Select Language:

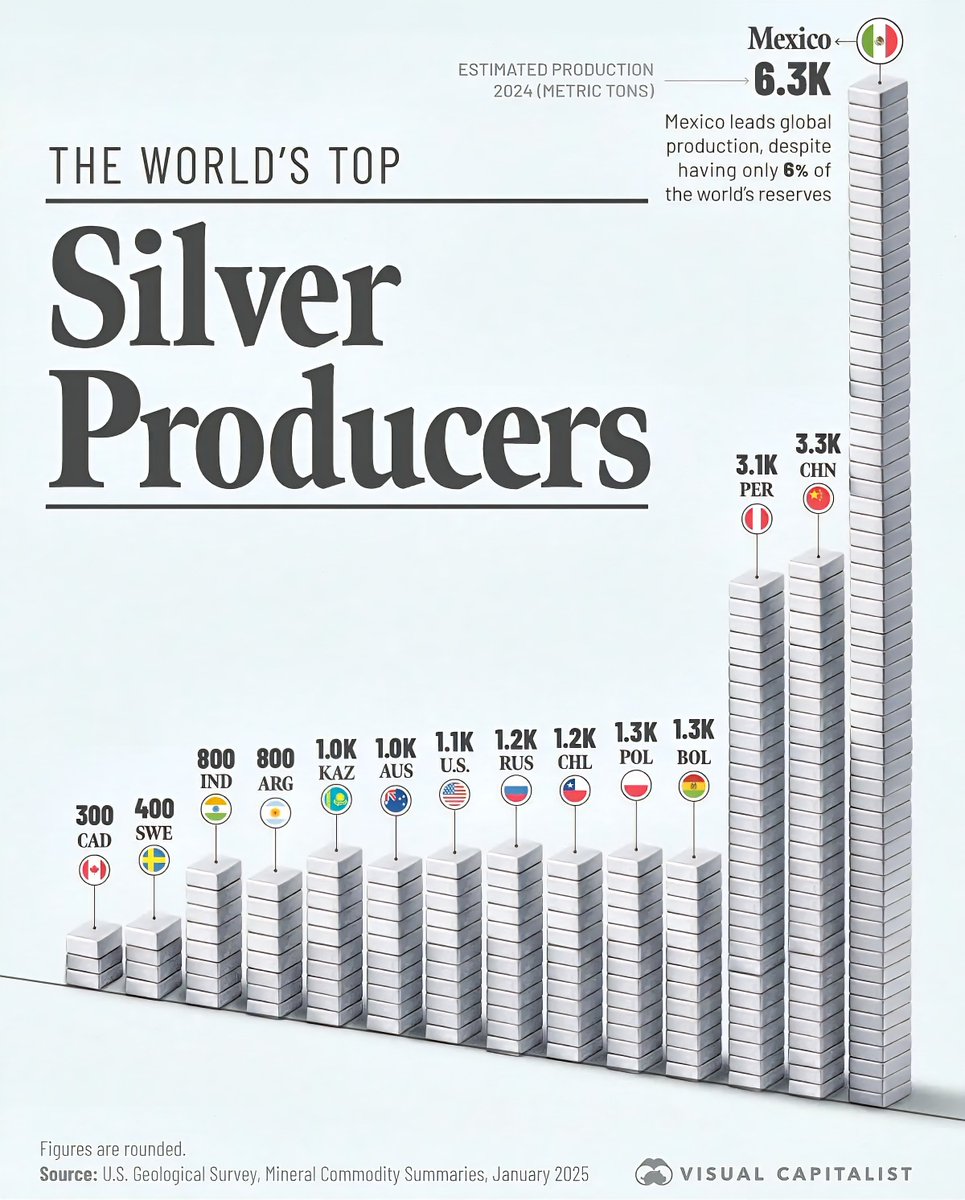

Top Silver Producing Countries in 2025: A Global Overview

Mexico Continues Its Lead as the World’s Silver Heavyweight

Mexico remains the dominant force in silver production for 2025, with approximately 6,300 metric tons mined this year. Its rich deposit reserves and extensive mining infrastructure sustain its top spot globally. The country’s mineral-rich regions, especially in the states of Zacatecas and Durango, contribute significantly to this enormous output. Mexican silver exports continue to play a pivotal role in the global commodity markets, influencing prices and investment trends in precious metals.

China Closes In, Securing the Second Place

China produces around 3,300 metric tons of silver annually, positioning it just behind Mexico. The nation leverages its vast industrial base and large-scale mining operations to maintain its status. Notably, Chinese silver output is boosted by its diversified mining sectors across provinces like Inner Mongolia and Henan. As China’s urbanization accelerates, the demand for silver in electronics and renewable energy sectors propels increased domestic production.

Peru’s Silver Industry Surges Amidst Reshaped Global Markets

Peru has become a notable silver powerhouse, with an estimated 3,100 metric tons produced in 2025. Its mining industry benefits from innovative extraction technologies and resilient mine operations. The country, often termed the “Silver Capital of the World,” exports a significant portion of its output to North America and Asia, reinforcing its key position in the global supply chain.

Bolivia and Poland: Compact but Crucial Contributors

Bolivia and Poland each produce around 1,300 metric tons of silver this year. Bolivia’s mineral-rich deposits, particularly in Potosí, continue to bolster its mineral output. Meanwhile, Poland’s well-developed mining infrastructure and friendly regulatory environment support steady silver production. Both countries play essential roles in regional and global silver markets, often serving as supply sources for specialty industries.

Chile and Russia: Major Players with Strategic Significance

Chile and Russia contribute approximately 1,200 metric tons each. Chile, with its sophisticated mining industry centered in the Andes, is a key supplier of silver, often alongside copper. Russia’s extensive mining operations in Siberia and the Ural Mountains aid its consistent silver output. Both nations are exploring new extraction methods to expand their production capacity further.

United States: A Steady Contributor

The U.S. produces around 1,100 metric tons of silver annually. Major mining states, such as Nevada and Arizona, host lucrative silver deposits. American silver focus increasingly extends toward sustainable and environmentally responsible extraction practices, aligning with global trends for eco-conscious mining.

Australia and Kazakhstan: Rising Trends

Australia and Kazakhstan each contribute approximately 1,000 metric tons. Australia’s mining industry benefits from advanced technology and stringent environmental standards, ensuring long-term, sustainable production. Kazakhstan’s mining sector is gaining momentum with increased foreign investment and modernized extraction techniques, positioning these nations for growth in future years.

Argentina and India: Emerging Markets in Silver

Argentina and India each produce about 800 metric tons. Argentina’s mineral deposits, especially in regions like Jujuy, are gaining recognition. India’s expanding industrial base fosters domestic silver consumption, alongside modest local production that is set to grow as new deposits are explored.

Sweden and Canada: Specialized but Smaller-scale Players

Sweden and Canada, with approximately 400 and 300 metric tons respectively, are notable for their specialized mining operations. Sweden’s focus on sustainable metal extraction, alongside Canada’s advancements in environmentally friendly techniques, position these nations as innovative contributors to the global silver supply chain.

In Summary

The world’s silver production landscape remains highly concentrated, with Mexico leading robustly, followed by China and Peru. The collective efforts of nations like Bolivia, Poland, and Russia fill out the top ranks, driven by advancements in mining technology and increasing global demand, particularly in electronics, renewable energy, and industrial applications. As the industry evolves, these countries’ efforts yield a resilient and adaptive silver supply chain geared for the demands of 2025 and beyond.

Note: The figures are rounded estimates based on 2024 production data.

Source: U.S. Geological Survey, Mineral Commodity Summaries, January 2025.