Select Language:

Understanding Recent Trends in U.S. Consumer Spending and Saving

The landscape of U.S. consumer spending has undergone significant shifts recently, particularly in early 2025. In the face of economic uncertainty and looming tariffs, American consumers are demonstrating a change in behavior regarding their finances. This blog delves into the details of these trends, highlighting the implications for both the economy and consumer confidence.

The Decline in Consumer Spending

A Noticeable Drop

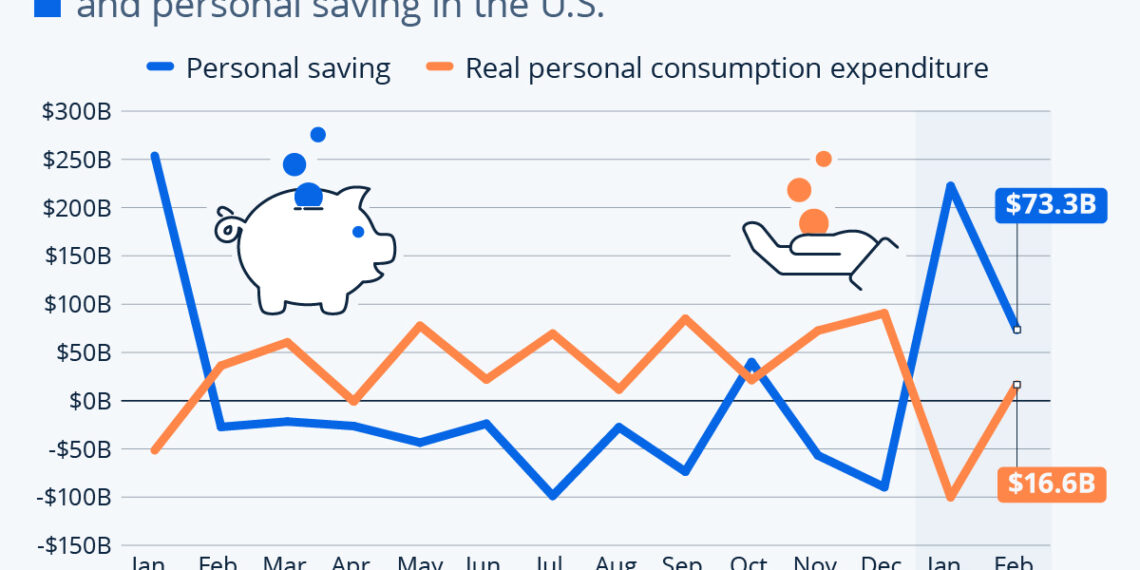

Recent reports indicate that U.S. consumer spending has shown noticeable signs of weakness, particularly in the first two months of 2025. This downturn is marked by a decline of over 0.6% in January alone. While February saw a slight improvement, with real personal consumption expenditure edging up by only 0.1% (equivalent to $16 billion on a seasonally adjusted basis), the overall picture remains concerning.

Breakdown of Spending Categories

The reduction in spending can largely be attributed to a significant drop in service spending. This decline was particularly noteworthy as it marked the first decrease since January 2022. The decrease in expenditures on services serves as a warning signal that consumers may be starting to reconsider their discretionary spending habits. This trend may reflect a growing sense of economic caution among consumers.

Shift Towards Durable Goods

Strategic Purchases Amidst Tariff Concerns

In a fascinating counterbalance to the decline in service spending, consumers have increased their spending on durable goods. This uptick suggests that consumers are making purchase decisions strategically, perhaps in anticipation of higher prices that new tariffs may impose. By buying durable goods earlier, consumers appear to be taking proactive measures to shield themselves from expected cost increases.

Implications for Retailers

For retailers, this shift signifies a critical juncture. As consumers prioritize durable goods over services, businesses may need to adapt their marketing strategies and inventory management to align with changing consumer preferences. This could involve promoting items perceived as essential or beneficial in the long run, as consumers navigate an uncertain economic landscape.

Rise in Personal Saving Rates

Increasing Personal Savings

Simultaneously, the reports reveal a significant increase in personal savings, which has seen a positive trend for the second consecutive month. The personal saving rate climbed from 3.3% in December to 4.6% in February. This increase suggests that consumers are prioritizing savings over spending amid economic uncertainty and inflationary pressures.

What High Savings Rates Indicate

While a higher saving rate can reflect a healthy financial buffer for consumers, it can also signify underlying concerns about the economy. When consumers become wary of the short-term economic outlook, they are more likely to delay large purchases and focus on building their savings. This shift in behavior often correlates with decreased consumer confidence, which can lead to a slowdown in overall economic growth.

The Broader Economic Context

Tariffs and Economic Uncertainty

The looming threat of new tariffs adds complexity to the current U.S. economic scenario. As consumers adjust their purchasing behaviors in anticipation of price hikes due to tariffs, businesses may experience fluctuations in demand across various sectors. This environment requires companies to remain agile, adapting to consumers’ shifting priorities and economic anxieties.

Consumer Confidence and Economic Growth

Ultimately, consumer confidence plays a vital role in driving economic growth. A decline in confidence can lead to reduced spending, creating a potential ripple effect that impacts businesses and the broader economy. As consumers exhibit both caution in discretionary spending and a surge in savings, the interplay between these factors will be essential to monitor as we move through 2025.

In summary, the trends emerging from early 2025 highlight a complicated landscape of consumer behavior shaped by economic uncertainty. As spending patterns change and savings rates rise, both consumers and businesses will need to navigate this evolving terrain to adapt successfully.