Select Language:

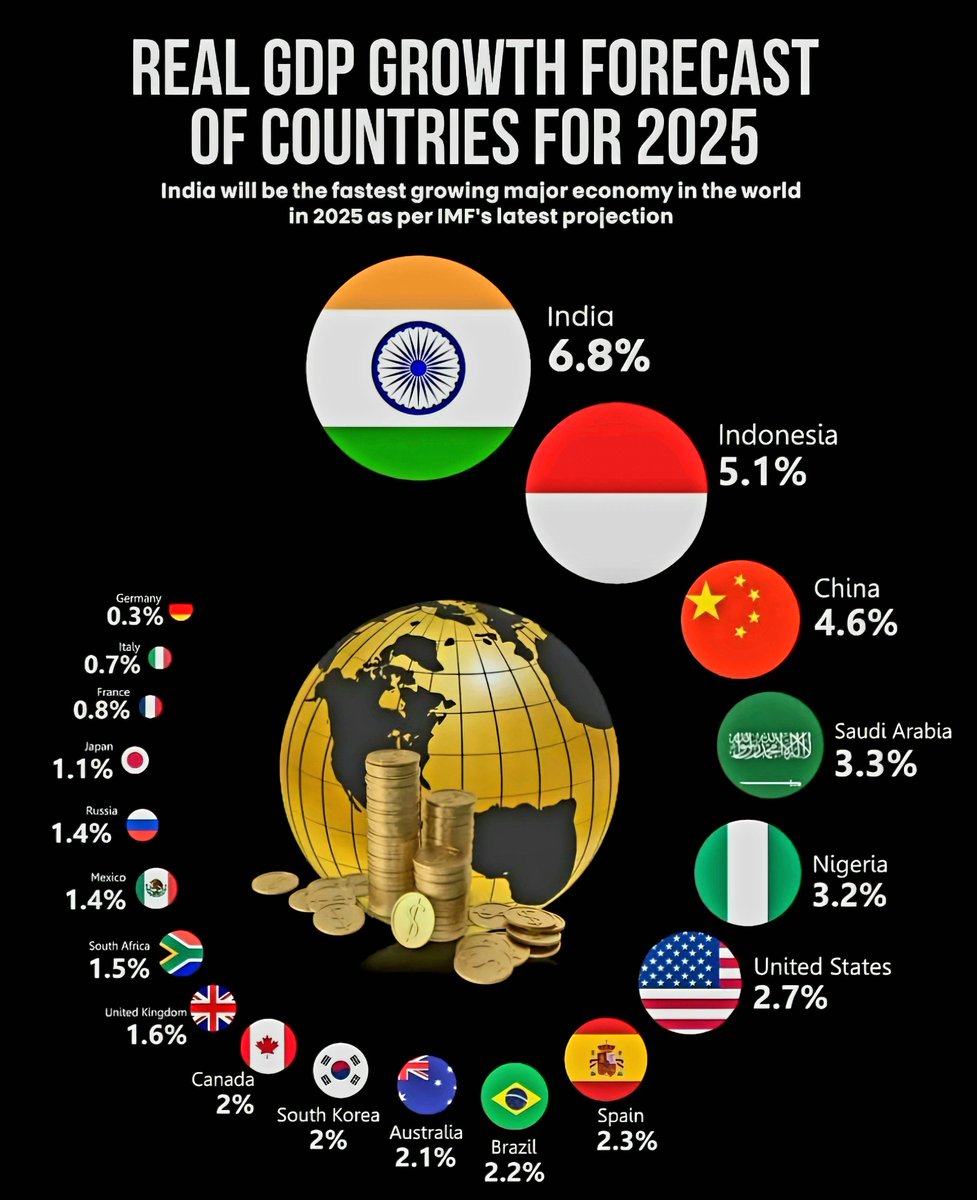

GDP Growth Forecasts for 2025

As the global economy continues to evolve, various nations exhibit differing trajectories of growth. The International Monetary Fund (IMF) has recently released forecasts for GDP growth in 2025, revealing insights about the state of economies around the world. Below, we explore these forecasts, highlighting the top countries expecting notable economic expansion.

India – 6.8%

Leading the pack is India, anticipated to achieve a remarkable GDP growth of 6.8%. Various factors drive this growth, including a youthful population, significant strides in technology, and government initiatives aimed at fostering investment. India’s burgeoning middle class and consumer market are also pivotal in this upswing.

Indonesia – 5.1%

Following closely is Indonesia, which is projected to grow by 5.1%. As Southeast Asia’s largest economy, Indonesia has been making waves with its robust manufacturing sector and rich natural resources. Efforts to improve infrastructure and boost digital transformation are expected to sustain its growth momentum.

China – 4.6%

China is forecasted to experience a GDP growth of 4.6%. After decades of rapid expansion, the country is transitioning towards a consumption-driven economy. While challenges such as an aging population and environmental concerns persist, China’s focus on innovation and technology remains a crucial pillar for future growth.

Saudi Arabia – 3.3%

Saudi Arabia’s economy is set to expand by 3.3%. The nation is diversifying its revenue streams away from oil, with initiatives like Vision 2030 aiming to develop sectors such as tourism and entertainment. As a result, this ambitious plan is likely to contribute positively to its GDP growth figures.

Nigeria – 3.2%

Not far behind is Nigeria, expected to witness a growth rate of 3.2%. Africa’s largest economy faces unique challenges, but innovations in fintech and agriculture are shining beacons of hope. The increasing youth population and efforts to harness digital technologies could pave the way for brighter economic prospects.

United States – 2.7%

The United States, a global economic powerhouse, forecasts a growth rate of 2.7%. Factors such as robust consumer spending, ongoing job growth, and technological advancements contribute to this expectation. However, challenges such as inflation might impact growth in the coming years.

Spain – 2.3%

Spain is anticipated to grow by 2.3%. The tourism sector plays a significant role in Spain’s economy, and as global travel continues to recover, this nation is poised for a rebound. Furthermore, investments in renewable energy are projected to foster sustainable development.

Brazil – 2.2%

With a growth forecast of 2.2%, Brazil aims to bounce back post-pandemic. Initiatives to enhance agricultural productivity, develop infrastructure, and foster international trade are integral to its recovery strategy. The new government has also pledged reforms that could potentially stimulate growth.

Australia – 2.1%

Australia’s economy is expected to grow by 2.1%. The nation benefits from a strong service sector and abundant natural resources. Additionally, rising demand from Asian markets particularly bolsters the outlook, especially in sectors like agriculture and mining.

South Korea – 2.0%

South Korea is forecasting a modest 2.0% growth. The country’s focus on technology and innovation continues to set it apart, with giants like Samsung leading the charge. However, external factors such as geopolitical tensions may pose risks to its growth trajectory.

Canada – 2.0%

Also projected at 2.0%, Canada’s economy enjoys stability due to its resource-rich landscape and strong trade relationships, especially with the U.S. Ongoing investments in green technology may also play a significant role in bolstering economic expansion.

United Kingdom – 1.6%

The UK anticipates a growth rate of 1.6%. Despite uncertainties related to Brexit and inflationary pressures, sectors such as finance and technology are adapting and evolving to meet challenges, which could help drive growth.

South Africa – 1.5%

South Africa’s growth forecast stands at 1.5%. With an emphasis on reforms aimed at attracting investment, the nation is focusing on infrastructure development and boosting key sectors like mining, which are vital for economic recovery.

Mexico – 1.4%

Mexico is projected to see a growth rate of 1.4%. The country plays a crucial role in North America’s manufacturing landscape, benefiting from trade agreements with the U.S. and Canada. Ongoing domestic reforms may also help stimulate growth.

Russia – 1.4%

Russia’s economy is expected to grow by 1.4%. Although it faces geopolitical challenges and sanctions, sectors such as energy remain strong. Diversifying the economy could benefit Russia in the long run.

Japan – 1.1%

Japan is forecasted for a growth of just 1.1%. With a declining population and slow productivity growth, Japan faces significant challenges. Nevertheless, government initiatives aimed at increasing labor force participation may offer some relief.

France – 0.8%

France’s anticipated growth rate of 0.8% reflects a complex economic landscape. While tourism remains a significant contributor, the nation faces hurdles, including labor market rigidity and regulatory challenges.

Italy – 0.7%

Italy’s forecasted growth rate stands at 0.7%. Economic recovery post-COVID is slow and complicated by structural issues. However, investments in technology and infrastructure could provide a necessary boost.

Germany – 0.3%

Finally, Germany, Europe’s largest economy, is expected to grow by just 0.3%. With challenges such as energy shocks and supply chain disruptions plaguing the manufacturing sector, Germany may need to adapt swiftly to stabilize and promote future growth.

Conclusion

As we move towards 2025, the landscape of global economies presents both opportunities and challenges. The variations in GDP growth forecasts highlight the importance of adaptive policies and strategic investments for nations around the world. Each country’s unique circumstances shape its economic destiny, and while some economies are on the rise, others face significant headwinds.