Select Language:

Understanding Tariffs: A Financial Perspective

What Are Tariffs?

Tariffs are taxes imposed by a government on goods and services imported from other countries. They serve multiple purposes, ranging from generating government revenue to protecting domestic industries by making imported goods more expensive. While tariffs might seem like a straightforward way to address trade imbalances and foster local production, the economic implications of these taxes are more complex and nuanced.

The Historical Context of Tariffs in the U.S.

Tariffs have played a significant role in U.S. economic history, influencing trade policies and economic relations since the founding of the republic. With various ups and downs, the debate surrounding tariffs often centers around their effectiveness as a revenue source and their impact on consumers and businesses.

While tariffs were once a primary source of federal revenue, their contribution has significantly diminished in modern times. In the context of the recent administration, there have been efforts to revitalize tariff usage as a means of generating income.

The Economics of Tariffs

Economists uniformly agree that tariffs are usually passed on to consumers in the form of higher prices. This is particularly evident in the case of the tariffs instated by the previous administration. Studies estimated that these tariffs would increase costs for the average American middle-class family by anywhere from $1,200 to $2,600 annually.

Tariffs as Political Leverage

One of the principal arguments put forth by proponents of tariffs is their utility as political leverage. Tariffs can be used strategically in international negotiations, providing a government with tools to compel other nations to comply with specific demands or trade regulations. This perceived flexibility is often seen as a significant benefit in a global trade landscape that is constantly evolving.

The Reality of Tariff Revenue

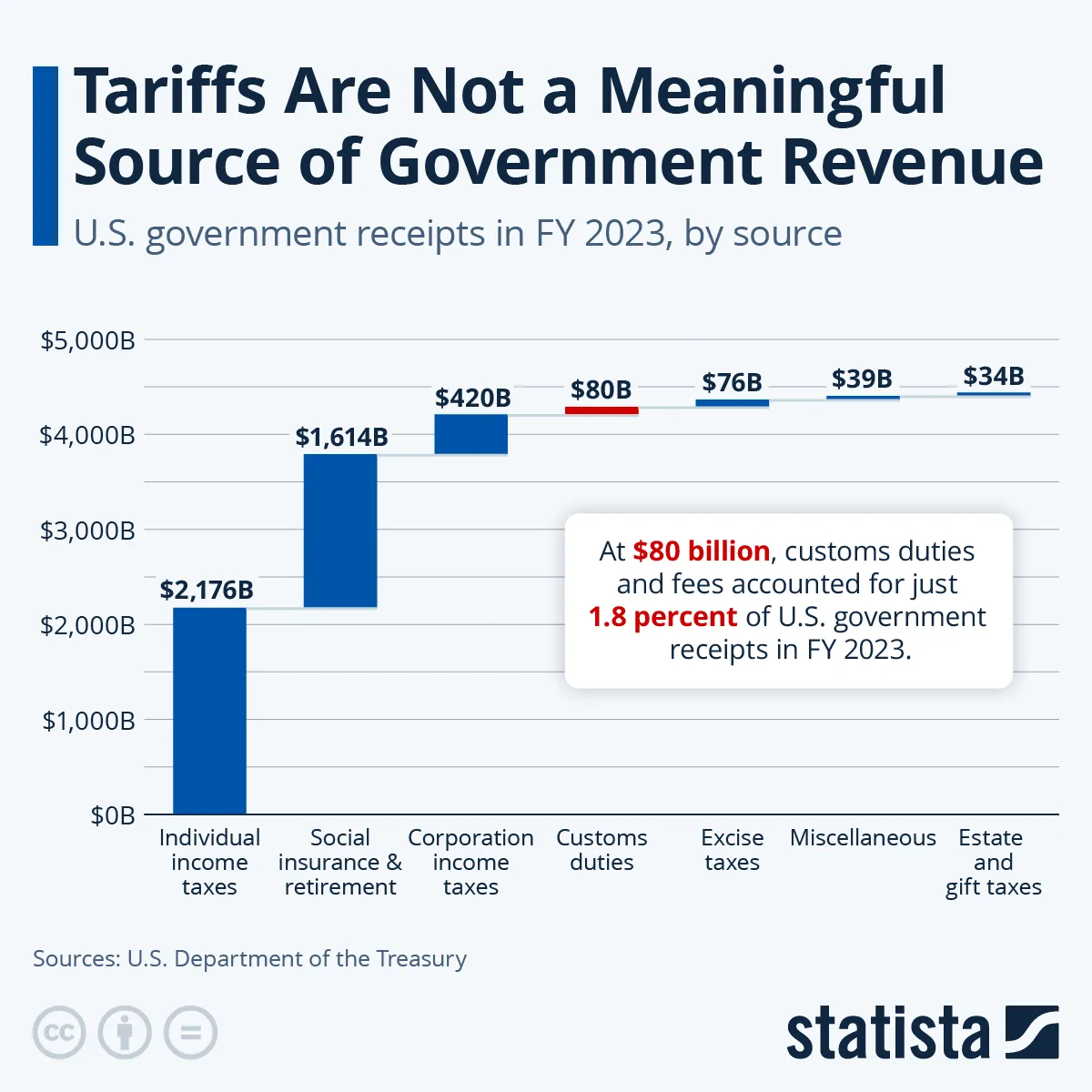

Despite the theoretical benefits, the actual contribution of tariffs to government revenue has been modest. For the fiscal year 2023, tariffs generated approximately $80 billion. This sum is trivial compared to the nearly $2.2 trillion collected through individual income taxes during the same period.

The Challenge of Replacing Income Tax with Tariffs

The idea of replacing income tax with tariffs gained momentary attention during political discourse. Proponents suggested that the revenue from new tariffs could offset income tax receipts entirely. However, basic mathematical analysis indicates that a universal tariff rate of around 70 percent would be necessary to match income tax revenue. Such a drastic measure would undoubtedly have catastrophic effects on imports, negating any potential benefits.

Projections and Predictions for Future Tariff Revenues

The Tax Foundation has projected that proposed tariff increases could yield approximately $2 trillion in additional revenue over the next decade. However, this projection does not take into account adverse dynamic effects, such as retaliatory tariffs imposed by other countries. Such responses could drastically reduce the revenue generated from U.S. tariffs, illustrating a fundamental weakness in relying on tariffs as a lasting solution for revenue generation.

Economic Impact on Consumers

The implementation of tariffs has direct consequences for consumers, who often find themselves paying higher prices for imported goods. This price increase disrupts household budgets and can disproportionately affect lower and middle-income families. Understanding who ultimately bears the burden of tariffs is crucial in assessing their effectiveness not just as a revenue source, but as a tool for economic policy.

Summary of Tariff Impacts

In summary, while tariffs are often positioned as a pathway to bolster government revenues and protect domestic industries, their efficacy is contested. The complexities surrounding their economic impact, particularly on consumers and international trade relations, present challenges that cannot be overlooked in the broader discourse on U.S. economic policy.

By examining tariffs in this light, we recognize both their historical significance and the nuanced effects they have on modern economics.