Select Language:

For many years, Dolby Labs has held a dominant position in the audio and video formats industry. Even if customers can't articulate why a movie sounds superior in Dolby Atmos or appears better on a television for having Dolby Vision, they recognize these terms as desirable markers when purchasing new TVs, sound systems, or subscribing to streaming platforms like Netflix. Dolby's pervasive influence reflects its groundbreaking innovations and strategic marketing; it’s rare to see a company that produces no physical merchandise yet enjoys such remarkable brand recognition.

However, Dolby might soon face challenges to its reign as shifts towards free alternatives gain momentum.

Royalties Necessitate Payment

The bulk of Dolby Labs' revenue arises from licensing its technologies to various manufacturers and service providers. Each sale of a TV, streaming device, or soundbar compatible with Dolby’s formats generates a small fee for the company. While the precise fee per unit is confidential between Dolby and its licensees, it totals hundreds of millions collectively.

Given the typically slim profit margins in consumer electronics, every cent is crucial. This reality has prompted industry players to collaborate on developing royalty-free alternatives to Dolby’s technologies.

The Clash of Video Formats

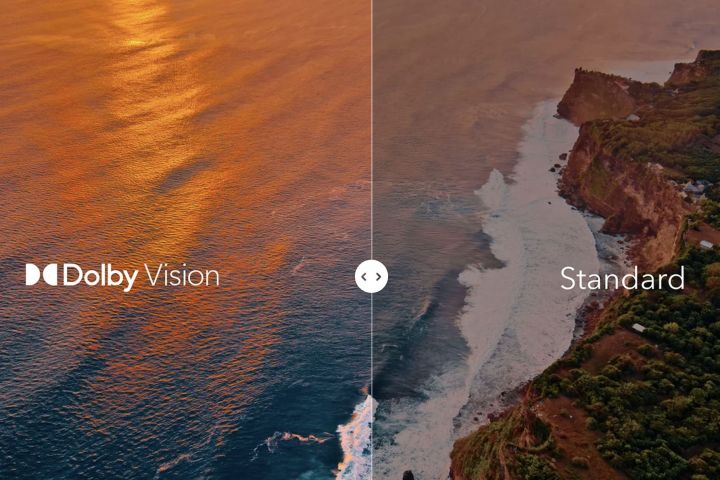

In the realm of video, Dolby Vision stands out as the leading dynamic HDR format — offering increased brightness and scene-by-scene adjustments for color and contrast compared to standard HDR.

It has become a staple for 4K UltraHD Blu-ray releases, and nearly every HDR-compatible streaming service features titles formatted in Dolby Vision.

Shortly after its launch, the HDR10+ format was developed by a consortium led by Samsung as a royalty-free, open-source alternative. Initial adoption of HDR10+ was sluggish, but Netflix's recent decision to provide HDR10+ for all HDR titles by the end of 2025 signals a decline in Dolby Vision's monopoly.

This shift is particularly significant for Samsung, which not only initiated the HDR10+ format but also declined to license Dolby Vision for its televisions.

The Challenge to Atmos

Dolby Atmos represents Dolby's other essential content technology. This spatial audio format has gained wide acceptance across films, television programs, and recently, music content through the Dolby Atmos Music initiative.

Considering the sheer volume of audio content and devices, along with Atmos surpassing its main competitors (DTS:X and Sony 360 Reality Audio) in terms of adoption, Dolby Atmos has effectively become synonymous with spatial audio.

A few years back, Samsung aimed to challenge Dolby Atmos, hoping to replicate its success with HDR10+.

This time, Samsung partnered with Google and the Alliance for Open Media, which boasts members like Apple, Amazon, Microsoft, THX, and Nvidia. The result is a new open-source spatial audio format officially named IAMF. However, since that name lacked appeal, it has been rebranded as Eclipsa Audio.

According to Samsung and Google, Eclipsa Audio provides the ability for anyone to create spatial audio at no cost. For professionals utilizing industry-standard software like Avid Pro Tools, there will soon be complimentary Eclipsa plugins available. Most critically, manufacturers can incorporate Eclipsa in their audio products without incurring licensing fees.

Like HDR10+, Eclipsa adoption may start slowly. Once again, Samsung is leading this initiative through hardware support, with its new flagship soundbar, the HW-Q990F, being the first to feature Eclipsa compatibility.

The Possibility of a Free Future

Despite the emerging competition, it’s unlikely that Dolby Vision or Dolby Atmos will fade away anytime soon. These technologies have a significant lead in market presence, and the public’s recognition of the Dolby brand adds significant value. The presence of Dolby labels on a product is viewed as assurance of superior audio or video quality, even among buyers lacking access to the content that maximizes those technologies. This perception motivates companies to keep licensing Dolby's innovations.

It may take years for audiences to equate the same level of quality with HDR10+ and Eclipsa, if that ever happens. Achieving this will necessitate substantial marketing efforts. If a major player like Apple were to champion these new technologies in the same way it has with Dolby Vision and Dolby Atmos, it could significantly shift the landscape.

Additionally, Dolby remains astute. Even with free alternatives threatening its market position, it continues to innovate. One such advancement is Dolby Atmos Flex Connect, a method enabling television manufacturers to provide wireless speakers that can be placed anywhere in a room without relying on a linked soundbar while still delivering an immersive sound experience.

Ultimately, the budding rivalry seems to be doing exactly what is expected — broadening choices for consumers and acting both as motivation and pressure for the next wave of technological advancements — even if it means that you may need to familiarize yourself with some new tech terminology before purchasing your next television.