Select Language:

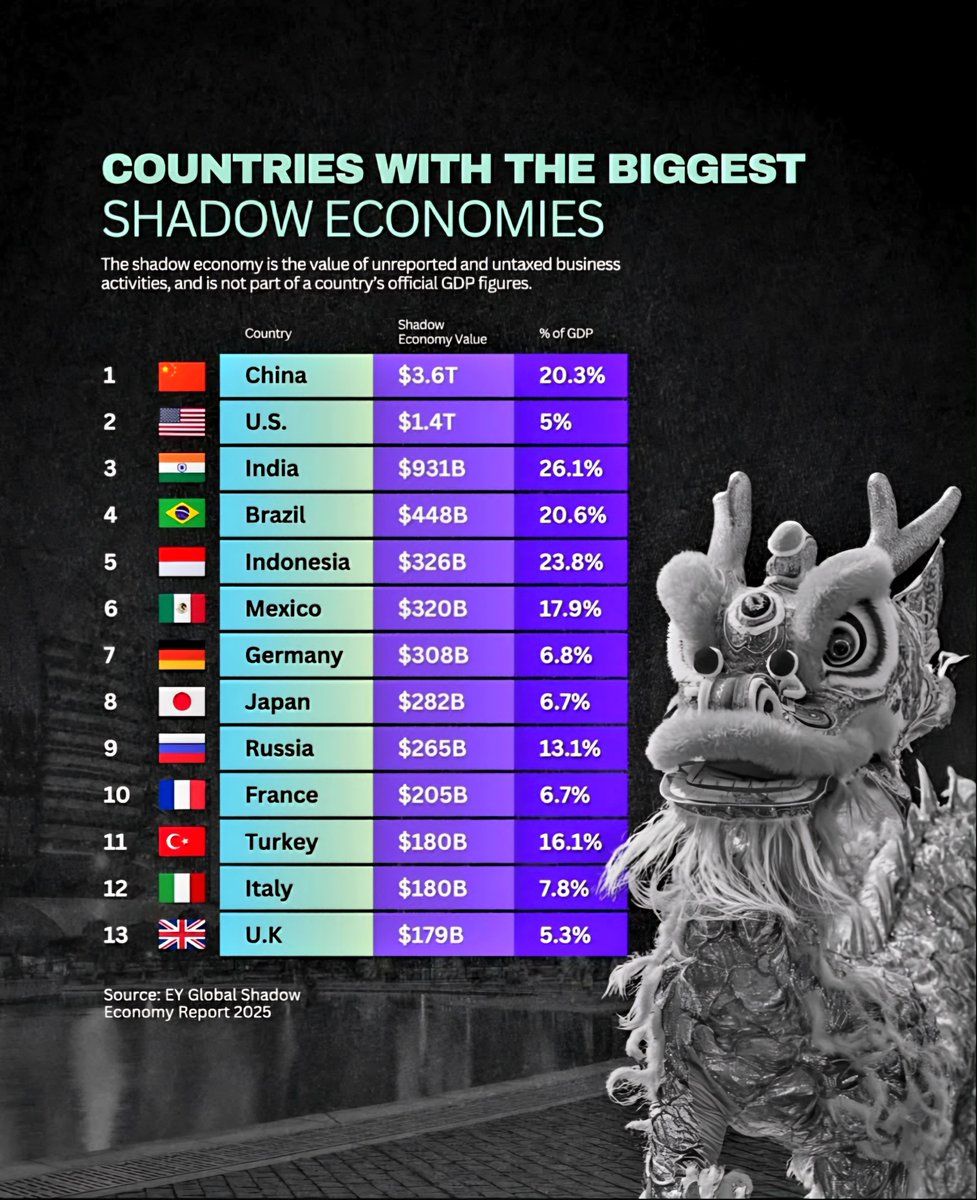

Top Countries with the Largest Shadow Economies in 2025

China: Leading the Pack with $3.6 Trillion in Shadow Activities

China boasts the world’s largest shadow economy in 2025, with an estimated value of $3.6 trillion. This accounts for approximately 20.3% of the country’s total GDP. The vast scale of China’s underground economy reflects factors such as regulatory complexities, regional disparities, and high levels of informal labor. Despite efforts to curb illicit activities, a significant portion of economic transactions remain unreported, highlighting persistent challenges in formalizing sectors like small-scale manufacturing and street commerce.

The United States: A Shadow Economy Worth $1.4 Trillion

In second place, the United States has an estimated $1.4 trillion in unreported economic activities, representing about 5% of its GDP. While the U.S. maintains a relatively smaller shadow economy percentage-wise, the sheer economic size means that covert operations still reach into millions of dollars daily. Common sectors include cash-based businesses such as hospitality, home services, and informal gig work, driven by regulatory burdens and tax considerations.

India: The Growing Shadow Economy at $931 Billion

India’s shadow economy is the third largest globally, valued at approximately $931 billion — about 26.1% of the nation’s GDP. Rapid urbanization, a large informal workforce, and complex tax policies all contribute to this significant underground sector. The pervasive nature of unregistered small businesses and subsistence activities in rural areas often escape official reporting, fostering a substantial shadow economy that impacts government revenue and economic planning.

Brazil: A Notable $448 Billion in Hidden Economic Activity

Brazil ranks fourth, with its shadow economy reaching around $448 billion, which makes up about 20.6% of its GDP. Economic instability, high taxation, and corruption facilitate widespread informal trade. Small vendors, agricultural workers, and street traders often operate outside the formal banking and tax systems, especially in major urban centers like São Paulo and Rio de Janeiro.

Indonesia: An Estimated $326 Billion in Unseen Business

Indonesia’s shadow economy is substantial at $326 billion, making up roughly 23.8% of its GDP. Factors such as complex licensing processes, taxation issues, and cultural norms around informal work contribute to a thriving underground sector. Many small-scale traders and farmers prefer unregistered operations, especially in remote areas where government oversight is limited.

Mexico: Approximately $320 Billion in Unreported Income

Mexico’s underground economy is valued at approximately $320 billion, or about 17.9% of its GDP. Drug trafficking, smuggling, and unregistered retail enterprises are major components. The informal sector provides employment for a significant portion of the population and often fills gaps left by formal employment opportunities, though it erodes tax revenues.

Germany: A Developed Economy with $308 Billion in Shadow Activities

Germany, Europe’s largest economy, has an estimated shadow economy worth $308 billion, representing 6.8% of its GDP. Despite strict regulations, sectors such as construction, freelance services, and small retail businesses often operate informally to navigate bureaucratic hurdles. The country’s recent efforts focus on digitizing tax reporting to reduce underreporting.

Japan: $282 Billion in Hidden Economic Activities

Japan’s underground economy totals around $282 billion, accounting for approximately 6.7% of its GDP. Cultural factors, such as intricacies in tax filings and resistance to formalization, play a role. Many small businesses, especially family-run shops, prefer operating informally to avoid taxation and compliance costs.

Russia: $265 Billion in Unreported Business

Russia’s shadow economy, valued at about $265 billion, makes up roughly 13.1% of its GDP. Opaque financial practices, corruption, and extensive use of cash transactions facilitate this sizable underground sector. Informal employment in construction and resource extraction is particularly prevalent.

France: An Estimated $205 Billion in the Shadows

France’s hidden economy is estimated at $205 billion, representing 6.7% of its GDP. Heavy regulation, high taxes, and bureaucratic procedures help sustain a sizable informal sector. Small artisans, tradespeople, and independent service providers often prefer operating outside official channels for financial reasons.

Turkey: A Notable $180 Billion in Informal Business

Turkey’s shadow economy is approximately $180 billion, or 16.1% of its GDP. Economic volatility, currency fluctuations, and complex licensing processes encourage informal practices, especially in sectors like retail, construction, and agriculture. Many entrepreneurs operate without official registration to avoid stiff taxes and regulations.

Understanding the Shadow Economy

The shadow economy comprises unreported and untaxed business activities that are not captured in official GDP figures. Its size varies significantly from country to country, influenced by factors like governance, taxation policies, cultural norms, and economic stability. While some underground activities are driven by necessity, others are a result of deliberate tax evasion or corruption.

Sources: EY Global Shadow Economy Report 2025

Note: The figures in this report reflect estimations from 2025 and are subject to change as countries implement new regulatory measures or economic reforms.