Select Language:

Guangzhou Pharmaceutical Holdings, a top producer of traditional Chinese medicine, is planning a significant investment during China’s 15th Five-Year Plan (2026-2030). The company intends to allocate between 10 billion and 15 billion yuan (approximately $1.4 billion to $2.1 billion) toward research and development, and an additional 20 billion to 30 billion yuan (around $2.8 billion to $4.2 billion) for industrial investments, mergers, and acquisitions, according to the company’s leadership.

This substantial expenditure underscores the increasing pressure on the publicly owned drug company to speed up innovation and transformation amid slowing growth and fierce competition in its main sectors. The new strategy was outlined at an internal meeting held on December 27 by the company’s leadership, following the appointment of the new chairman in November of the previous year.

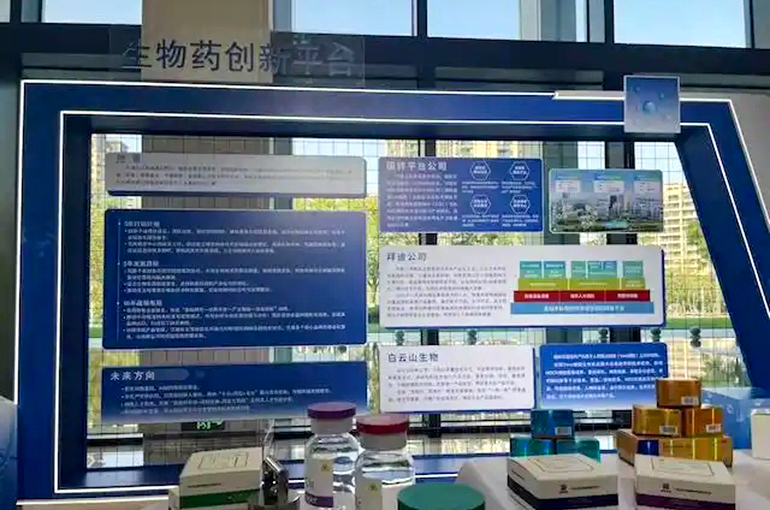

The challenges faced by Baiyunshan Pharmaceutical Holdings, its publicly listed subsidiary, help illustrate the broader issues. The company’s revenue primarily derives from three areas: Big South Medicine, Big Health, and Big Commerce. Big South Medicine focuses on manufacturing, producing Chinese and Western patent medicines, chemical active pharmaceutical ingredients, and biotech drugs. Big Health produces beverages, food, and health supplements, while Big Commerce—its largest revenue stream—handles pharmaceutical distribution, including wholesale, retail, import-export activities, medical devices, and health products.

Big Commerce accounts for a substantial portion of the company’s income, generating 29 billion yuan (roughly $4.1 billion) in the first half of this year—nearly 70% of total revenue—with a gross profit margin of just 6.1%. In contrast, Big Health brought in 7 billion yuan (about $995.9 million) with a profit margin of 44.7%, and Big South Medicine generated 5.2 billion yuan (around $738 million), boasting the highest profit margin at nearly 50%.

Despite these revenues, growth in both the Big Health and Big South Medicine divisions has been slow, hampered by increased competition within the beverage sector and the ongoing implementation of China’s centralized drug procurement policies. Last year, Baiyunshan invested approximately 828 million yuan ($118.1 million) into research and development, which represented just 4.3% of its revenue—considerably lower than industry norms.

The company’s leadership recognizes that transformation and innovation are essential. General Manager Chen Jiehui emphasized that the company must now prioritize achieving excellence in select areas and establish a business model driven by both independent research and development and strategic mergers and acquisitions. The goal is to gain tangible results: from acquired companies within one to two years, from acquired pipelines within three to five years, and from independent R&D efforts within five to ten years.