Select Language:

The New Trade War: Understanding the Leverage Dynamics

The international trade landscape is constantly evolving, and recent developments have thrust a renewed trade war into the spotlight. With tariffs imposed and retaliatory measures threatened, it is crucial to analyze who holds more leverage in this escalating economic conflict. This blog delves into the complexities of trade relationships, focusing on the United States, China, and the European Union.

H2: An Overview of the Tariff Landscape

H3: U.S. Tariffs and Retaliation

Recently, the U.S. government implemented tariffs exceeding 10% on imports from various countries. The immediate response was swift, particularly from China, which retaliated by slapping an eye-watering 84% tariff on U.S. imports. The European Union also joined the fray, imposing tariffs on $23 billion worth of U.S. goods—though these tariffs were significantly smaller compared to China’s.

H3: The Current Tariff Situation

With the new round of tariffs, the total tariffs imposed by the U.S. on Chinese goods have escalated to an average of 104%. Meanwhile, the EU implemented additional tariffs at a rate of 20%. These figures serve to outline the aggressive posture both the U.S. and its trading partners have taken in an effort to assert dominance in international trade.

H2: Trade Dynamics: The U.S. vs. China and the EU

H3: The U.S. as a Buyer of Foreign Goods

The U.S. has positioned itself as a significant buyer of foreign goods, a trend that President Trump aimed to reverse. However, transforming this dynamic is fraught with challenges. U.S. tariffs could lead to increased costs for American consumers and businesses reliant on imports, thereby complicating the overall effectiveness of the tariffs aimed at changing trade behavior.

H3: China’s Position in the Trade War

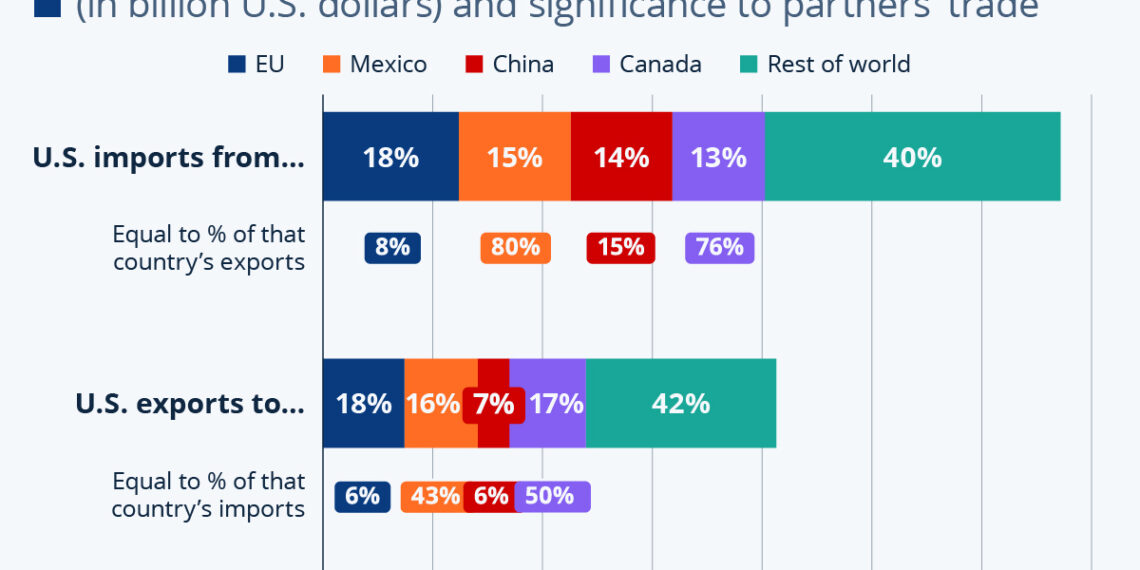

China represents a crucial market for the U.S., as it purchases approximately 15% of its exports. This significantly establishes the U.S. as China’s top international customer, thereby granting it considerable leverage in negotiations. However, China’s robust, centralized economy may be more resilient to the adverse effects of the trade conflict, revealing an interesting balance of power.

H3: Understanding EU Trade Dynamics

The trade relationship between the U.S. and the EU is also noteworthy. U.S. imports from the EU account for about 18% of total U.S. imports, while U.S. exports to the EU make up a similar share. By contrast, trade with the U.S. constitutes only 6% of EU imports and 8% of exports, suggesting that while critical, the EU does not depend on the U.S. to the same extent.

H2: Comparative Economic Strengths

H3: Economic Size and Resilience

While China’s economy is smaller than that of the United States in nominal terms, the EU’s economy stands on more equal footing with the U.S. in size. This economic parity affects the dynamics of the trade war, as both parties have much to gain or lose from the conflicts that arise.

H3: Retaliation Options for the EU

In addition to tariff strategies, the EU has options to target U.S. services—an area in which America has a significant competitive advantage. This potential form of retaliation adds another layer of complexity to the ongoing trade war, illustrating how interwoven trade relationships are.

H2: Impacts on Neighboring Trade Partners

H3: Canada and Mexico: The Ripple Effect

Two of the U.S.’s closest trade partners, Canada and Mexico, are feeling the reverberations of the escalating trade conflict. With their economies heavily reliant on trade with the U.S., the introduction of additional tariffs makes them particularly vulnerable. Tariffs projected at 12% on non-free-trade goods are an immediate concern, as previous tariffs on U.S. imports ranged from 10% to 25%.

H3: The Broader Economic Implications

The trade war will not only reshape bilateral relationships but may also have broader economic ramifications. The interconnected nature of modern economies means that setbacks in one region can quickly lead to adverse effects elsewhere. Understanding these dynamics is crucial for anticipating the potential fallout from the trade war.

As we explore these multi-faceted relationships and economic strategies, it’s clear that the stakes are high and the path ahead is fraught with uncertainty. The complexities of this trade war require a nuanced understanding of leverage and dynamics among the primary stakeholders involved.