Select Language:

WASHINGTON: In an unexpected shift, President Donald Trump announced a temporary reduction of the heavy tariffs he recently implemented on a multitude of countries, all while intensifying pressure on China, leading to a surge in global stock prices.

Following Trump’s declaration, various experts and lawmakers took to social media to share their opinions, with some accusing the president of engaging in a reverse “pump and dump” scheme that affected the U.S. economy.

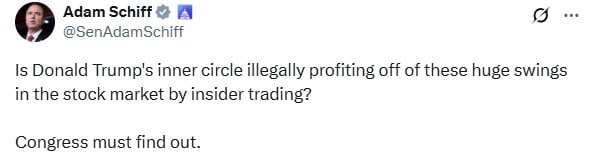

Democratic Senator Adam Schiff is advocating for an investigation into possible market manipulation or insider trading. He tweeted, “Is Donald Trump’s inner circle illegally benefiting from these drastic fluctuations in the stock market through insider trading? Congress needs to find out.”

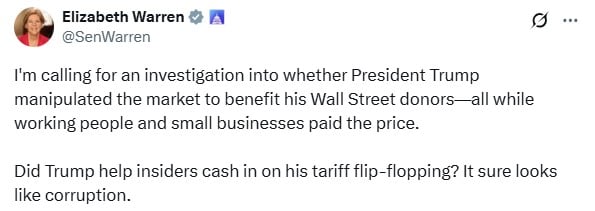

Senator Elizabeth Warren echoed these calls for an investigation, stating, “I’m demanding an inquiry into whether President Trump manipulated the market to favor his Wall Street donors, at the expense of everyday workers and small businesses.” She added, “Did Trump assist insiders in profiting from his sudden tariff changes? It certainly appears corrupt.”

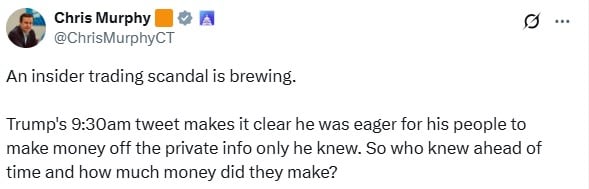

Furthermore, Senator Chris Murphy responded to Trump’s announcement, indicating, “A scandal involving insider trading may be unfolding. Trump’s tweet at 9:30 AM signaled his eagerness for his associates to benefit from private information not available to the public. Who had advance knowledge, and how much profit did they make?”

Trump’s announcement on Wednesday came just under 24 hours after new tariffs were implemented on many trading partners, marking the most significant period of financial market volatility since the onset of the COVID-19 pandemic. This instability wiped out trillions of dollars in stock market value and triggered a concerning rise in U.S. government bond yields, which caught the president’s attention.

“I thought people were overreacting; they were getting a bit too excited,” Trump remarked to reporters post-announcement, using a golf term.

Since resuming office in January, Trump has repeatedly threatened punitive actions against trading partners only to backtrack at the last minute. This erratic behavior has left world leaders perplexed and unnerved business leaders, who claim the unpredictability complicates market forecasts.

The recent events highlighted the uncertainty surrounding Trump’s policies and the ways in which they are conceived and executed.

U.S. Treasury Secretary Scott Bessent suggested that the reduction of tariffs was intended to incentivize negotiations with other countries. However, Trump later implied that the recent turmoil in the markets had influenced his decision-making.

Despite maintaining for several days that his policies were set in stone, he stated on Wednesday, “You need to be adaptable.”

Nonetheless, he continued to apply pressure on China, the second largest source of U.S. imports, announcing that tariffs on Chinese imports would increase to 125% from the 104% rate that had gone into effect at midnight, further escalating tensions between the two economic giants, which had already been engaged in a series of reciprocal tariff increases.

The reduction in country-specific tariffs is not entirely comprehensive. The 10% blanket duty on nearly all U.S. imports will remain in effect, as confirmed by the White House. The new measures will not impact existing duties on automobiles, steel, and aluminum, which remain in place.

The 90-day suspension does not apply to tariffs imposed on Canada and Mexico, which will continue to be subject to 25% fentanyl-related tariffs unless they comply with the rules set forth in the U.S.-Mexico-Canada trade agreement. These tariffs still remain until further notice, with an indefinite exemption for goods that comply with the USMCA.

Experts believe that China is unlikely to alter its strategy, which involves staying resolute, enduring the pressure, and allowing Trump to make overly ambitious moves. According to Daniel Russel, vice president of international security and diplomacy at the Asia Society Policy Institute, “Beijing perceives concessions as a sign of weakness and believes that yielding will only invite additional demands.”

Russel added, “While other nations may welcome the 90-day reprieve—if it lasts—such abrupt changes create the kind of uncertainty that businesses and governments dread.”

Trump’s tariffs initially incited a prolonged sell-off that resulted in the loss of trillions in global stock market value and exerted pressure on U.S. Treasury bonds and the dollar, which serve as the foundation of the global financial system. In response, Canada and Japan announced they would step in to stabilize the situation if necessary, a role typically assumed by the United States during economic crises.

Analysts indicated that the sudden increase in stock prices might not restore all the lost value. Surveys have indicated diminished business investment and household spending as a result of concerns over the tariffs’ consequences. A recent poll found that three out of four Americans anticipate rising prices in the near future.

Goldman Sachs revised its recession probability estimate from 65% down to 45% following Trump’s announcement, asserting that the tariffs still in place are likely to result in a 15% increase in the overall tariff rate.

Treasury Secretary Bessent dismissed inquiries regarding market turbulence, claiming that the abrupt shift benefited countries that adhered to Trump’s advice to avoid retaliation. He posited that Trump employed the tariffs to achieve maximum negotiating advantage, stating, “This was his strategy from the start,” and suggested that Trump had pushed China into a precarious position.

Bessent is the primary negotiator in discussions with over 75 countries concerning issues that may include foreign aid, military collaboration, and economic matters. Trump has also communicated with leaders from Japan and South Korea, and a delegation from Vietnam met with U.S. officials on Wednesday to discuss trade.

Bessent did not disclose how long these negotiations might take.

Trump indicated that an agreement with China could be on the horizon, although officials plan to prioritize discussions with other nations. “China wants to strike a deal,” Trump remarked. “They just aren’t sure how to approach it.”

He noted that he had been contemplating a pause in tariffs for several days. On Monday, the White House sharply denied a report suggesting that such a pause was under consideration, labeling it “fake news.”

Earlier on Wednesday, before the official announcement, Trump attempted to reassure investors, posting on his Truth Social account, “STAY CALM! Everything will turn out well. The USA will emerge bigger and better than ever!” He later added, “NOW IS A GREAT TIME TO INVEST!”

— Additional input from Reuters