Select Language:

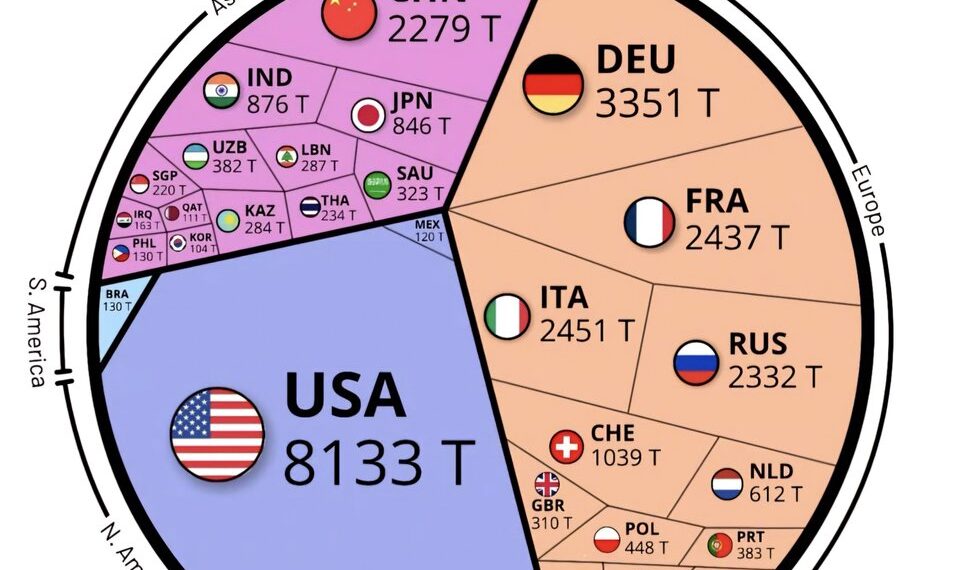

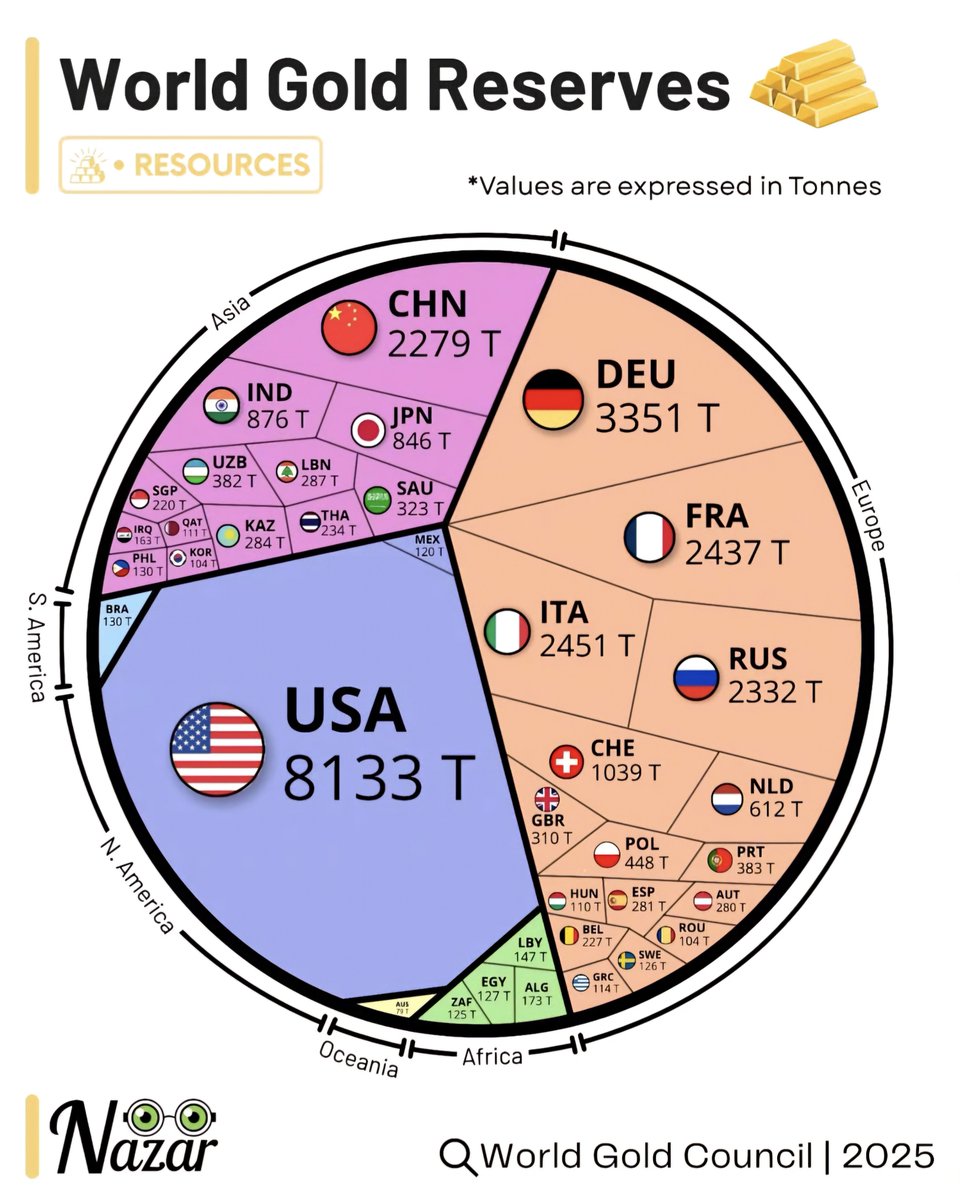

Top Countries with the Largest Gold Reserves in 2025

1. United States: The Unyielding Leader in Gold Reserves

The United States continues to hold the largest gold reserves in the world, with approximately 8,133.5 metric tons. These reserves have historically played a vital role in maintaining the country’s economic stability and financial dominance. Fort Knox remains the iconic storage site for much of the U.S. gold holdings, symbolizing the country’s long-standing monetary strength. The U.S. gold reserves are predominantly held as a safeguard against global economic uncertainties, ensuring confidence in the dollar and the nation’s financial system.

2. Germany: Europe’s Largest Gold Repository

Germany ranks second globally with roughly 3,355 metric tons of gold. The Bundesbank, Germany’s central bank, has been actively managing its gold reserves by repatriating a significant portion stored abroad. These reserves serve as a crucial pillar in Germany’s economic security and are strategically stored across various locations, including New York, London, and within German vaults. The country’s commitment to maintaining its gold stock reflects its focus on financial stability amidst volatile global markets.

3. Italy: A Significant Reserve Holder

Italy’s gold reserves stand at approximately 2,452 metric tons, making it one of the top holders in Europe. These reserves have been stabilized over the years, acting as a buffer during economic crises and currency fluctuations. The Bank of Italy oversees these assets, emphasizing the importance of gold as a fiscal safeguard and a symbol of national financial resilience in the European context.

4. France: Holding Firm with Substantial Gold Stash

France maintains around 2,437 metric tons of gold, ranking among the top five globally. The Banque de France has historically been cautious about gold transactions, preferring to hold its reserves domestically. Gold acts as a vital reserve asset for France, backing its monetary policies and offering a reliable store of value during economic upheavals.

5. Russia: Rapid Accumulation of Gold Reserves

Russia has seen a rapid increase in its gold holdings, reaching approximately 2,300 metric tons in 2025. The country’s strategic shift away from reliance on the US dollar has driven its gold acquisition efforts, aiming to strengthen its financial sovereignty. Moscow actively adds to its reserves through mining and strategic purchasing, making Russia a significant player in global gold holdings.

6. China: The Rising Gold Power

China, with roughly 2,227 metric tons of gold reserves, continues to expand its bullion stockpile, aligning with its goal to diversify its foreign reserves and reduce dependence on the U.S. dollar. Despite longstanding secrecy surrounding its holdings, recent disclosures indicate that China’s reserves are steadily increasing, reflecting its ambitions to bolster its financial system and prepare for future economic challenges.

7. Switzerland: Europe’s Financial Hub with Gold Holdings

Switzerland’s gold reserves are estimated at about 1,040 metric tons, serving as a key asset within its robust financial infrastructure. Known for its banking secrecy and stability, Switzerland’s gold holdings act as a pillar of trust and security in its monetary system. The country maintains a conservative approach to gold management, emphasizing long-term stability.

8. Japan: Asia’s Gold Custodian

Japan’s gold reserves total approximately 846 metric tons. The Bank of Japan manages these assets, which contribute to the country’s monetary security amid regional economic fluctuations. Japan’s strategic stockpile acts as a financial buffer, especially given the country’s significant dependence on imports and exports.

9. India: Growing Gold Reserves

India’s gold reserves are estimated at about 760 metric tons, which have grown steadily over recent years. Historically, the country’s love for gold as both a cultural symbol and investment asset has driven its reserves. India’s central bank continues to increase gold holdings to diversify its foreign exchange reserves and bolster economic stability amid global uncertainties.

10. Netherlands: European Reserve Stabilizer

The Netherlands holds approximately 612.5 metric tons of gold, making it one of Europe’s notable reserve holders. The Dutch central bank views gold as a crucial element of its foreign exchange reserve strategy, safeguarding national economic interests in an increasingly interconnected global financial ecosystem.

As global dynamics shift and economies evolve, gold remains a vital asset for nations seeking financial stability and resilience. These countries continue to balance their gold holdings as part of broader monetary policies, securing their economic future amidst turbulent times.