Select Language:

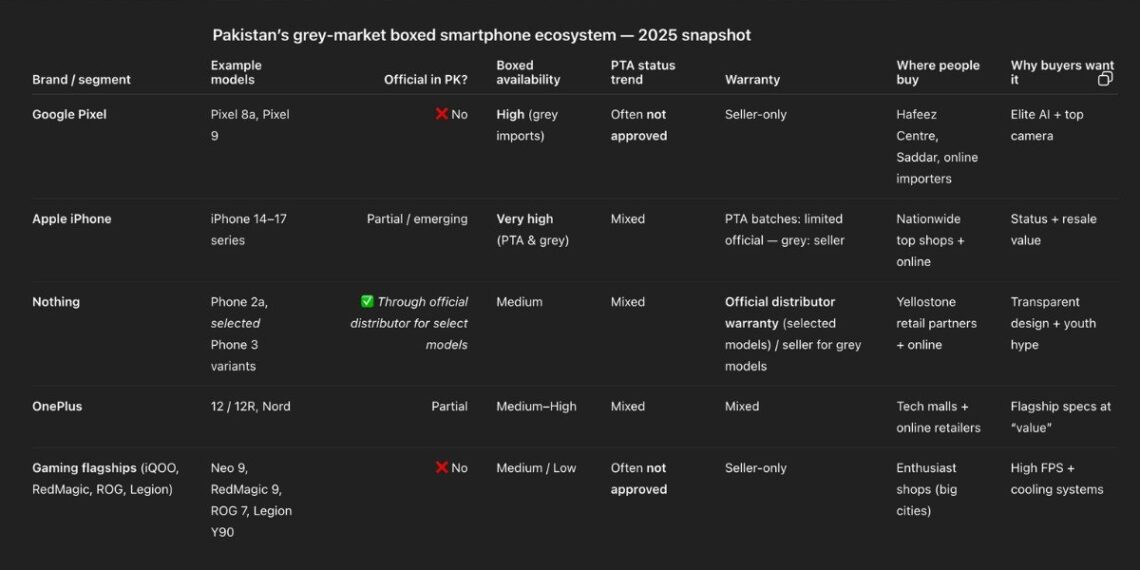

Sealed Pixels, Nothing, and flagship gaming devices are quickly becoming available, but buyers face challenges like PTA fees and uncertain warranties.

A growing number of Pakistani consumers are purchasing smartphones outside official local launches. Sealed Google Pixels, Nothing phones, OnePlus flagships, ROG and Redmagic gaming devices, and boxed iPhones are being sold through parallel imports and specialized resellers. This provides faster access to niche models but also increases the risk of regulatory issues, warranty problems, and repair uncertainties.

These devices generally arrive factory sealed. Sellers often provide shop-backed warranties and PTA registration services; however, the level of official support varies by brand and batch.

Sources: Pakistan Telecommunication Authority (DIRBS FAQ, IMEI registration rules); Federal Board of Revenue mobile duty schedules; market prices from Yellostone Pakistan, Cube Online, PhoneDroid, OLX listings, Hafeez Centre (Lahore)

Impact of the grey imports market on consumers

The grey import economy allows buyers to access desired models quickly, sometimes even before they are officially launched in Pakistan. However, this convenience comes at a price. Final costs often increase once PTA registration, brokerage fees, and customs duties are factored in, meaning the out-the-door price can be significantly higher than the advertised price. Warranties offered on these units are typically provided by shops rather than manufacturers, limiting recourse in case of hardware or software issues.

Repair times tend to be longer because region-specific spare parts are not typically available locally and must be imported. Additionally, some models require firmware or region adjustments that can prevent over-the-air updates or restrict certain network features. While buyers benefit from early access and novelty, they also face hidden costs, longer downtime, and uncertain long-term support.

Understanding the PTA tax gap explains why sealed Pixel and OnePlus prices fluctuate widely.

Listings for imported phones usually separate non-PTA stock from PTA-approved batches. Non-PTA devices may be cheaper initially, but buyers often pay extra for IMEI registration, customs duties, and brokerage fees. Retailers often market PTA approval as an optional add-on or promote limited PTA-cleared stock at higher prices. This creates a confusing price disparity; for some flagship models, the difference can amount to tens of thousands of rupees.

Where repairs are done (and why this is risky)

Most parallel imports lack authorized manufacturer service centers in Pakistan. Repairs are consequently handled by independent technicians or the selling shops. Region-specific variants—like some Pixels and gaming models—often require parts ordered individually, extending repair times and raising costs. While seller warranties exist, they are contractual promises from retailers rather than official manufacturer guarantees, and their enforcement and spare part availability differ depending on location and seller.

How retailers market ‘global variants’ and ‘PTA approved’ phones as premium options

Stores often label phones as “global ROM,” “US box,” “factory unlocked,” or “PTA ready” to justify higher prices for certain stock. Influencer reviews and international unboxing videos boost demand for these variants, which sellers capitalize on with upsells such as IMEI verification, PTA paperwork handling, and extended shop warranties. While these measures facilitate smoother transactions, they do not substitute for manufacturer-backed after-sales support.

Position of iPhones in the market

iPhones are available through both channels: PTA-approved boxed units sold via authorized resellers and cheaper grey imports listed on classifieds and in street markets. Global warranty coverage is limited without Apple’s official service presence in Pakistan; consumers often rely on reseller warranties or third-party repair networks. Persistent rumors suggest a possible Apple authorized reseller arrangement, which, if confirmed, could clarify warranty and service concerns.

Example: Nothing’s efforts toward formalization

The market’s structure is evolving. In an interview with The Express Tribune, Yellostone confirmed it is the official distributor for select Nothing Phone models in Pakistan, offering local warranty support. However, this formal channel is limited to specific models, and many other Nothing variants, along with competing brands, continue to be primarily available through parallel importers.

A balanced approach for buyers

If you’re interested in importing or early models, consider the following steps:

-

Check IMEI status on the PTA DIRBS portal prior to purchase.

-

Obtain a written warranty from the seller or distributor, detailing coverage duration and what faults are covered.

-

Confirm availability of spare parts and typical repair timelines with the seller.

-

Compare the final price—including PTA registration—rather than just the initial sticker price.

-

Prefer units sold through recognized distributors (like Yellostone for certain Nothing models), especially if warranty and parts support are priorities.

Today’s boxed imports are an integral part of Pakistan’s smartphone landscape. They offer consumers options and early access but shift post-sale responsibilities onto buyers. Whether this parallel import channel remains a temporary workaround or becomes a permanent feature depends on clearer regulatory policies, expanded official distribution, and stricter consumer protection enforcement.