Select Language:

The State of the U.S. Auto Industry: Understanding Tariffs and Import Dynamics

As the U.S. auto industry faces challenges from foreign competition and evolving supply chain dynamics, important questions arise surrounding the need for protective measures such as tariffs. This discussion is vital, considering the implications for both national security and economic stability.

The Tariff Debate and National Security

In recent statements, former President Donald Trump referenced Section 232 of the Trade Expansion Act of 1962 to justify the implementation of tariffs on imported cars and auto parts. This section empowers the president to impose restrictions on imports that may threaten national security, arguing that a robust domestic auto industry is essential for the country’s industrial base.

Defining National Security in Economic Terms

The concept of national security in the context of the auto industry encompasses more than military defense; it includes ensuring the viability of critical sectors that can support national interests. With technological advancements and shifts in global trade, the auto industry is viewed as a cornerstone of America’s economic infrastructure that requires safeguarding against potential vulnerabilities.

Current Production Trends in the U.S. Auto Industry

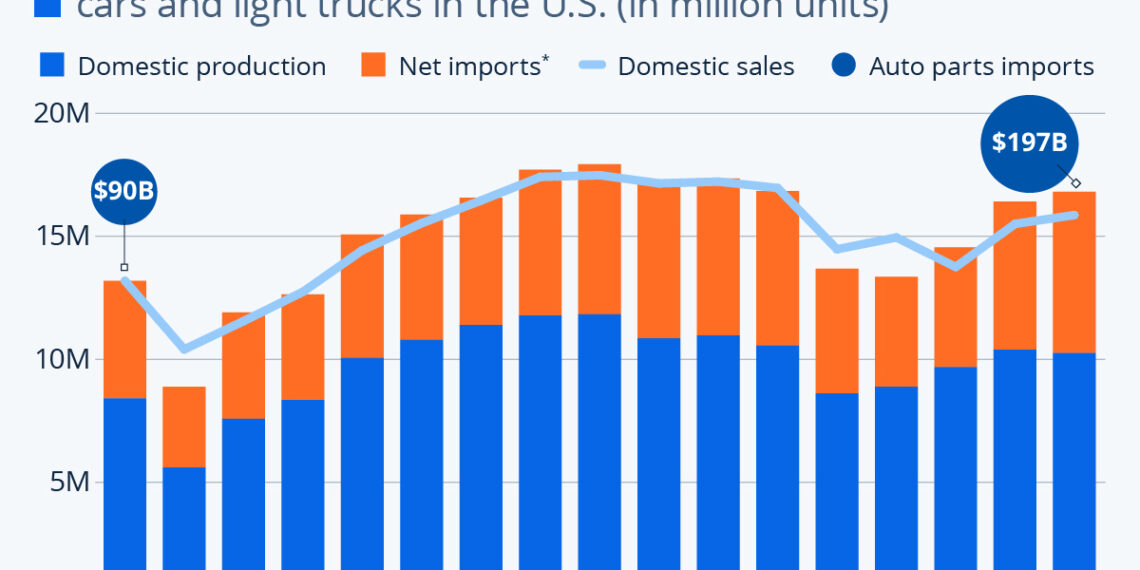

Recent data from the Board of Governors of the Federal Reserve System presents a clearer picture of the auto industry’s health.

An Overview of Vehicle Production

In 2024, the U.S. assembled approximately 10.25 million passenger cars and light trucks. This production figure has shown relative stability over the past two decades, albeit with notable exceptions during economic downturns such as the 2008 financial crisis and the COVID-19 pandemic.

Historical Context

The peak production year for light vehicles was 1999, with 12.6 million units assembled. The production numbers in 2024 reflect a significant long-term pattern, revealing that while the industry has faced setbacks, the current output is only 23% less than the peak nearly 25 years ago.

Import and Export Dynamics in the U.S. Auto Industry

As part of the evolving landscape, both export and import figures play a crucial role in understanding the true state of the U.S. auto market.

The Balance of Exports and Domestic Market Supply

Last year, 1.5 million vehicles produced in the U.S. were exported, leaving the domestic market with approximately 8.5 million vehicles. Despite importing 8 million light vehicles—representing roughly 50% of the total sales—the share of domestic production in relation to domestic sales remains significant.

Fluctuating Import Shares

Since 2008, the share of imported vehicles has ranged between 41% to 50%. As of 2024, domestic production accounted for 65% of the market, consistent with the average since 2008. This steady ratio counters allegations of a drastic decline in local manufacturing, suggesting that the situation may not be as dire as portrayed by proponents of tariffs.

The Surge in Auto Parts Imports

While vehicle production has maintained a relatively stable outlook, the dynamics of car parts imports tell a different story.

Significant Growth in Auto Parts Imported

According to the International Trade Administration, auto parts imports skyrocketed from $90 billion in 2008 to a staggering $197 billion by last year—a 119% increase. This surge highlights the complexities of modern automotive manufacturing, where many vehicles marketed as “made in America” are actually comprised of a large proportion of foreign components.

Implications for the Value Chain

The increase in parts imports reflects the broader trend towards global supply chains in the automobile sector. As manufacturing processes become more reliant on international components, questions arise about the sustainability of domestic employment and production practices.

Employment in the U.S. Auto Industry

One of the most critical aspects of the tariff and production discussions is their impact on employment within the auto industry.

Job Trends Over the Years

According to the Bureau of Labor Statistics, the motor vehicle and parts industry accounted for around one million jobs in February 2025. Though this figure represents a decrease from 1.3 million jobs at the turn of the century, it marks a period of growth relative to the aftermath of the financial crisis, indicating resilience in the labor market despite outsourcing trends.

Analyzing Job Losses and Gains

The implications of outsourcing and increased imports raise concerns about the long-term sustainability of automotive jobs. Nevertheless, as the data suggests, the current job landscape, while not at peak performance, remains relatively stable considering broader economic challenges.

The Future of Tariffs and the U.S. Auto Industry

With ongoing debates about the necessity of tariffs and protectionism, the U.S. auto industry stands at a crossroads. The challenge lies in balancing national security interests with economic realities, as well as the complexities introduced by globalization. Understanding the interplay between protection measures, production trends, import dynamics, and employment statistics is essential for framing a coherent strategy for the future.