Select Language:

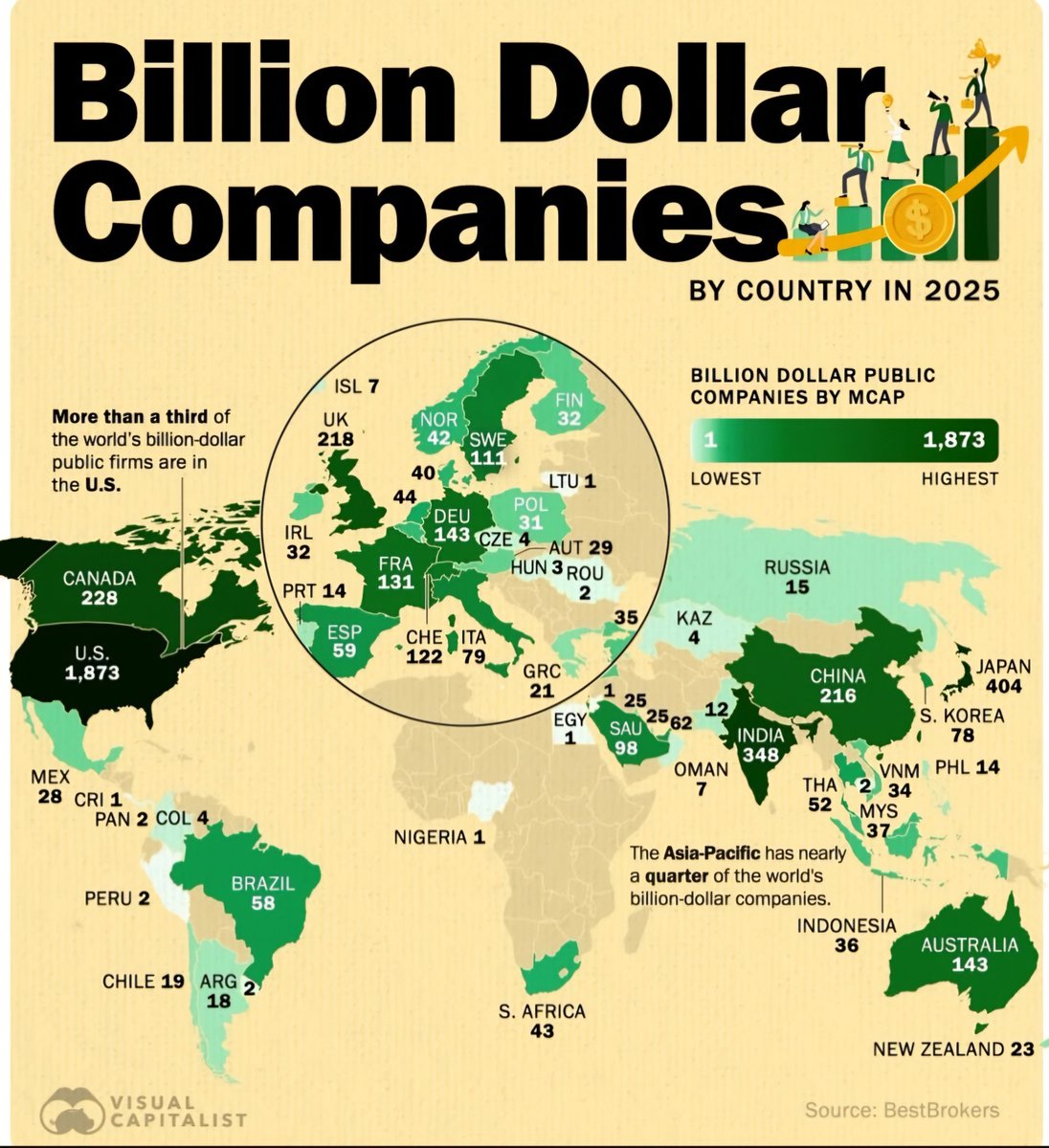

Top Countries Expected to Host the Most Billion-Dollar Companies by 2025

The United States Dominates the Billion-Dollar Club

With a staggering projection of 1,873 billion-dollar companies by 2025, the United States continues to lead the world in corporate valuation. Over a third of all publicly traded giants hail from the U.S., underscoring its dominance in global markets. Whether in technology, finance, or consumer goods, American firms are expected to maintain their economic stronghold, reflecting the country’s robust innovation ecosystem and capital markets. This numbers boost the country’s economy significantly, attracting talent and investments from around the globe.

Japan and India Maintain Strong Positions

Japan is projected to have around 404 billion-dollar companies, a testament to its longstanding technological and manufacturing prowess. The country’s strong industrial foundation continues to support its sizeable corporate sector. India, with an expected 348 billion-dollar firms, is rapidly catching up, driven by its burgeoning tech scene, startups, and an expanding middle class. The rapidly evolving Indian economy makes it a promising hub for future business giants, contributing heavily to the broader Asian economic landscape.

Canada and the UK: Key Players in North America and Europe

Canada is forecasted to have 228 billion-dollar companies, supported by its natural resources, technology, and finance sectors. Meanwhile, the UK is expected to have around 218 such firms, maintaining its reputation as Europe’s financial hub. London’s status as a global financial center continues to attract multinational companies, keeping the UK firmly in the global top tier.

China and Australia: Growing Economic Titans

China, with an estimated 216 billion-dollar companies, remains a critical player, especially as it advances in technology, e-commerce, and manufacturing. Despite potential regulatory challenges, Chinese firms continue expanding domestically and internationally. Australia is expected to host about 143 billion-dollar companies, primarily bolstered by its mining, finance, and energy sectors, which continue to fuel its economic growth.

Europe’s Leading Economies

Germany and France each boast around 143 and 131 billion-dollar companies, respectively. Germany’s strength in automotive and industrial manufacturing keeps it as Europe’s economic powerhouse, whereas France benefits from luxury brands, pharmaceuticals, and tech firms. Switzerland, with 122 companies, remains influential due to its banking and pharmaceutical industries. Sweden, Spain, and Italy follow, each contributing significantly to the continent’s corporate landscape.

Middle East and Asia-Pacific: Rising Powers

Saudi Arabia is expected to have nearly 98 billion-dollar companies, primarily driven by the oil and energy sectors. The UAE also features prominently with 62 firms, reflecting its strategic investments in tourism, real estate, and finance. The Asia-Pacific region as a whole is poised to house almost a quarter of the world’s billion-dollar companies, with Singapore (51 firms), South Korea (78), Taiwan (77), and Israel (70) leading the charge. These nations are becoming innovation hubs, with technology, biotech, and manufacturing industries flourishing.

Emerging Markets and Smaller Economies

While many smaller or emerging markets have fewer billion-dollar companies, they play crucial roles in their regional economies. Brazil, with 58 firms, illustrates the potential of Latin America’s largest economy. Thailand, Singapore, and South Korea show the diversity and vibrancy of Asia. African nations like South Africa (43) continue to develop their economic infrastructures, aiming for higher corporate valuations.

What the Data Tells Us

The projection highlights that economic powerhouses such as the United States, China, and Japan will remain critical centers of corporate wealth. The significant number of companies in emerging markets like India and Southeast Asia underscores the shifting global economic landscape, where growth opportunities increasingly come from developing regions.

Final Thoughts

As these figures suggest, the global economy in 2025 will be marked by a mixture of well-established financial giants and rapidly evolving markets. Countries investing in innovation, infrastructure, and technology are best positioned to see their corporate sectors grow into billion-dollar firms, shaping the business world for the years to come.

Source: BestBrokers