Select Language:

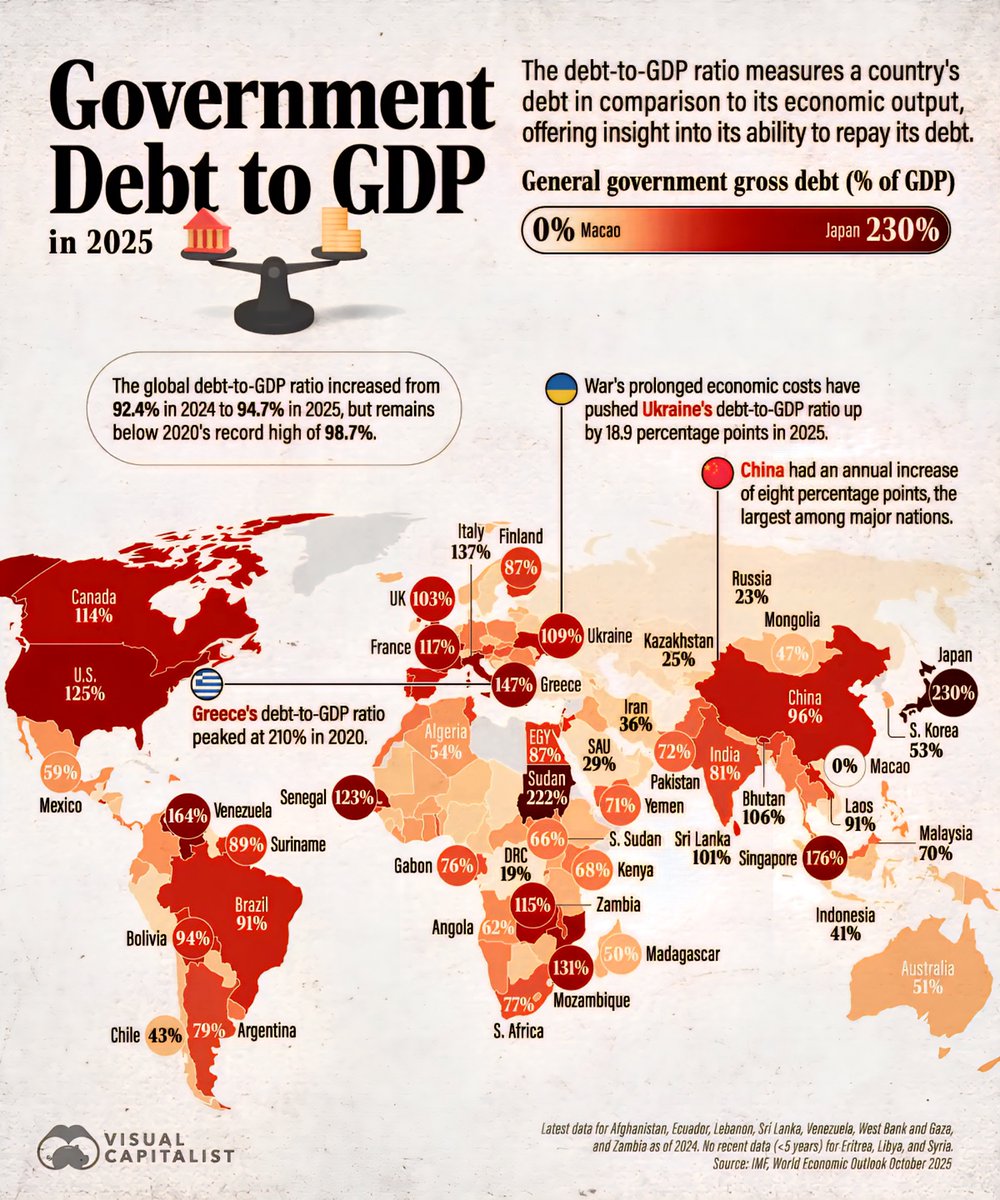

Underlying Factors Driving the Surge in Government Debt-to-GDP Ratio

The government debt-to-GDP ratio reached new heights in 2025, reflecting the complex interplay of economic policies, global events, and internal fiscal management. This metric indicates the country’s borrowing relative to its economic output and has significant implications for fiscal stability and economic growth. Several factors have contributed to this rise, shaping the financial landscape of the nation.

Impact of Post-Pandemic Economic Recovery Measures

In 2025, the government’s response to the lingering effects of the COVID-19 pandemic continues to influence debt levels. Massive stimulus packages introduced during the pandemic aimed to stabilize the economy, but they resulted in substantial borrowing. Although these measures provided temporary relief and supported millions of jobs, they have increased public debt, evident when comparing current figures to pre-pandemic levels. As the economy gradually recovers, the debt-to-GDP ratio reflects these accumulated liabilities.

Increased Spending on Infrastructure and Social Programs

A significant driver of the rising debt ratio is the government’s commitment to modernizing infrastructure and expanding social programs. Investments in transportation, renewable energy, healthcare, and education have been prioritized to bolster long-term economic sustainability. However, these initiatives require hefty upfront funding, often financed through borrowing. While they are expected to yield benefits in the future, the current spending has contributed to a higher debt-to-GDP figure.

Rising Interest Rates and Debt Servicing Costs

The global rise in interest rates over the past year has compounded the debt situation. As borrowing costs increase, the government faces higher debt servicing expenses, which further strain the fiscal budget. Existing debt accumulates more quickly under these conditions, pushing the debt-to-GDP ratio upward. This scenario creates a feedback loop, where increased servicing costs limit room for new investments or deficit reductions.

External Economic Shocks and Market Volatility

Unpredictable external shocks, including geopolitical tensions and fluctuating commodity prices, have added volatility to the economic environment in 2025. Such shocks can slow down economic growth or decrease tax revenues, making it more difficult for the government to keep up with debt repayments. Market volatility also affects foreign investment flows, impacting revenue streams and forcing the government to borrow more to bridge gaps.

Demographic Shifts and Aging Population

An aging population poses long-term fiscal challenges that influence the debt-to-GDP ratio. With more individuals retiring and collecting benefits, government expenditures on pensions and healthcare increase significantly. Simultaneously, a shrinking workforce reduces overall economic productivity and tax revenues, amplifying the need for borrowing and adding to debt levels.

Growing Deficit Spending in Critical Sectors

Deficit spending continues in vital sectors such as defense, technology innovation, and climate change mitigation. While these investments aim to secure strategic advantages and address urgent global issues, they often result in budget deficits that must be offset through borrowing. Such sustained deficits contribute directly to the rising debt-to-GDP ratio.

Global Economic Environment and Trade Dynamics

The interconnectedness of the global economy influences national debt levels. In 2025, trade disruptions and tariffs have affected export and import balances, reducing revenue and increasing import costs. These factors lead to increased deficits, compelling the government to borrow more.

Future Outlook and Policy Considerations

Looking ahead, managing the government debt-to-GDP ratio will require balanced fiscal policies, including revenue enhancement and expenditure moderation. Structural reforms, such as tax modernization and entitlement review, will be crucial. Additionally, fostering sustainable economic growth through innovation and workforce development remains key to stabilizing debt levels.

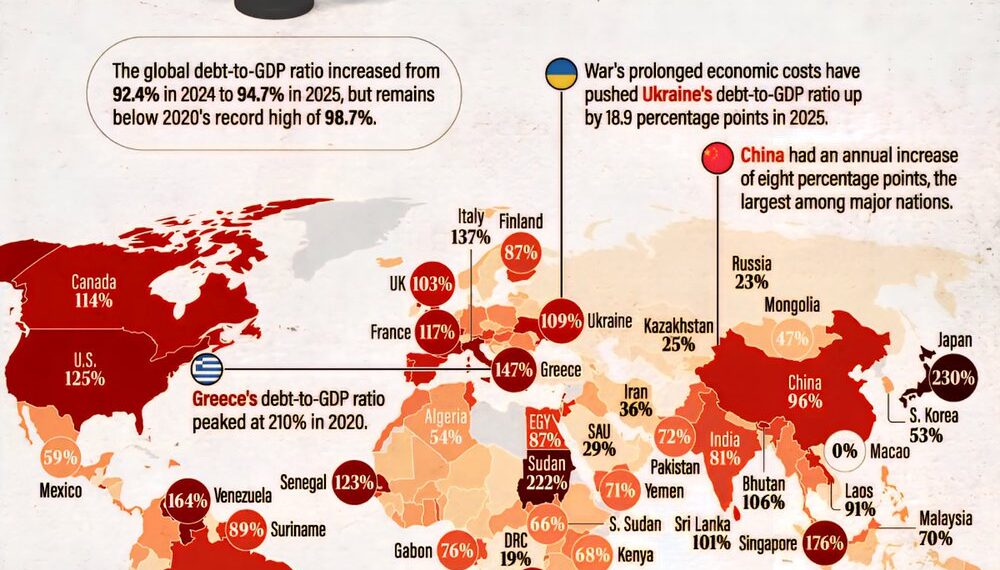

As shown in the chart, the trajectory of government debt relative to the country’s economic output underscores the urgent need for strategic fiscal planning. The rising debt-to-GDP ratio in 2025 is a multifaceted issue challenging policymakers to implement sustainable measures that will ensure economic stability for decades to come.