Select Language:

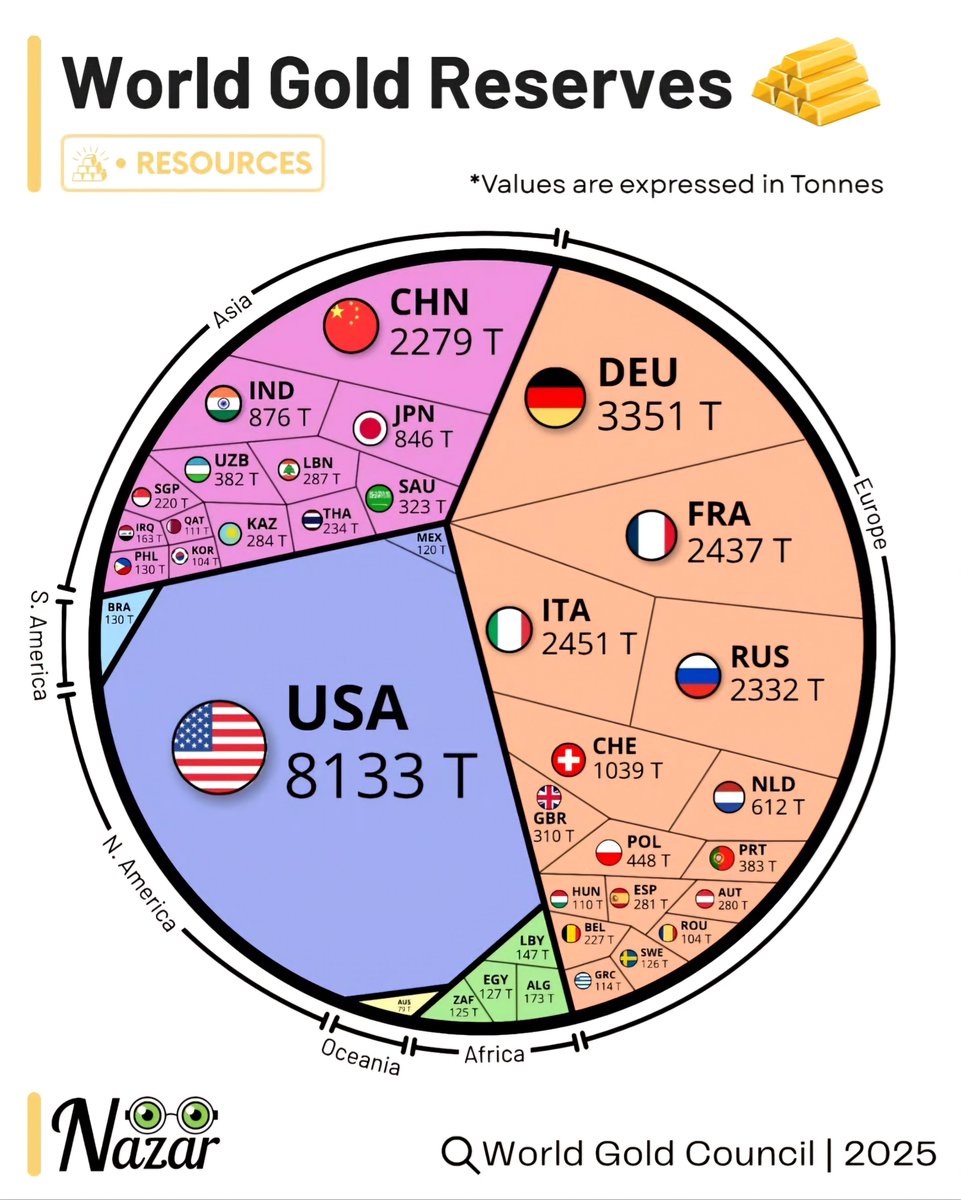

The Top Countries with the Largest Gold Reserves in 2025

1. United States: Leading the Gold Reserve Race

The United States continues to hold the world’s largest supply of gold reserves, with approximately 8,133.5 metric tons stored primarily at Fort Knox, Kentucky. This extensive reserve not only symbolizes the nation’s economic strength but also provides a significant backing for its currency and financial stability. Over the past few years, the U.S. has maintained strategic acquisitions and hasn’t significantly altered its stockpile, reinforcing its position as the undisputed leader in gold holdings.

2. Germany: Europe’s Gold Powerhouse

Germany comes in second, with around 3,355 metric tons of gold. A large portion of its reserves is stored abroad, particularly in New York and London. Recently, Germany has been focused on increasing transparency and rebuilding trust in its holdings, with some of its gold being repatriated to local vaults. This move aligns with Germany’s efforts to assert economic independence and bolster confidence in German financial stability.

3. Italy: A Significant European Reserve

Italy’s gold reserves clock in at approximately 2,452 metric tons, placing it third globally. The country has a historically strong banking sector and gold acts as a safeguard against economic uncertainties. Recently, Italy has diversified its reserves, balancing gold holdings with foreign currencies and other assets, to prepare for ongoing geopolitical and financial challenges in Europe.

4. France: Gold Ownership as a Strategic Asset

With around 2,437 metric tons, France ranks fourth on the list. Historically, France has been cautious about its gold assets, often opting for diversified reserves. The country has steadily maintained its holdings, and its central bank actively manages its gold to ensure the stability of the national economy, especially amid the volatile global financial markets of 2025.

5. Russia: Growing Reserves Amid Political Tensions

Russia’s gold reserves have seen a significant increase in recent years, now totaling approximately 2,300 metric tons. This trend reflects Russia’s strategic efforts to insulate its economy from Western sanctions and increase its financial sovereignty. Russia’s central bank continues purchasing gold, bringing its reserves to levels that rival some of Europe’s largest economies.

6. China: An Ascending Gold Power

China’s gold reserves have slightly increased, currently estimated at about 1,936 metric tons. While still behind the U.S. and European countries, China is rapidly expanding its holdings due to its ongoing economic growth and desire for greater financial independence. The Asian giant is also fostering domestic gold mining and refining industries, aiming to bolster its reserves further.

7. Switzerland: A Global Financial Hub with Gold Clout

Switzerland maintains roughly 1,040 metric tons of gold reserves. It’s renowned for its robust banking system and vaults that serve as storage for global wealth, including substantial private holdings. Despite its smaller official reserves, Switzerland remains a critical player in global gold markets, often impacting prices and supply through trading hubs.

8. India: Gold as Cultural Wealth

India holds approximately 800 metric tons of gold reserves, with much of it owned privately by individuals. Gold holds profound cultural significance in India, both historically and economically. Recent government policies have aimed at encouraging domestic gold deposit schemes and reducing reliance on imports, which could alter its reserve levels in the coming years.

9. Japan: Strategic and cautious

Japan’s gold reserves stand at about 765 metric tons. As one of the world’s largest economies, Japan views gold as a strategic asset for hedging against economic disruptions. The country’s central bank employs conservative strategies, ensuring gold’s role as a safeguard amid turbulent global markets.

10. Netherlands and Other Notables

The Netherlands holds around 612 metric tons of gold, serving as a significant European custodian. Several other nations—such as Taiwan, Portugal, and Lebanon—maintain sizable gold reserves that bolster their financial security and position in the global market.

This year, global gold reserves reflect shifting geopolitical priorities and economic strategies. Countries like Russia and China are increasing holdings to assert financial independence, while traditional leaders like the United States maintain commanding reserves that underpin their economic stability.