Select Language:

This illustration showcases RAM memory chips. SOURCE: REUTERS

Global demand for smartphones, personal computers, and gaming consoles is expected to decline this year as companies from the UK’s Raspberry Pi (RPI.L) to HP Inc. (HPQ.N) increase prices to offset rising memory chip expenses.

The rapid development of artificial intelligence infrastructure by U.S. tech giants like OpenAI, Google (owned by Alphabet – GOOGL.O), and Microsoft has consumed much of the world’s memory chip supply, driving up costs as manufacturers prioritize components for more profitable data centers over consumer devices.

Samsung (005930.KS), SK Hynix (000660.KS), and Micron (MU.O), the top three memory chip producers globally, have recently reported difficulties in meeting demand, despite posting strong quarterly earnings fueled by soaring semiconductor prices.

However, this price surge is now impacting consumer markets.

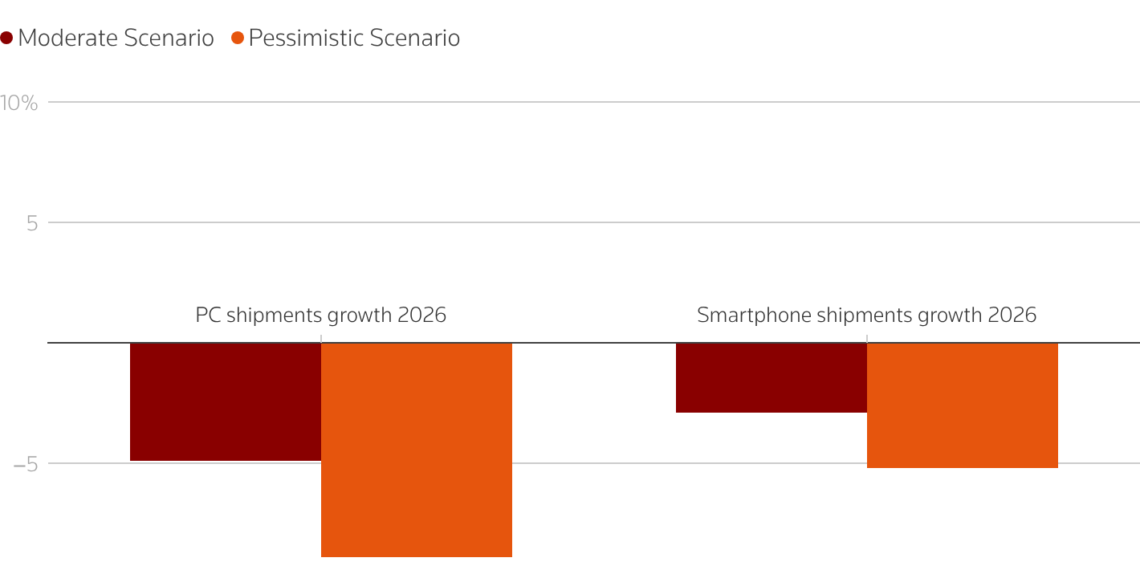

Research firms IDC and Counterpoint now project global smartphone sales will decline by at least 2% this year, a significant shift from their earlier growth forecasts. This would mark the first yearly drop in shipments since 2023.

The PC market is expected to contract by at least 4.9% in 2026, following last year’s 8.1% increase. Meanwhile, gaming console sales are forecasted to fall by 4.4% this year after an estimated 5.8% growth in 2025, according to TrendForce.

[Image: Chart showing decline in PC and smartphone markets]

CENTERED CAPTION: PC and smartphone sectors are preparing for downturns

Manufacturers face tough decisions

While some companies have already increased prices, industry giants like Apple (AAPL.O) and Dell (DELL.N) grapple with whether to absorb the costs and maintain margins or pass them on to consumers, risking dampened demand.

“Manufacturers may take on some costs, but given the scale of the shortage, higher prices for consumers are inevitable,” said Emarketer analyst Jacob Bourne.

“This will lead to tentative consumer device sales in 2026. Companies will face challenges trying to sell products during a period of broader inflation.”

The situation is compounded by expectations that price hikes will continue, possibly into next year. Counterpoint predicts memory prices will jump 40% to 50% in the first quarter, following a 50% increase last year.

“In the past two quarters, we’ve observed drastic inflation in some products—up to 1,000%—and prices keep climbing,” said Tobey Gonnerman, president of semiconductor distributor Fusion Worldwide.

“Consumers should anticipate significantly higher costs for laptops, smartphones, wearables, and gaming devices very soon.”

Analysts believe the impact will be most severe for manufacturers of budget and mid-range products, including Chinese brands like Xiaomi (1810.HK) and TCL Technology (000100.SZ), as well as PC maker Lenovo (0992.HK).

TrendForce reports that Dell and Lenovo are planning price hikes of up to 20% early in 2026.

Shares of Raspberry Pi, Xiaomi, Dell, HP Inc., and Lenovo dropped during the last three months of 2025, with Xiaomi experiencing the largest fall of 27.2%.

[Image: Chart illustrating decline in electronics stocks amid memory chip shortage]

CENTERED CAPTION: Electronics stocks react to the memory chip shortage

HP CEO Enrique Lores stated in November that the company would raise PC prices due to “significant” memory chip costs, while Raspberry Pi’s CEO called the cost increase “painful” in a December blog post announcing price hikes.

Weak demand outlooks could also hinder sales at electronics retailers like Best Buy (BBY.N), which had already warned last year that tariff-driven price increases might discourage potential buyers.

Apple is scheduled to report quarterly earnings on January 29, with Dell following on February 26, and Xiaomi typically reports in late March.

The dominance of Apple

Some analysts believe Apple, with its significant market power, pricing flexibility, and extensive supplier network, is better positioned to withstand the memory chip cost surge than smaller competitors.

Apple generally maintains stable prices for its flagship iPhone models in the U.S. between launch events. Last year, it absorbed hundreds of millions of dollars in tariff-related costs rather than passing them on to customers.

“Apple’s better positioning stems from its use of contract pricing (rather than more volatile spot markets), enabling it to secure more favorable prices,” said Morningstar analyst William Kerwin.

“However, they are not immune and might need to increase prices to cover higher input costs.”