Select Language:

Millionaires on the Move: 2025 Migration Trends Revealed

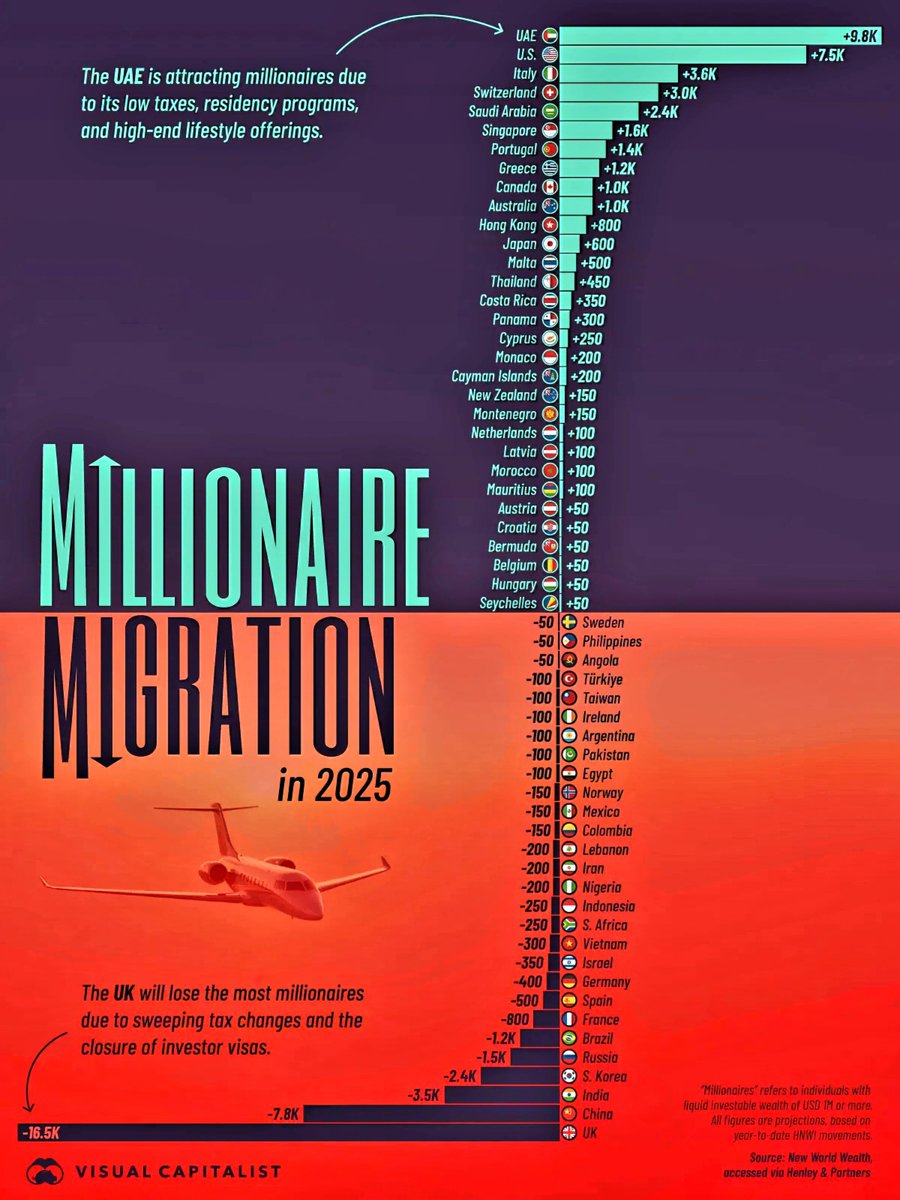

As we look ahead to 2025, a noteworthy trend is emerging in the world of wealth management: the migration of millionaires. A recent report indicates significant shifts in where high-net-worth individuals (HNWIs) are choosing to reside. Below, we break down the countries gaining and losing the most millionaires in the near future.

UAE: The Millionaire Magnet

With an astonishing increase of 9,800 millionaires, the United Arab Emirates tops the list as the most desirable destination for affluent individuals. The allure of the UAE lies in its favorable tax environment, attractive residency programs, and luxury lifestyle offerings that appeal to the wealthy.

USA: A Strong Contender

Following closely behind is the United States, projected to gain 7,500 millionaires. The country continues to draw HNWIs with its vibrant economy, diverse investment opportunities, and a lifestyle that many find appealing. The promise of innovation and business-friendly policies contributes significantly to this influx.

Italy: A Taste of Luxury

Italy, with its rich history and culture, sees a predicted increase of 3,600 millionaires. The country’s elegant lifestyle, culinary delights, and high-value real estate are key factors attracting wealthy individuals who seek both enjoyment and investment opportunities.

Switzerland: Financial Haven

Known for its banking secrecy and strong economy, Switzerland is expected to gain 3,000 millionaires. The country remains a financial stronghold, making it an attractive relocation option for many HNWIs.

Saudi Arabia: Rising Wealth

The Kingdom of Saudi Arabia is projected to gain around 2,400 millionaires. As the nation diversifies its economy through initiatives like Vision 2030, it is becoming a more appealing location for investors seeking new opportunities.

Singapore: An Economic Anchor

With an anticipated influx of 1,600 millionaires, Singapore maintains its status as a global financial hub. Its stable economy, advanced infrastructure, and quality of life continue to attract affluent expatriates looking for a secure and prosperous environment.

Portugal: The Sunny Escape

Portugal is seeing a rise of 1,400 millionaires, thanks largely to its Golden Visa program, which attracts HNWIs looking for residency through investment. The country’s Mediterranean climate and relatively low cost of living enhance its appeal.

Greece: The New Hotspot

Anticipating an increase of 1,200 millionaires, Greece is gaining traction among wealthy migrants. The beautiful landscapes, rich culture, and citizenship-by-investment programs are significant draws.

Canada: A Safe Harbor

Canada is projected to welcome 1,000 millionaires. Known for its high quality of life and inclusive values, Canada remains an attractive destination for those interested in stability and safety.

Australia: A Land of Opportunity

Also expecting to gain 1,000 millionaires, Australia offers a combination of scenic beauty, economic opportunity, and a friendly environment, making it a popular choice for wealthy individuals.

Other Notable Countries

Several other countries are also seeing a moderate rise in millionaire migration, including:

- Hong Kong +800

- Japan +600

- Malta +500

- Thailand +450

- Costa Rica +350

These nations are recognized for their strong economies, favorable living conditions, and attractive business environments.

Countries Facing Losses

While some countries thrive, others are expected to experience significant drops in millionaire populations:

- United Kingdom (-16,500): The UK suffers the most due to drastic tax changes and the end of investor visas, prompting many wealthy individuals to relocate.

- China (-7,500): Economic pressures and stringent regulations largely contribute to the outflow of 7,500 millionaires.

- India (-3,500) and South Korea (-2,400) also face notable losses, reflecting challenges in their respective economic and regulatory landscapes.

- France (-800), Germany (-400), and Brazil (-1,200) are among other countries witnessing substantial declines in their millionaire populations.

Conclusion

The dynamics of millionaire migration in 2025 reveal significant trends that underscore the global shifts in wealth concentration. Emerging markets like the UAE and established hubs like the USA continue to attract high-net-worth individuals, while traditional powerhouses like the UK and China grapple with challenges that lead to significant outflows. As the landscape evolves, it will be essential for nations to understand and respond to the needs of affluent individuals to ensure they remain competitive in the global arena.

This projection serves as a wake-up call for countries facing losses to reevaluate their policies and create more inviting environments for HNWIs. The future is undeniably interconnected, and the pursuit of wealth knows no boundaries.