Select Language:

China, the U.S., Germany, and India Dominate Global Manufacturing in 2025

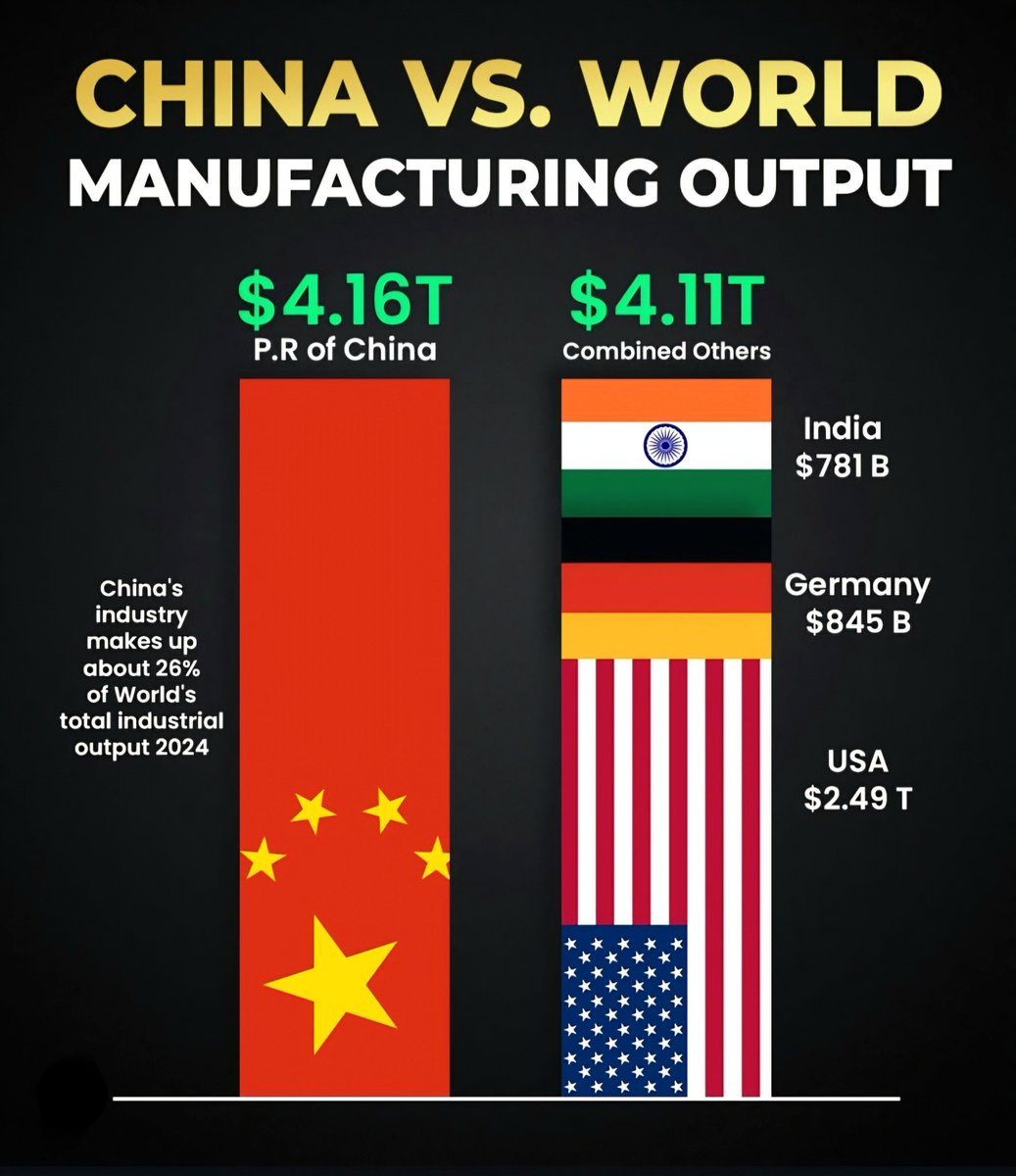

1. China Leads with Over a Quarter of the World’s Manufacturing Output

In 2025, China maintains its position as the world’s manufacturing powerhouse with a staggering $4.16 trillion in production, comprising around 26% of the global total. This impressive figure underscores China’s ongoing dominance in manufacturing, driven by extensive infrastructure, advanced supply chains, and large-scale industrial investments. The country continues to lead in sectors ranging from electronics to textiles, sustaining its critical role in the global supply chain.

2. The United States Holds Strong as the Second-Largest Producer

The United States comes in second, with manufacturing output reaching approximately $2.49 trillion. Although significantly behind China, this figure underscores the resilience and innovation capacity of the U.S. manufacturing sector. The nation focuses heavily on high-tech, aerospace, and automotive industries, leveraging its technological prowess and skilled workforce to stay competitive in an evolving global economy.

3. Germany Remains a European Manufacturing Powerhouse

Germany’s manufacturing sector contributed about $845 billion in 2025, reaffirming its position as Europe’s leading manufacturing country. Known for precision engineering, automotive manufacturing, and industrial machinery, Germany’s industry benefits from a high level of automation and sustainable practices, which help maintain its competitive edge globally.

4. India Continues Rapid Growth with Notable Manufacturing Expansion

India’s manufacturing output has surged to approximately $781 billion, reflecting its rapid industrial development and efforts to bolster its manufacturing base. The country’s “Make in India” initiative, along with regional infrastructure modernization and increased foreign direct investment, has propelled India into the top tier of global manufacturing players.

5. Combined Output of the Top Four Countries Surpasses $8 Trillion

Altogether, China, the United States, Germany, and India account for a combined manufacturing output of nearly $8.27 trillion, representing over half (51%) of all global manufacturing activity. This concentration of production underscores the ongoing trend of manufacturing hubs consolidating in these leading economies, which are pivotal in setting global industry standards.

6. Global Manufacturing Dominance and Future Outlook

When aggregating their outputs, these nations’ combined manufacturing production stands at $8.27 trillion out of a total estimated global manufacturing volume of approximately $16.2 trillion in 2025. The remaining 49% is distributed among emerging markets, Southeast Asian countries, and other developed nations. The dominance of China and the U.S. highlights the ongoing competition and cooperation in global manufacturing, with Europe and India steadily increasing their shares.

7. The Significance of the Collective Output

The collective output from China, the U.S., Germany, and India constitutes more than half the world’s manufacturing, emphasizing their critical roles in the global economy. Their production levels influence global supply chains, trade policies, and technological innovations, making them key players on the international stage.

8. Sources and Data Validation

The latest figures are based on data from the World Bank’s 2025 manufacturing report, with detailed analysis indicating sustained growth in these countries despite global supply chain disruptions, technological shifts, and geopolitical tensions.

Conclusion

The manufacturing landscape of 2025 underscores the importance of China, the United States, Germany, and India in shaping global industry trends. Their combined output not only reflects their economic resilience but also highlights the interconnected nature of modern manufacturing, which continues to evolve amidst technological innovation and geopolitical change. As they lead the way, emerging markets worldwide are watching closely and strategizing to increase their share in the global manufacturing pie.

Note: All figures are approximate estimates based on the latest available data from the World Bank in 2025.