Select Language:

Understanding the Impact of Trump’s Tariffs

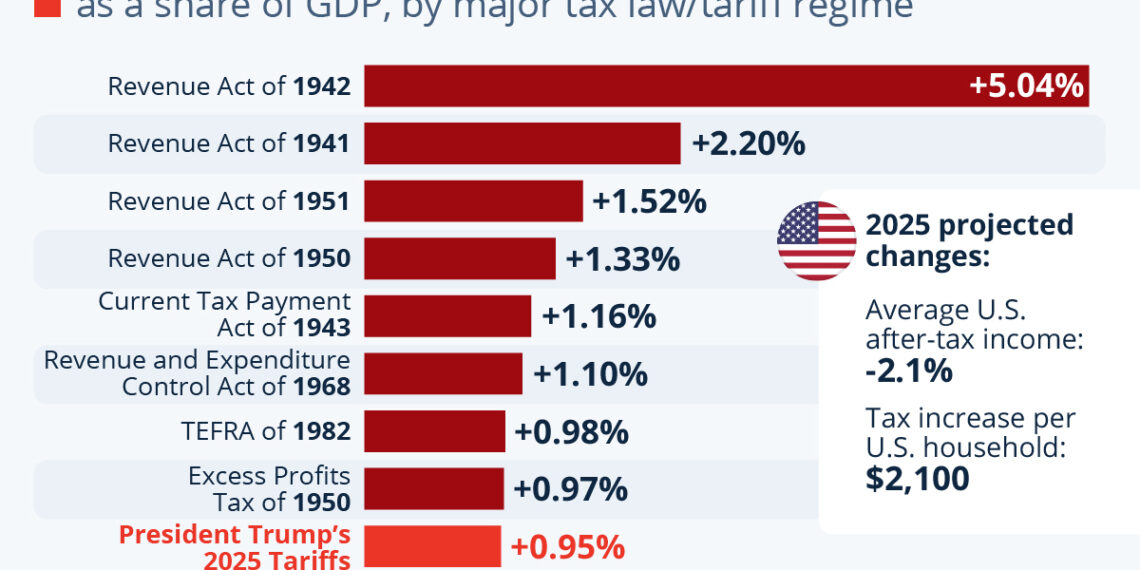

The Trump administration’s implementation of reciprocal tariffs has been a significant point of contention in economic discussions, particularly given its projected revenue implications and broader economic effects. Announced on April 2, the tariffs have been described as the largest tax hike since 1982, raising questions about their impact on consumers, companies, and the overall economy.

The Projected Revenue Increase

According to analysis by the Tax Foundation, these tariffs are expected to generate an additional $290 billion in government revenue by 2025, which translates to approximately 0.95% of the Gross Domestic Product (GDP). However, the dynamics of how tariffs function suggest that the burden is largely borne by U.S. entities. Though the government frames tariffs as taxes on foreign products, it is often the American importers who ultimately absorb these costs. The expectation is that these importers will transfer the increased costs down the line, affecting consumers directly.

Conventional vs. Dynamic Modeling

The Tax Foundation utilized conventional revenue estimates based on the new tariffs for its calculations. It anticipates a government revenue increase of $290 billion. However, adopting a dynamic economic model—one that accounts for changes in behavior and the broader impact of tariffs—would lower this estimate to about $244 billion. This reduction considers potential losses in tax income due to decreased personal and business earnings caused by the tariffs.

Implications for the Overall Economy

JPMorgan has characterized the tariff strategy as the most significant tax hike since 1968, citing an increase in the overall U.S. tariff rate projected to reach 22% by 2025. In contrast, the Tax Foundation’s estimate is slightly lower at 18.8%. This divergence in projections raises important questions about the long-term viability of the tariffs and their ability to generate expected revenue.

Potential for Global Recession

With rising tariffs, concerns regarding global economic stability have been amplified. JPMorgan has reported an increase in the risk of a global recession climbing from 40% to 60% due to these trade policies. This sentiment is echoed across various organizations, including the libertarian Cato Institute, which criticized the tariffs as hidden “massive tax increases” detrimental to free trade.

Impact on U.S. Incomes

The Tax Foundation’s analysis further estimates that these tariffs could reduce the average U.S. after-tax income by approximately 2.1%. However, the effect is somewhat less severe for those in higher income brackets, with the 99th and 100th percentiles seeing a smaller decrease of 1.8%. This effective tax increase translates to about $2,100 for the average U.S. household by 2025, leading to a re-evaluation of disposable income and consumer spending.

Effects on GDP and Employment

Updates regarding the impact of the tariffs on U.S. GDP and employment forecasts present a bleak outlook. The tariffs imposed on April 2 are projected to lead to a 0.5% decrease in GDP and the loss of nearly 400,000 full-time equivalent jobs. This is in addition to the existing tariffs on other countries, which already contribute to a GDP reduction of about 0.2% and a loss of 270,000 jobs.

Comparison with Past Trade Wars

To put these numbers in perspective, analyses of prior trade conflicts, such as the 2018-2019 trade war with China, demonstrate similar detrimental trends. That conflict alone was estimated to reduce GDP by about 0.2% and eliminate approximately 142,000 jobs.

Conclusion

In summation, the tariffs announced by the Trump administration have significant implications for U.S. economic health, underscoring the complexity of trade policies and their far-reaching effects on government revenues, employment rates, and consumers’ financial well-being. Understanding these dynamics is crucial not only for policymakers but also for businesses and households grappling with the tangible impacts of such financial decisions.