Select Language:

Top Countries Leading in Stock Market Participation in 2025

In 2025, global stock markets continue to be a key indicator of economic health and investor confidence. While developed nations maintain their dominance, some emerging markets are rapidly catching up. Here’s an in-depth look at the countries leading in stock market participation this year.

1. United States: The Market Leader

The United States remains the frontrunner in stock market involvement, with a staggering number of retail investors and institutional participation. The rise of accessible online trading platforms, zero-commission brokerages, and the influence of social media investing communities have fueled unprecedented participation rates.

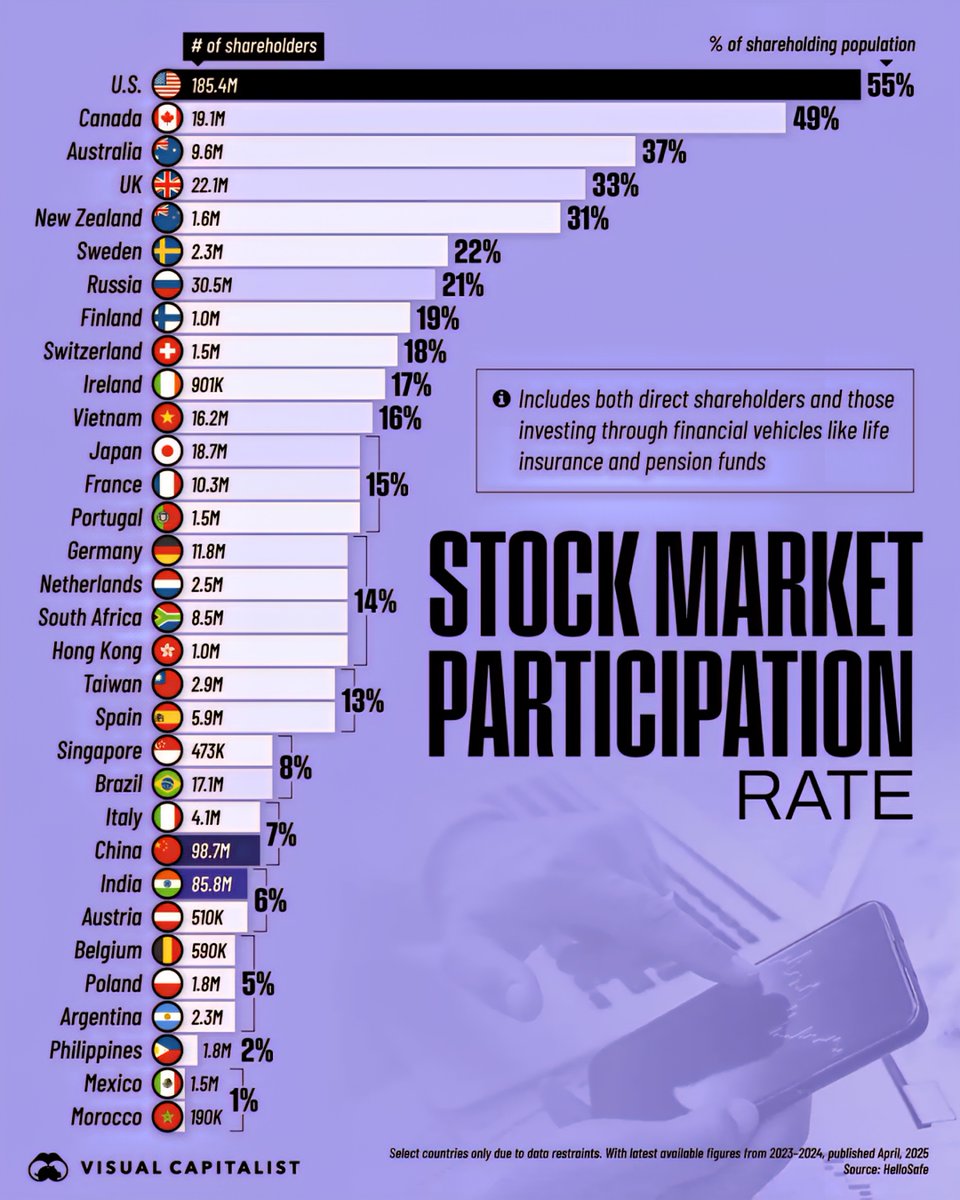

Data indicates that nearly 55% of American adults own stocks either directly or through retirement accounts. The strong performance of major indexes like the S&P 500 and NASDAQ has further encouraged participation. Additionally, innovations in fintech are lowering barriers for new investors, making stock investing more inclusive than ever before.

2. China: Rapid Growth and Expansion

China’s stock market has seen exponential growth in participation over the past few years, and 2025 marks a significant milestone. With the government’s push to modernize financial markets and enhance investor access, domestic participation has surged.

More than 40% of urban Chinese adults are now involved in stock trading, driven by increased smartphone adoption and the proliferation of local trading apps. The rise of tech giants and new economy industries listed on the Shanghai and Shenzhen markets has captivated investors, fueling further interest. The government also promotes financial literacy programs, which have contributed to expanding investor bases.

3. India: The Growing Investment Hub

India continues its ascent as a major player in worldwide stock markets. With over 35% of urban populations reported to be active investors, the country’s middle class’s expanding wealth and digital infrastructure are major factors.

The rise of platforms like Zerodha, Groww, and Upstox has democratized access, making it easier for retail investors to participate. Furthermore, government initiatives such as the ‘Angel Tax’ reforms and policies to ease compliance requirements have encouraged more people to venture into stock trading.

4. Canada and Australia: Stable and Growing Markets

Both Canada and Australia boast stable financial systems with increasing retail participation. Canada’s market features around 25% of its adult population engaged in stock investing, supported by robust pension schemes and homegrown fintech companies.

In Australia, approximately 30% of adults actively trade or hold stocks, largely driven by strong superannuation funds and a culture of investment. The affordability of online trading and appealing dividend yield prospects attract many new investors in these nations.

5. European Countries: Rising Engagement, Yet Varied

Across Europe, participation rates are improving steadily but vary significantly by country. Nations like the UK, Germany, and France are witnessing increased activity thanks to favorable regulations and growing awareness about personal finance.

In 2025, roughly 20-25% of adults in these countries actively participate in stock markets. European investors tend to focus more on long-term investments and dividend-paying stocks, influenced by the region’s cautious yet optimistic economic outlook.

6. Emerging Markets: The Future of Participation

Emerging economies such as Brazil, South Africa, and Indonesia are experiencing noteworthy increases in investor involvement. Efforts to improve financial education, coupled with mobile technology that simplifies access to trading platforms, are key drivers.

Although overall participation remains lower compared to developed nations—around 15-20%—these countries are expected to see rapid growth in the coming years. The expanding middle class and government policies aimed at expanding financial inclusion are vital contributors to this trend.

7. The Role of Technology in Boosting Market Engagement

Across the board, technological advancements are transforming stock market participation by breaking down traditional barriers. Mobile apps, AI-driven advisory tools, and social trading networks make it easier for investors of all levels to get involved.

Additionally, the rise of fractional investing enables people to buy small slices of expensive stocks, further democratizing access. As of 2025, these innovations have significantly expanded the investor base worldwide.

8. Challenges and Opportunities Ahead

While participation rates climb, challenges such as financial literacy gaps, market volatility, and regulatory differences persist. However, broader awareness, education initiatives, and technological strides are expected to turn these challenges into opportunities for further growth.

The ongoing trend suggests that stock market engagement will become a more integral part of individual financial planning worldwide, fostering economic resilience and wealth creation across diverse populations.

In 2025, the landscape of stock market participation highlights a shift towards inclusivity and technological integration, signaling promising prospects for investors worldwide.