Select Language:

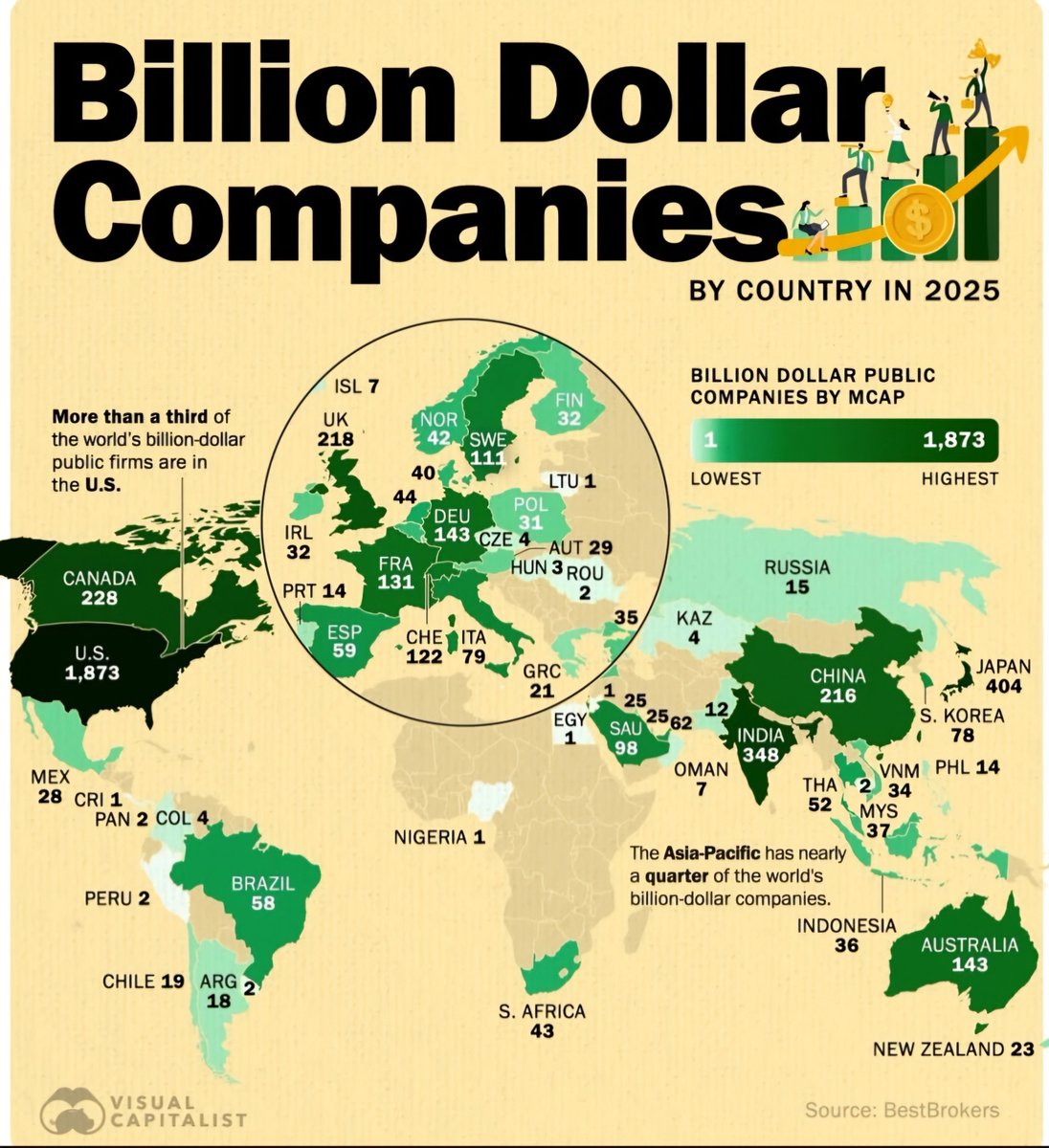

The United States Continues to Lead with Nearly 1,900 Billion-Dollar Companies

The United States remains the dominant force in the global corporate landscape, boasting approximately 1,873 firms valued at over a billion dollars. This tremendous count underscores the country’s robust technological, financial, and consumer sectors. Companies like Apple, Amazon, and Alphabet continue to set the pace for innovation and profitability, reinforcing the nation’s status as the hub of venture capital and startup growth.

Japan Rises as the Second Largest with Over 400 Top-Valued Firms

Japan holds its position as the second-largest base for billion-dollar companies, with around 404 firms. The country’s strong manufacturing industries, particularly in electronics and automotive sectors, contribute significantly to this tally. Major firms such as Toyota, Sony, and Mitsubishi are iconic players on the global stage, demonstrating Japan’s resilience and innovation in a shifting economic landscape.

India Sees Explosive Growth to Over 340 Billion-Dollar Companies

India’s corporate scene is booming, with approximately 348 companies reaching billion-dollar valuations. Driven by rapid digital transformation, e-commerce, and a burgeoning tech sector, India is quickly climbing the ranks. Homegrown giants like Reliance and Tata Group exemplify the country’s dynamic economic growth, attracting both domestic and international investments.

Canada and the UK Maintain Significant Numbers

Canada boasts about 228 billion-dollar companies, with a prominent presence in natural resources, technology, and financial services. British companies, including major banks and energy corporations, make up around 218 of these high-value firms. This reflects their stable economies and influential global outreach.

The Notable Presence of China and Australia

China and Australia each have approximately 216 and 143 billion-dollar companies, respectively. China’s economic might is exemplified by tech giants, state-owned enterprises, and manufacturing powerhouses, while Australia’s high-value firms are often in mining, finance, and healthcare sectors.

Key Highlights from the 2025 Data

- Top 10 Countries: The list remains dominated by the U.S., Japan, India, Canada, the UK, and China, capturing over 80% of the total billion-dollar firms globally.

- Emerging Economies: Countries like Saudi Arabia, Israel, and the UAE are increasingly making their mark, reflecting diversification in wealth and sectors.

- European Market: France, Switzerland, Sweden, and Germany demonstrate strong financial, luxury, and technological industries, maintaining high counts of billion-dollar companies.

- Technological Powerhouses: South Korea, Taiwan, Israel, and Singapore show robust tech ecosystems, supporting their sizable counts.

Asia-Pacific Continues to Grow Its Share

The Asia-Pacific region accounts for nearly a quarter of the world’s billion-dollar companies. Countries such as South Korea (78), Taiwan (77), and Singapore (51) exemplify innovation hubs with vibrant tech startups and mature industries. This region’s prominence signals a shifting global balance toward Asia in high-value corporate sectors.

Smaller Countries and Their Niche Markets

Nations like Luxembourg, Greece, Chile, and Argentina have fewer billion-dollar firms but remain key players within their regions. Their markets often focus on niche industries such as finance, agriculture, and energy.

Emerging Markets and New Frontiers

While many nations have minimal representation—with some having just a handful or none—this landscape is fluid. Countries like Nigeria, Pakistan, and Romania are gradually developing their high-growth sectors, hinting at future increases in their global counts.

Conclusion

The 2025 data underscores a progressive shift towards technological innovation and emerging markets, alongside the continued dominance of established economies like the United States and Japan. The growth of firms in India and other developing nations signals a more multipolar corporate world, with opportunities expanding across continents.

Source: BestBrokers