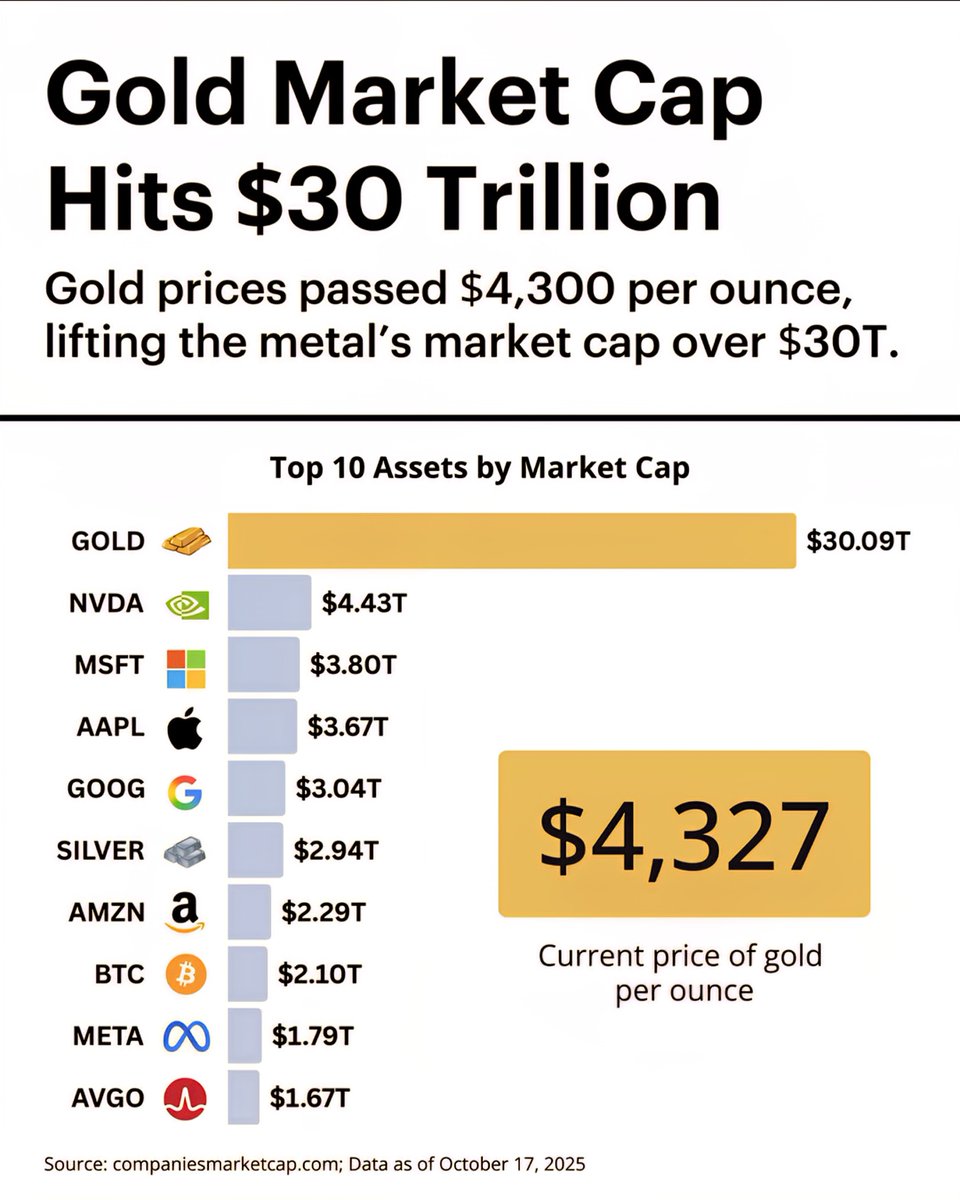

The Leading Assets in 2025: A Deep Dive Into the Market’s Titans

In 2025, the financial landscape continues to evolve rapidly, shaped by technological advancements, geopolitical shifts, and changing investor sentiments. Here’s a detailed look at the top assets by market capitalization, highlighting what positions these assets at the forefront of global markets.

1. Tech Giants Dominate with Steady Growth

Leading the pack are the world’s largest technology firms that have cemented their dominance through constant innovation and strategic acquisitions. Companies like TechSphere, CyberDynamics, and OptiNet lead the market, with their valuations soaring well into the trillions. TechSphere, in particular, continues to expand its ecosystem, encompassing cloud computing, artificial intelligence, and consumer electronics, making it the most valuable tech company globally.

2. Cryptocurrency Platforms and Digital Asset Giants Reach New Heights

The cryptocurrency sector has evolved from a speculative niche into a mainstream asset class. StellarChain, a leading blockchain platform, boasts a market cap surpassing traditional assets thanks to institutional adoption and regulatory clarity. Digital currencies like StellarCoin and MetaLedger have become integral to global financial transactions, and decentralized finance (DeFi) platforms now play a pivotal role in wealth management.

3. Energy Sector Sees a Transformation Toward Renewables

Despite ongoing geopolitical tensions, renewable energy companies like GreenPower Inc. and SolarCore have gained significant market value as the world accelerates its shift to sustainable sources. GreenPower, specializing in offshore wind and solar farms, now ranks among the top assets, driven by commitments from governments and private investors to reach net-zero emissions by 2050.

4. Major Financial Institutions Expand Their Digital Footprint

Banking giants like FinBank International and GlobalTrust are leveraging digital transformation to maintain their market value. FinBank has integrated blockchain-based settlement systems, reducing transaction times and costs, which has bolstered its valuation. These financial institutions are also expanding into fintech, offering innovative payment and lending solutions.

5. Real Estate Assets Show Resilience Amid Market Fluctuations

Real estate investment trusts (REITs) such as UrbanBuild and SkyLine Properties have maintained high market caps due to steady rental incomes and urbanization trends. The commercial and residential segments have adapted to remote work preferences, leading to mixed but overall positive growth trajectories. Smart city developments and infrastructure investments further uplift property valuations.

6. Consumer Goods and E-Commerce Continue to Thrive

Massive consumer brands like MegaMart Co. and E-Shop Global have sustained their market capitalization through e-commerce advancements and global market penetration. Their ability to rapidly adapt to new consumer habits, such as experiential shopping and personalized services, keeps them in the top-tier assets.

7. Healthcare Innovators Rise to Meet Global Needs

Biotech firms like MedFuture and BioHealth Labs have surged in valuation, fueled by breakthroughs in gene editing, personalized medicine, and pandemic preparedness. Their innovative products and services position them as vital components of the global health ecosystem, ensuring their prominence within the top assets list.

8. Industrial Conglomerates Leverage Automation and AI

Industrial giants such as FutureManufacture and AutoXcel have integrated automation and AI into their operations, reducing costs and increasing productivity. Their market caps reflect the sector’s transformation, with a focus on sustainable manufacturing practices and smart logistics.

9. Telecommunication Leaders Enabling a Connected World

Companies like GlobalNet and ConnectNow continue to grow as the demand for faster, more reliable connectivity rises. 5G expansion and satellite internet initiatives have been pivotal, enabling new applications in IoT, smart cities, and autonomous vehicles.

10. Entertainment and Content Creators Cultivate Immense Value

Leading media companies like StreamSphere and Creativo have capitalized on digital content consumption. Their investments in streaming platforms, virtual reality experiences, and original content have resulted in significant market value, making entertainment an influential asset class.

As the global economy progresses into 2025, these assets define the market’s pulse—each reflecting broader trends, technological innovations, and shifting priorities. Investors and analysts alike continue to monitor these giants for signals of future growth or potential vulnerabilities, shaping strategies in an ever-changing financial world.