Select Language:

Shares fell 13% in after-hours trading after Intel (INTC.O) released its earnings report, missing revenue and EPS estimates despite a boom in data centers. The company noted difficulty in meeting demand for its server chips used in AI data centers and projected Q1 revenue and profits below analyst expectations.

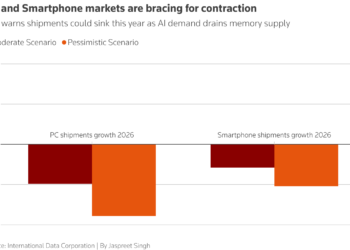

This highlights the challenge Intel faces in forecasting the global chip market, where many of its current products are based on decisions made years ago. Over the past month, the stock has surged 40%, partly driven by the launch of a new laptop chip aimed at reclaiming leadership in personal computers, even as a memory chip shortage is expected to hinder sales industry-wide.

Executives indicated that demand for AI-related server processors has taken them by surprise. Although they’re operating factories at full capacity, demand still outpaces supply, leaving potential profits in data center sales unfulfilled, while the new PC chip puts pressure on margins.

CEO Lip-Bu Tan expressed disappointment over the company’s short-term inability to fully meet market demand during a conference call. Intel expects this quarter’s revenue to range from $11.7 billion to $12.7 billion, below the $12.51 billion estimated by analysts, per LSEG data. Adjusted earnings per share are predicted to break even, versus analyst expectations of 5 cents per share.

Investors and analysts had anticipated that expanding data center investments driven by major tech companies would boost sales of Intel’s traditional server chips, which work alongside Nvidia’s (NVDA.O) leading GPUs. However, AI demand caught many cloud providers off guard, forcing them to upgrade aging hardware due to deteriorating network performance, according to CFO David Zinsner.

“Most were a little caught off guard,” Zinsner said. He also noted that despite owning manufacturing plants, Intel faces delays in shifting production types, as the company was not adjusting factory plans in response to changing data center demand.

External investments have helped lift Intel’s stock after a slump in 2024, with notable funding from Nvidia, SoftBank ($2 billion), and U.S. government stakes. However, a strategic shift has led Tan to cut back on aggressive investments in next-generation manufacturing processes, like the 14A technology, awaiting signals from key customers. When new customers show interest, it will likely reflect in increased capital expenditures.

Two clients are currently reviewing the 14A tech, with a decision expected in the second half of the year. Meanwhile, Intel’s planned capital spending may remain steady rather than decline. Last year’s high-profile investments have boosted optimism among investors, despite the company’s ongoing supply constraints delaying a full financial recovery, according to Michael Schulman of Running Point Capital.

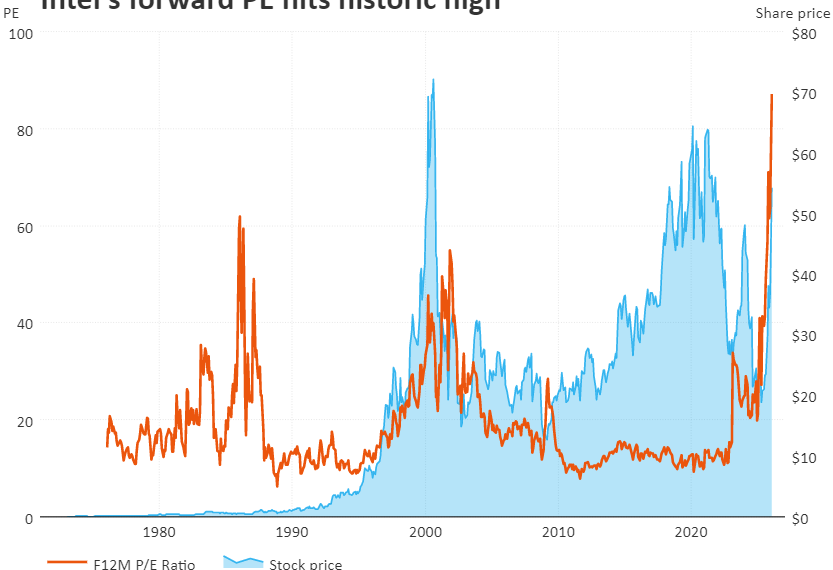

After experiencing a 60% decline in stock price in 2024, Intel’s shares rebounded 84% in 2025, outperforming the semiconductor index’s 42% gain. The company has begun shipping its new “Panther Lake” PC chips, produced using Intel’s critical 18A manufacturing technology—though early yields are below expectations and are pressuring margins.

Intel acknowledged that 18A yields are on track with its plans but not yet where they want them to be. Meanwhile, a global memory chip shortage has driven prices up and increased PC costs—a primary market for Intel. CFO Zinsner expects the supply shortage to peak early in Q1 and improve during Q2.

Despite advancements, Intel continues to lose market share in PCs to AMD (AMD.O) and Arm Holdings.