Select Language:

The United States Dominates the Billion-Dollar Club

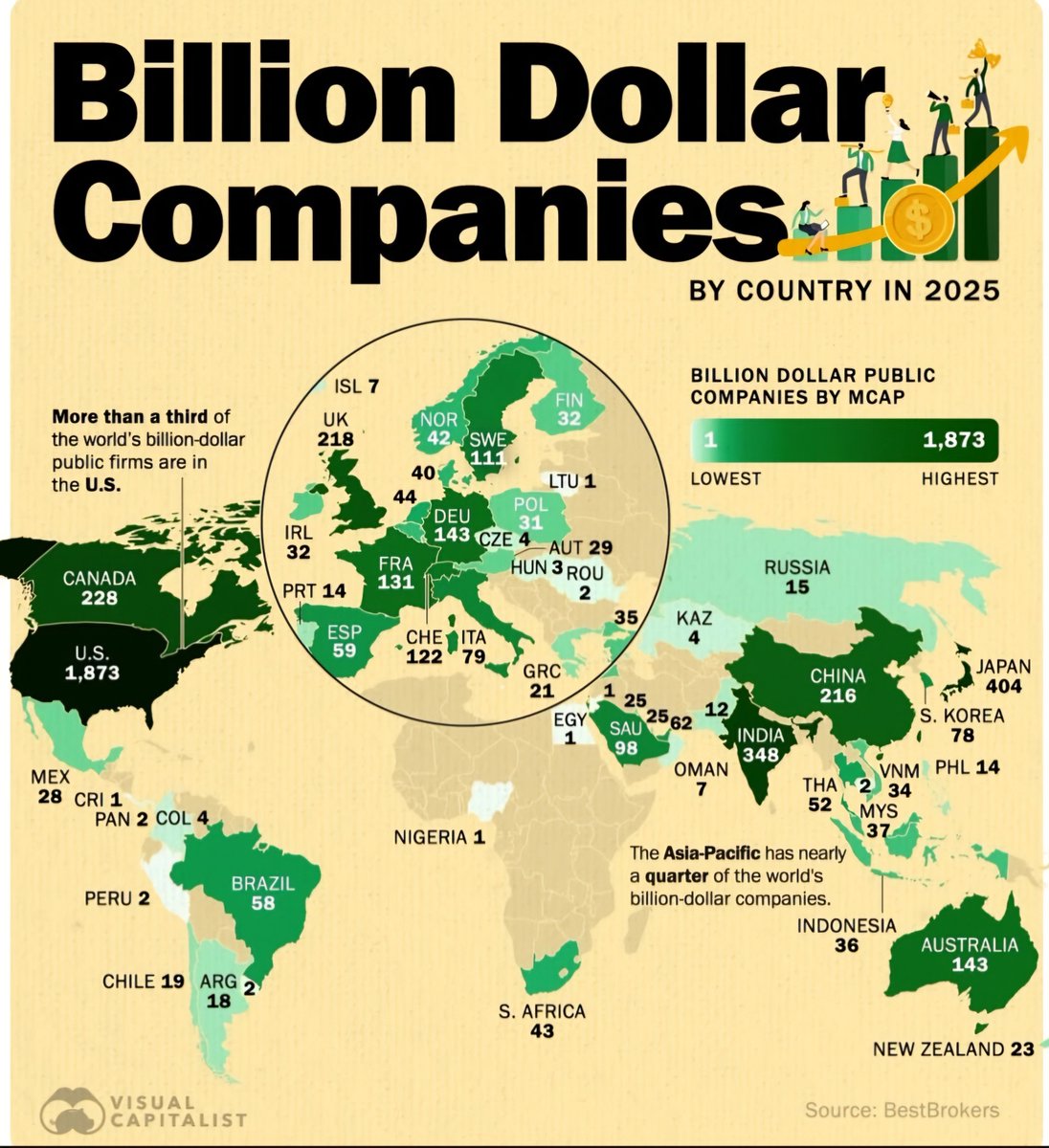

In 2025, the United States continues its leadership in the global market with an astonishing 1,873 billion-dollar public companies. This figure notably surpasses other nations, emphasizing America’s economic strength and entrepreneurial ecosystem. The sheer volume signifies that more than a third of the world’s billion-dollar listed firms are based in the U.S., reflecting the country’s vast and diverse economy.

Japan and India’s Growing Presence in the Billionaire League

Japan remains a significant player, with 404 billion-dollar companies, maintaining its position as a major Asian economic hub. Meanwhile, India sees remarkable growth, housing 348 such companies, signaling its rising prominence on the global corporate stage. Both nations are leveraging technological advancements and robust domestic markets to fuel this expansion.

Canada and the United Kingdom: North Atlantic Powerhouses

Canada has firmly established itself with 228 billion-dollar firms, strengthening its position as a hub for natural resources, technology, and finance. Similarly, the UK holds 218 companies, staying competitive despite recent economic shifts and emphasizing financial services and technology sectors.

China’s Ongoing Economic Climb

Holding 216 billion-dollar enterprises, China continues its rapid ascent. Its diverse industries, from manufacturing to tech, fuel this impressive array, making it one of the most influential economies with a substantial number of high-value companies.

The European Continent’s Economic Footprint

Germany and France each boast 143 and 131 billion-dollar companies respectively. Their combined corporate strength underpins Europe’s economic resilience. Switzerland and Sweden follow, with 122 and 111 firms, emphasizing stability and innovation in finance, pharmaceuticals, and technology sectors.

Middle Eastern and South Asian Markets

Saudi Arabia with 98 firms and Israel with 70 illustrate the Middle Eastern region’s diversification beyond oil, venturing into tech and finance. India’s neighbor, Pakistan, shows slow but steady growth with 12 billion-dollar companies.

Oceania and Smaller Economies

Australia and Germany are tied with 143 firms, further highlighting Europe’s influence. Australia’s thriving resources, finance, and tech sectors contribute significantly to this count. New Zealand’s smaller count of 23 indicates emerging markets and nascent tech industries.

Latin American Contributions

Brazil with 58 companies and Chile with 19 demonstrate Latin America’s increasing integration into the global economy. These numbers reflect improving investment climates and rising entrepreneurial activity in the region.

Asian Market Expansion

South Korea and Taiwan hold 78 and 77 billion-dollar firms, respectively, underpinning Asia’s tech prowess and manufacturing capabilities. Countries like Singapore (51 companies) and Malaysia (37) affirm Asia-Pacific’s growing corporate dominance.

European microstates and small nations

Luxembourg and Greece each feature 21 companies, representing stable yet small economic bases. Similarly, small nations like Malta, Cyprus, and Lithuania with 1-3 companies highlight the broad geographic distribution of high-value corporate entities.

Emerging Economies and New Frontiers

Countries such as Vietnam (34 companies), Indonesia (36), and Thailand (52) exhibit robust growth and are rapidly expanding their presence in the global market. Nations like Nigeria, with 1 company, show potential for future growth.

Insights on Global Corporate Distribution

- More than a third of the world’s billion-dollar companies are based in the U.S., underlining its unparalleled economic influence.

- The Asia-Pacific region is home to nearly a quarter of these companies, showcasing its rapid growth and technological advancements.

- Europe’s stability is reflected in its sizable number of high-value firms, particularly in Germany, France, and Switzerland.

Source: BestBrokers 2025

The landscape of global billion-dollar companies continues to evolve, driven by technological innovation, economic shifts, and regional growth strategies. As nations diversify their economies and embrace new sectors, the list of leading firms is expected to diversify further in the coming years.