Select Language:

The Surprising Energy Toll of Bitcoin Mining in 2025

As Bitcoin continues to dominate headlines and influence global markets, its environmental impact remains a point of concern. In 2025, the reality of how much energy is required to mine a single Bitcoin is capturing widespread attention worldwide. Here’s an in-depth look at why electricity consumption in Bitcoin mining is more significant than many realize.

1. Bitcoin Mining Is an Energy-Intensive Process

The process of mining Bitcoin involves solving complex mathematical puzzles known as proof-of-work algorithms. These computations require immense computational power, which translates directly into high electricity use. According to recent estimates, mining a single Bitcoin consumes roughly the equivalent of an average household’s energy consumption over several months.

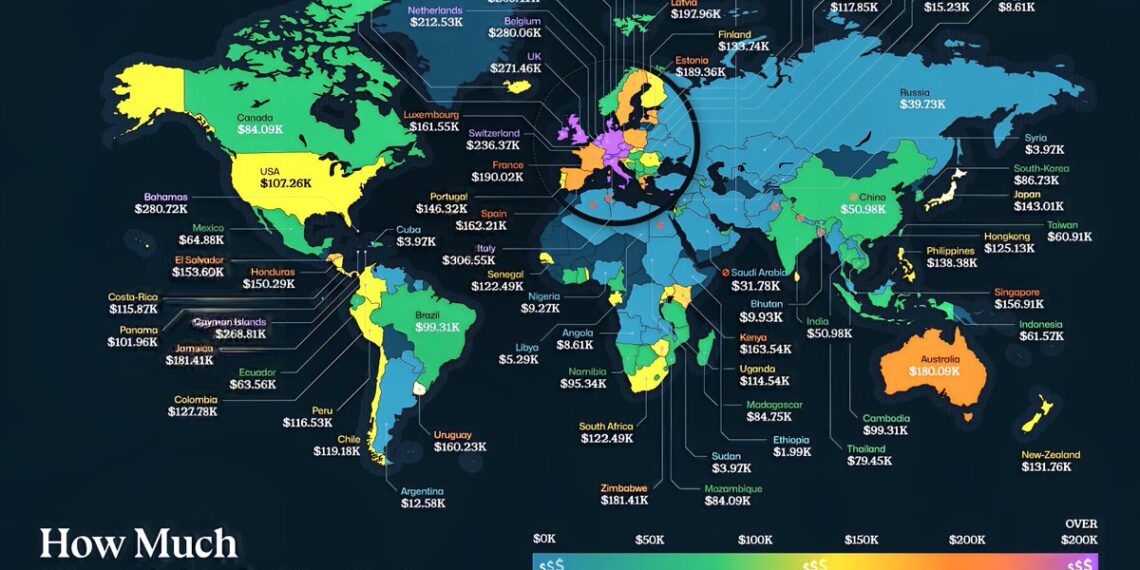

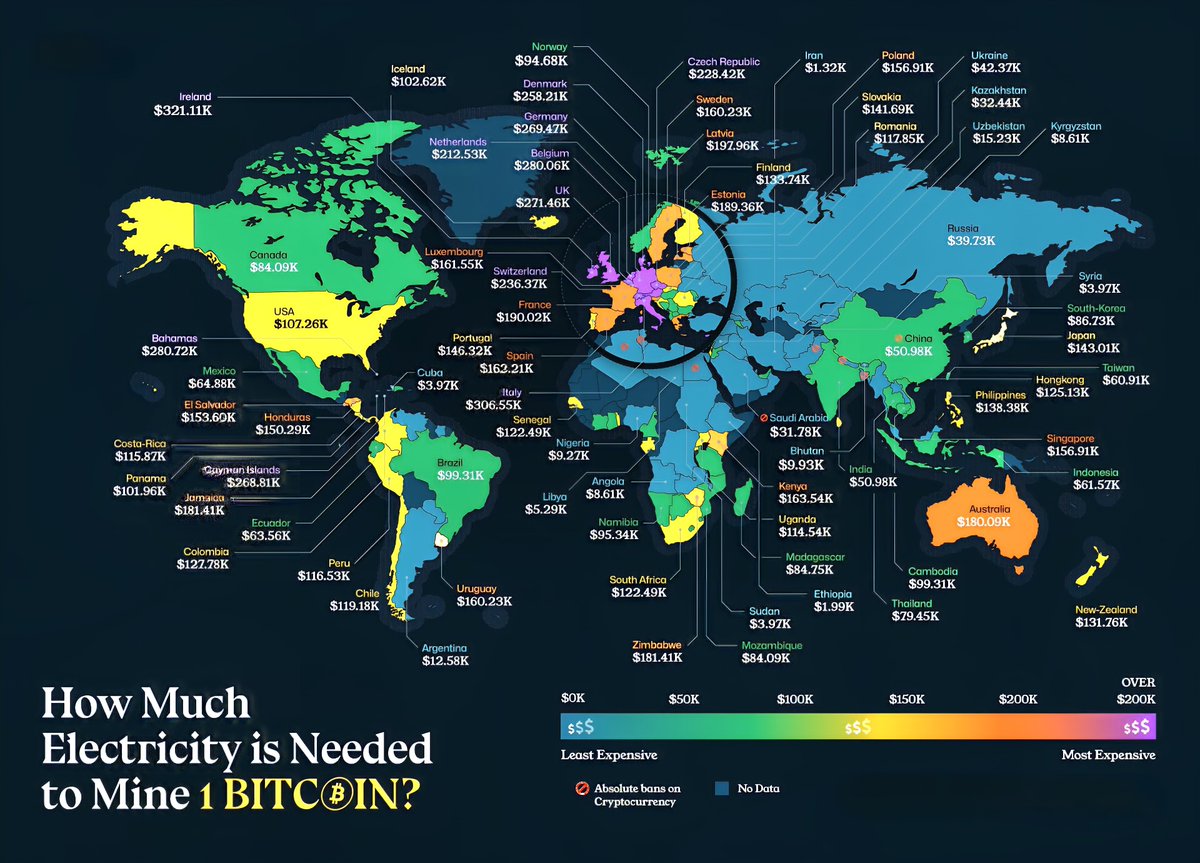

2. Global Mining Operations Demand Massive Power

Bitcoin mining isn’t confined to a few small-scale operations; it’s a global industry powered by large-scale farms. Countries like China, the United States, and Kazakhstan host significant mining facilities, many operating 24/7. These facilities operate in areas with abundant and inexpensive electricity sources, often from coal or other fossil fuels, amplifying carbon footprint concerns.

3. Environmental Concerns Are Intensifying

As the energy demand for Bitcoin mining surges, so do worries about its environmental impact. The industry’s carbon footprint rivals that of some medium-sized countries, contributing notably to climate change. Despite efforts to shift towards renewable energy, a significant share of Bitcoin mining still relies heavily on fossil fuels, especially in regions where green energy infrastructure is lacking.

4. Innovations in Mining Technology Are Not Enough

Efforts to reduce energy consumption through more efficient mining hardware are ongoing. Companies are developing newer, more power-efficient chips and cooling systems. Nonetheless, these advances have yet to prevent overall energy use from climbing as the network’s total computational power, or hash rate, expands exponentially. The total energy needed to maintain Bitcoin’s blockchain continues to grow.

5. Economic Incentives Drive High Energy Use

The profitability of Bitcoin mining incentivizes miners to operate regardless of energy costs or environmental impact. As Bitcoin’s price continues to rise, so does the incentive to expand mining operations, further increasing electricity demand. This creates a cycle where higher prices attract more miners, which in turn ups the total energy consumption.

6. The Push for Renewable Energy Sources in Mining

Some industry players are attempting to transition towards renewable energy sources like wind, solar, and hydroelectric power. Countries rich in renewable resources are becoming hotspots for sustainable mining efforts. However, widespread adoption remains challenging due to high initial costs and regional infrastructure limitations.

7. The Future Outlook of Bitcoin’s Energy Consumption

Looking ahead, experts warn that Bitcoin’s energy requirements could become unsustainable without significant technological or regulatory changes. Several initiatives are exploring alternative consensus mechanisms like proof-of-stake, which are less energy-intensive but are not yet implemented for Bitcoin. Meanwhile, policymakers are debating regulations aimed at limiting mining operations that rely on fossil fuels.

8. What Consumers and Investors Should Know

While many cryptocurrency enthusiasts focus on the financial returns, awareness of the environmental toll is crucial. Investors are increasingly scrutinizing the sustainability practices of mining firms. Consumers can support eco-friendly mining by choosing providers that utilize renewable energy sources or by advocating for stricter environmental regulations.

In summary: The energy required to mine Bitcoin in 2025 remains staggering, with current estimates indicating that a single Bitcoin’s genesis consumes the equivalent power of entire small nations. As the industry advances, balancing technological innovation, economic incentives, and environmental responsibility will be vital to shaping the future of cryptocurrency.