Select Language:

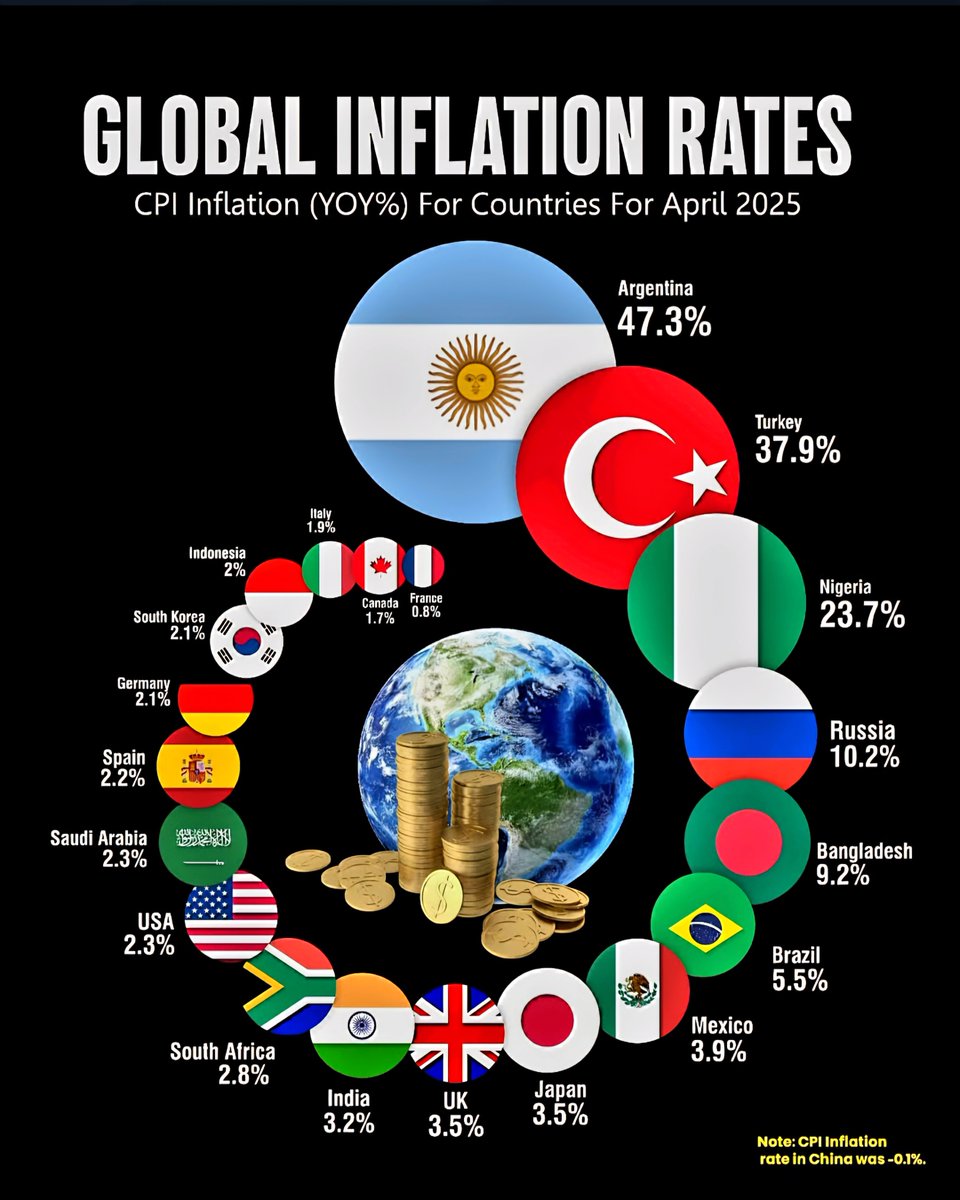

Top Countries Facing Soaring Inflation in April 2025: A Detailed Look

- Argentina’s Inflation Surges Past 47%

Argentina continues to grapple with the highest inflation rate globally, registering a staggering 47.3% in April 2025. This relentless inflationary pressure erodes purchasing power and exacerbates economic instability. The country’s ongoing fiscal challenges, coupled with political unrest and currency devaluations, have fueled soaring consumer prices across the board. Citizens face increasing costs for essentials like food, housing, and transportation, intensifying the economic hardship faced by millions.

- Turkey’s Persistent Top Tier with 37.9% Inflation

Turkey remains one of the most inflation-stricken nations, with prices rising nearly 38%. Elevated inflation has led to a decline in the standard of living for many Turks. The country’s unique economic policies and geopolitical tensions have contributed to the instability. As a result, the Turkish Lira continues to depreciate, pushing up the costs of imported goods and keeping consumer prices high, impacting both households and businesses nationwide.

- Nigeria’s Inflation at 23.7%, Compounded by Currency Challenges

African heavyweight Nigeria’s inflation rate stands at 23.7%, reflecting ongoing economic challenges. Weak oil prices, inflationary pressures, and foreign exchange shortages have all played a role. Food inflation, in particular, has surged, making daily essentials less affordable for ordinary Nigerians. The government is under pressure to implement reforms that can stabilize the economy and curb inflation’s impact on its population.

- Russia’s Inflation Eases Slightly to 10.2% Amid Sanctions and Global Tensions

Russia’s inflation rate has settled at 10.2%, down from previous highs. Persisting international sanctions and fluctuating oil prices continue to influence consumer prices. Although higher than pre-2022 levels, the moderation indicates some stabilization efforts by policymakers. Still, Russian consumers face increased costs in housing, transportation, and everyday goods, reflecting ongoing economic strain.

- Bangladesh’s Growing Inflation at 9.2%

Despite its reputation for economic growth, Bangladesh faces inflation at 9.2%. Rising food and fuel prices have impacted consumers, especially the lower and middle classes. The government has launched initiatives to control inflation, but supply chain issues and global commodity price surges have continued to pressure prices domestically.

- Brazil’s Inflation Rate at 5.5%, Signaling Stabilization

Brazil’s inflation has moderated to 5.5%, indicating a period of relative stability. The country’s efforts to tighten monetary policy and diversify its economy appear to be paying off. However, inflation remains a concern for consumers and policymakers alike, as food and energy prices continue to fluctuate.

- Mexico’s Inflation at 3.9%

Mexico’s economy shows moderate inflation at 3.9%, aligning close to its target range. Stable energy prices and controlled monetary policy have helped keep inflation under check. Consumers are experiencing somewhat predictable price increases, fostering consumer confidence.

- Japan and the UK Locked at 3.5% Inflation

Both Japan and the United Kingdom share a similar inflation rate of 3.5%. Japan’s inflation remains subdued, reflecting its longstanding deflationary pressures, while the UK’s costs are driven by recent post-Brexit economic adjustments. Both countries are navigating inflation through monetary policy adjustments to stabilize prices without slowing growth.

- India’s Inflation at 3.2%, Maintaining Moderate Levels

India’s robust economy maintains a steady inflation rate of 3.2%. Government policies focused on infrastructure development and subsidies have helped contain price growth. Still, rising food and fuel costs threaten to push inflation upward if global commodity prices continue to rise.

- South Africa’s Inflation at 2.8%

South Africa’s inflation shows signs of modest control at 2.8%, below many emerging markets. The country’s efforts to stabilize its currency and tame inflation have had some success, but high unemployment and socio-economic issues remain prevalent concerns.

- United States and Saudi Arabia Both at 2.3%

In 2025, the US and Saudi Arabia mirror each other with an inflation rate of 2.3%. The US’s inflation remains within target ranges, thanks to resilient monetary policy measures. Meanwhile, Saudi Arabia’s inflation is influenced by global oil prices and local economic reforms. Both nations aim to sustain growth while keeping prices steady.

- Spain and Germany Hover Slightly Above 2%

European economies like Spain and Germany show inflation just over 2%, consistent with the European Central Bank’s targets. Stable inflation levels allow these countries to maintain economic confidence, though energy and housing costs are areas to watch.

- South Korea, Indonesia, and Italy: Slight Variations in Inflation

South Korea and Indonesia are experiencing inflation around 2%, reflecting moderate growth. Italy’s inflation slightly dips below 2%, signaling modest price pressures in Europe’s third-largest economy. These nations are carefully balancing monetary policies to avoid overheating.

- Canada and France: Below 2% Inflation

Canada reaches an inflation level of 1.7%, and France at 0.8%, both within comfortable ranges. Low inflation helps sustain purchasing power, but cautious policy measures are in place to prevent deflation and keep the economic engines running.

Deflation noticed in China

Despite global inflation pressures, China is experiencing slight deflation at -0.1%. This unusual trend suggests sluggish consumer demand and excess supply in certain sectors, prompting policymakers to consider stimulus measures to boost growth.

Note: Consumer Price Index (CPI) inflation stands as the most widely used measure to track price changes over time, influencing decisions by policymakers, financial markets, businesses, and consumers worldwide. As the global economy navigates these inflation trends in 2025, understanding the regional differences provides crucial insights into the shifting economic landscape.

Image Caption: A visual representation of the diverse inflation rates seen across the globe in April 2025.