Select Language:

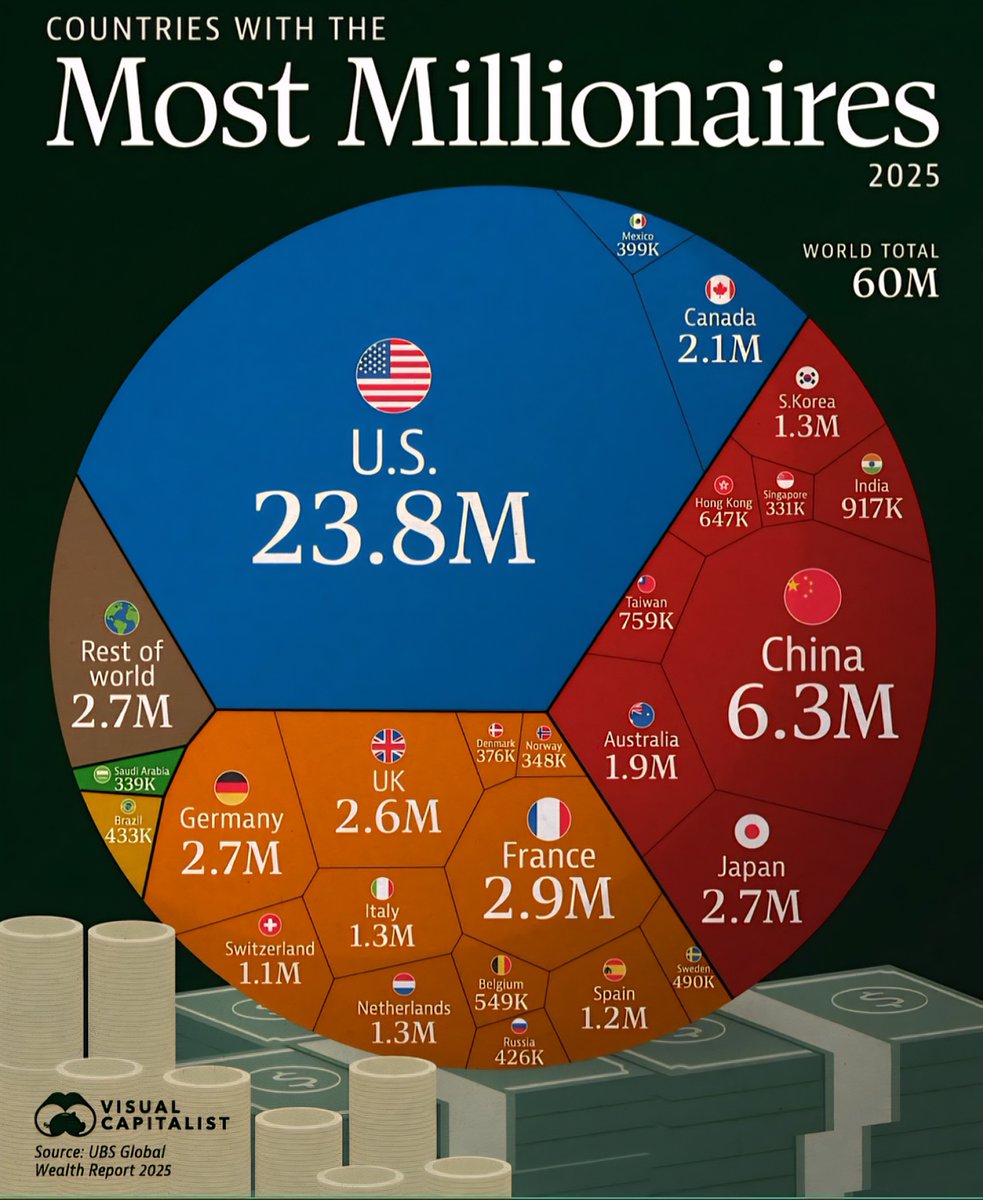

Countries with the Most Millionaires in 2025 💰

United States Dominates the List

The United States continues to hold its position as the country with the highest number of millionaires in 2025, boasting over 22 million high-net-worth individuals. Despite global economic fluctuations, the U.S. economy’s resilience and technological innovation have contributed significantly to this growth. Many of these millionaires are concentrated in major cities like New York, Los Angeles, and San Francisco, where financial, tech, and entertainment industries thrive. The country’s favorable tax policies and business environment have also played a crucial role in attracting and retaining wealth.

China Experiencing Rapid Growth

China ranks second on the list, with approximately 5.5 million millionaires. Over the past few years, China’s wealth gap has widened, fueled by booming real estate markets, successful tech startups, and a growing middle class. Cities such as Beijing, Shanghai, and Shenzhen continue to be hotspots for high-net-worth individuals. The Chinese government’s focus on technology development, innovation hubs, and attracting foreign investments has contributed to the rapid accumulation of wealth among its citizens in 2025.

Japan’s Steady Wealth Accumulation

Japan remains one of the top countries with a significant millionaire population, totaling around 2.8 million individuals. While Japan’s economy has faced challenges, its wealthy class tends to be more conservative in investment strategies, often holding onto assets long-term. Tokyo is the leading city, home to many corporate executives, entrepreneurs, and senior professionals. The country’s aging population has also influenced wealth distribution, with many retired individuals maintaining sizable investment portfolios.

Germany’s Leading European Wealth Hub

Germany takes the fourth spot with roughly 2.1 million millionaires. Its robust manufacturing sector, particularly automotive, engineering, and technology industries, continues to propel wealth creation. Cities like Frankfurt, Berlin, and Munich are crucial financial and business centers, attracting international bankers, investors, and entrepreneurs. Germany’s stable political climate and strong economy make it an attractive location for both wealth preservation and growth.

United Arab Emirates Rises in Wealth Rankings

The UAE, especially Dubai and Abu Dhabi, has experienced a sharp increase in millionaires, now surpassing 900,000 individuals. The country’s strategic geographic position, tax-free policies, and luxury lifestyle have made it a magnet for global high-net-worth individuals. Wealthy expatriates and business magnates are increasingly setting up residence, investing in real estate, startups, and financial markets within the emirates, contributing to the country’s rapidly expanding millionaire population.

United Kingdom’s Persistent Wealth

Despite geopolitical uncertainties, the United Kingdom maintains a significant millionaire population, estimated at around 2.5 million in 2025. London remains the wealth capital, serving as a global financial hub for banking, asset management, and legal services. Many entrepreneurs, hedge fund managers, and inheritors continue to retain their wealth in the UK. The country’s long-standing reputation as an international financial center helps sustain its high millionaire count even amid economic shifts.

Canada’s Stable Wealth Growth

Canada features approximately 1.2 million millionaires and is increasingly appealing for high-net-worth individuals seeking stability and quality of life. Its strong banking system, natural resources, and tech startup scene have contributed to wealth accumulation. Toronto Vancouver, and Calgary are the key cities attracting wealthy residents, particularly those involved in finance, energy, and technology sectors.

India Slow but Steady Rise

India’s millionaire population has reached around 1 million, reflecting a steady growth driven by technological advancements, entrepreneurial ventures, and expanding consumer markets. Despite a smaller proportion compared to Western nations, India’s rising middle class and wealth creation in sectors like technology and manufacturing have made it a significant emerging market for high-net-worth individuals. Mumbai and Delhi serve as primary hubs for affluent professionals.

Australia’s Continued Wealth Build-Up

Australia hosts approximately 950,000 millionaires in 2025, driven largely by its booming real estate market and natural resource sector. Sydney and Melbourne—famous for their high-end neighborhoods and luxury markets—continue to attract wealthy investors from around the world. Australia’s proximity to Asia and its strong economy make it an appealing destination for both investment and residence.

Summary

The global landscape of wealth in 2025 showcases the continued dominance of the United States, bolstered by technological innovation and financial strength. China is rapidly catching up, fueled by its booming markets and investment in innovation. Meanwhile, European countries such as Germany and the United Kingdom maintain their historic advantage, while the Middle East and Asia experience dynamic growth due to strategic policies and market expansion. The wealthiest nations in 2025 exemplify resilience, innovation, and strategic growth, shaping the future of global prosperity.

Note: All figures are estimates based on current trends and data from leading wealth research firms as of 2025.