Select Language:

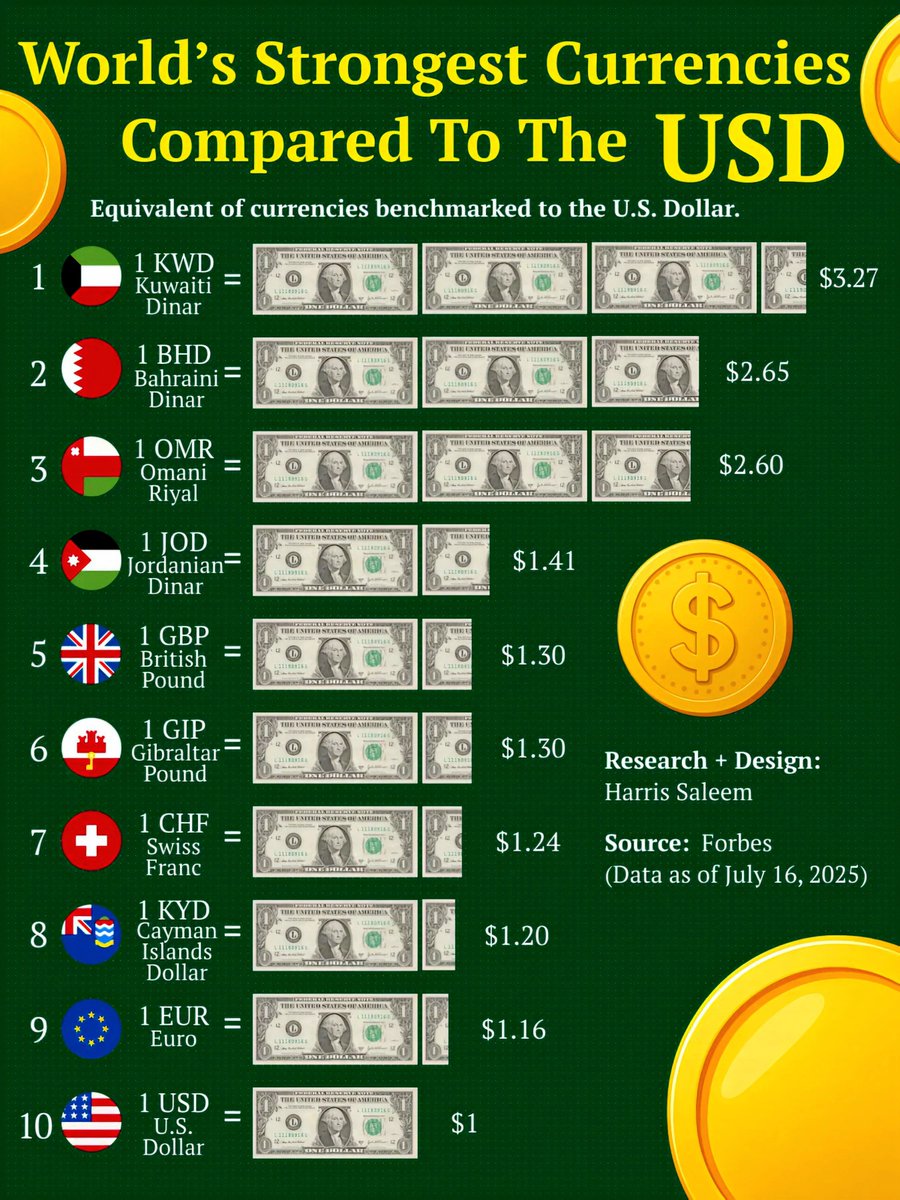

The Top 10 Strongest Currencies in 2025 Compared to the U.S. Dollar

1. Kuwaiti Dinar (KWD)

The Kuwaiti Dinar continues to reign as the most powerful currency globally in 2025. Thanks to Kuwait’s strong oil reserves and a stable political environment, the Dinar remains highly valuable against the US dollar. With an exchange rate approaching 3.25 KWD to 1 USD, it exemplifies the nation’s robust economy and significant financial reserves.

2. Bahraini Dinar (BHD)

Bahrain’s Dinar maintains high strength, largely due to the country’s diversified economy that includes banking, finance, and oil industries. Its exchange rate stands at approximately 0.38 BHD to 1 USD, reflecting Bahrain’s stable economic policies and investment climate. The government’s focus on economic reforms and financial services has cemented the Dinar’s position.

3. Omani Rial (OMR)

Oman’s Rial is renowned for its resilience and strength, trading around 0.38 OMR to 1 USD in 2025. The country’s efforts to diversify beyond oil dependency and invest in infrastructure projects have helped uphold the Rial’s high value. Its stability is further reinforced by prudent monetary policy and steady government growth strategies.

4. Jordanian Dinar (JOD)

The Jordanian Dinar remains a strong currency in the regional context, valued at roughly 0.70 JOD to 1 USD. Despite regional challenges, Jordan’s economic reforms, solid fiscal management, and strategic alliances have contributed to its currency’s strength. Its relative stability makes it a key regional currency in 2025.

5. Cayman Islands Dollar (KYD)

The Cayman Islands Dollar boasts a high valuation at about 0.83 KYD to 1 USD. The island’s thriving offshore financial services sector, tourism, and high-income inhabitants help sustain its strength. The currency’s stability attracts international investment, contributing to its continued dominance.

6. European Euro (EUR)

The Euro remains one of the world’s leading currencies, valued at around 1.07 USD in 2025. Despite economic challenges and geopolitical tensions, the Eurozone’s collective monetary policy, monetary reserves, and economic resilience shape its currency strength. It continues to be a key trade and reserve currency in global markets.

7. Swiss Franc (CHF)

The Swiss Franc (CHF) remains a safe haven currency, trading at roughly 1.09 USD. Switzerland’s stable political system, strong banking sector, and prudent fiscal policies underpin the Franc’s appeal. Its reputation for financial stability attracts global investors seeking safety amid geopolitical uncertainties.

8. British Pound Sterling (GBP)

The British Pound, in 2025, holds its position as a robust currency, valued at about 1.24 USD. Despite Brexit aftermath and ongoing economic adjustments, the GBP benefits from London’s status as a global financial hub. Its strength is driven by the country’s diversified economy, innovation, and political stability.

9. Singapore Dollar (SGD)

The Singapore Dollar remains a key Asia-Pacific currency, trading close to 1.35 SGD to 1 USD. Singapore’s strategic location, strong financial sector, and government policies favor its currency’s stability. Its open market economy and robust trade environment uphold its high value.

10. Norwegian Krone (NOK)

The Norwegian Krone’s strength, trading at approximately 10.10 NOK to 1 USD, underscores Norway’s wealth derived from abundant natural resources, particularly oil and gas. The country’s prudent fiscal policies and sovereign wealth fund safeguard the Krone’s value amid volatile markets.

Keeping an eye on these currencies provides insight into the shifting global economic landscape in 2025. Countries with stable political systems, rich natural resources, and diversified economies continue to bolster the strength of their currencies against the U.S. dollar. However, geopolitical tensions, market fluctuations, and economic reforms will undoubtedly influence currency values moving forward.