Select Language:

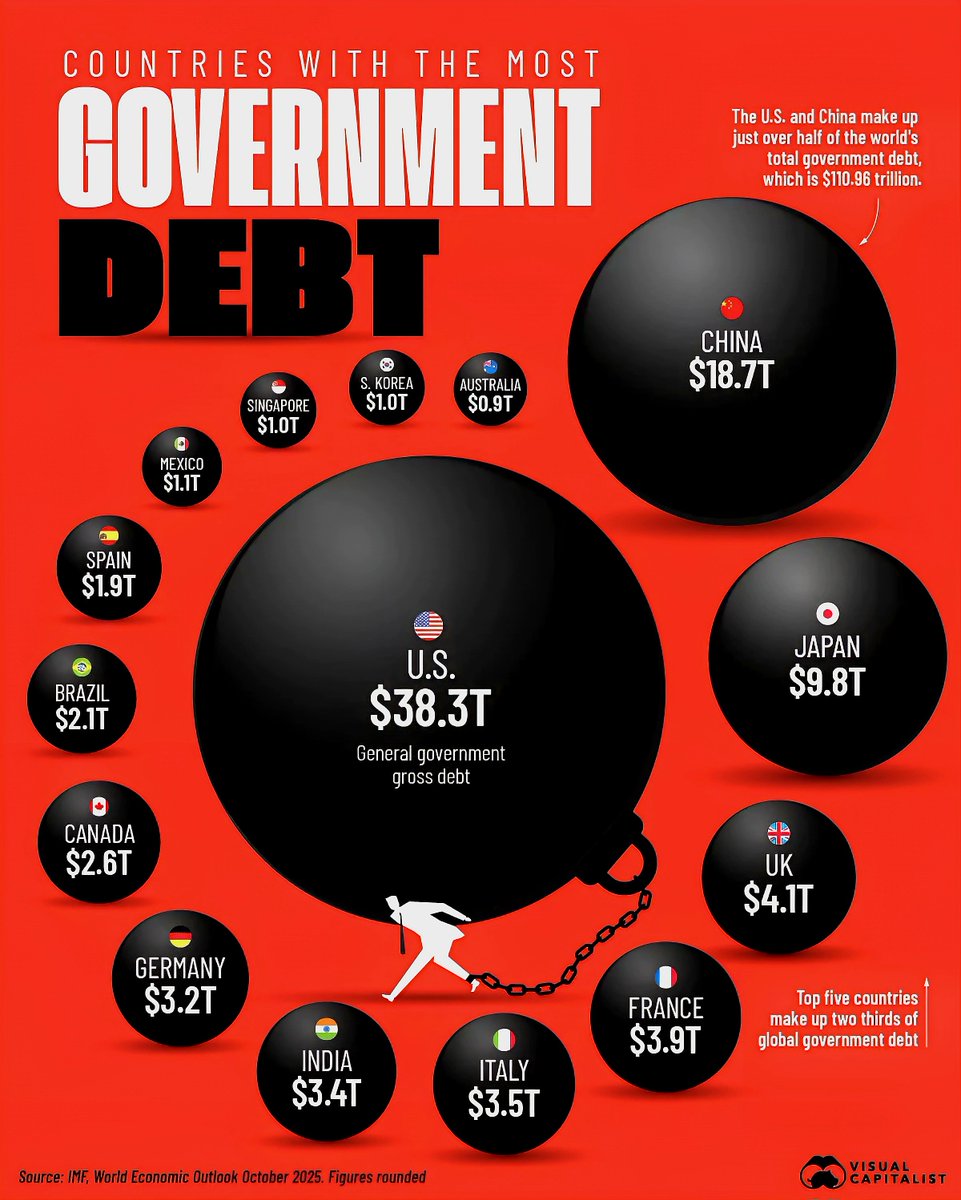

Top Nations Carrying the Highest Government Debt in 2025

1. Japan: The Debt King in the Global Arena

Japan remains the country with the highest government debt ratio worldwide, surpassing 250% of its Gross Domestic Product (GDP). Despite having a relatively stable economy, Japan’s aging population and extensive social welfare programs have contributed to its soaring debt levels. The Japanese government’s strategy has often involved issuing long-term bonds to manage its debt, but concerns persist about future sustainability when demographic shifts lead to shrinking workforce and tax revenues.

2. United States: The Heavyweight in Debt Accumulation

America’s national debt has climbed past $32 trillion in 2025, representing roughly 125% of its GDP. This increase is driven by expansive fiscal policies, military spending, and infrastructure investments, especially in the aftermath of recent global challenges. The U.S. Treasury continues to issue bonds to finance deficits, prompting debates on how rising debt impacts economic growth, inflation, and national security. Although the U.S. maintains its status as a global economic powerhouse, concerns about debt sustainability are mounting among analysts.

3. China: Rising Debt Amid Economic Rebalancing

China’s government debt has ballooned to approximately 80% of its GDP this year. While traditionally viewed as having manageable debt levels, recent rapid infrastructure development and increased borrowing by local governments have pushed debt higher. Beijing’s efforts to rebalance its economy away from export dependence towards domestic consumption are complicated by this rising debt—further intensified by concerns over the health of state-owned enterprises and property giants like Evergrande.

4. Italy: Europe’s Debt Dilemma

With debt levels currently at 150% of its GDP, Italy remains one of Europe’s most heavily indebted nations. The country faces ongoing challenges such as sluggish growth, high unemployment, and political instability, all of which hinder efforts to reduce debt. Despite receiving substantial support from the European Union’s recovery fund, Italy struggles with the structural issues that keep its debt-to-GDP ratio elevated. Policymakers are grappling with balancing fiscal discipline and social needs.

5. France: Rising Debt, Economic Concerns

France’s government debt has edged up to about 115% of its GDP. Recent economic stagnation, coupled with increased social spending, has contributed to the rising debt figures. The government has been cautious in implementing austerity measures amid social unrest, leading to a delicate balancing act between debt reduction and maintaining public services. The country’s economy faces headwinds from global uncertainties, putting more pressure on fiscal sustainability.

6. Brazil: Latin America’s Heavy Debtor

Brazil’s debt load has increased significantly in recent years, now reaching around 85% of its GDP. Economic volatility, inflation, and social spending have played a part in elevating debt levels. The government is under pressure to manage its fiscal deficit while fostering economic growth, which is challenging amid global economic slowdown and internal political instability.

7. India: Emerging Market with Growing Debt

India’s government debt stands at approximately 70% of its GDP in 2025. Rapid infrastructure development and social programs have led to increased borrowing. While India’s economic growth remains robust, the country faces the task of managing its debt responsibly to ensure long-term fiscal stability. The government continues to focus on reforms aimed at reducing deficits without stifling economic momentum.

8. United Kingdom: Navigating Debt Challenges

The UK’s national debt has escalated to roughly 100% of GDP. Post-Brexit economic adjustments, coupled with pandemic-related spending, have pushed debt levels higher. The government is faced with the challenge of stimulating economic recovery while keeping fiscal deficits in check. Discussions around tax reforms and public spending cuts are ongoing to address mounting concerns.

In Summary: As of 2025, global government debt levels remain a significant concern for policymakers worldwide. Countries like Japan and Italy lead the pack, but emerging economies are catching up as they grapple with growth and development challenges. The balance between fostering economic growth and maintaining fiscal health continues to be a delicate dance for nations across the globe.

Note: This data is continually evolving, and nations are implementing various strategies to manage their debt levels amidst a complex economic landscape.