Select Language:

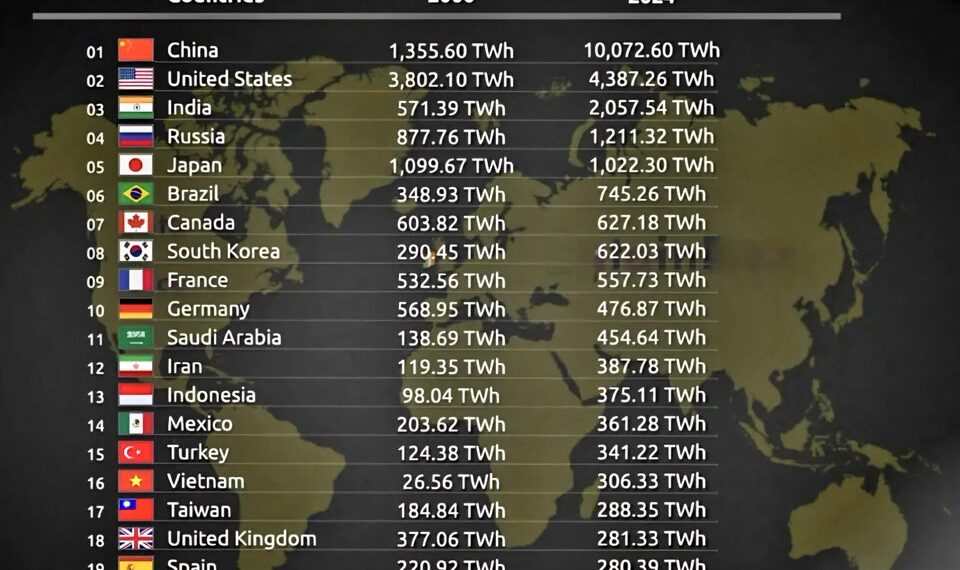

China’s Leadership in Electricity Production

China continues to dominate the global electricity landscape, escalating its generation from 1,355.60 TWh in 2000 to a staggering 10,072.60 TWh in 2024. This meteoric rise underscores China’s rapid industrial growth and urbanization, positioning it as the world’s largest energy producer. The country’s heavy investment in both traditional and renewable energy sources plays a pivotal role in supporting its vast economic infrastructure, including manufacturing, technology, and infrastructure projects. China’s commitment to expanding clean energy options is also evident as it increasingly invests in solar, wind, and hydroelectric power.

The United States: Maintaining and Growing Its Electricity Capacity

The United States saw a steady increase in electricity production, from 3,802.10 TWh in 2000 to 4,387.26 TWh in 2024. Although its growth rate is less dramatic than China’s, the U.S. remains a significant player, with a diverse energy mix comprising coal, natural gas, nuclear, and renewables. Enhanced initiatives in green energy are gradually reshaping its energy ecosystem, aligning with broader climate objectives. The U.S.’s ongoing transition toward cleaner sources signals a shift that could influence global energy trends in the coming years.

India’s Rapid Expansion in Power Generation

India’s electricity generation tripled over the last two decades, from 571.39 TWh in 2000 to 2,057.54 TWh in 2024. This surge mirrors India’s fast-paced economic development, infrastructural investments, and an expanding population demanding more energy. The country is heavily investing in coal, but also making significant strides in solar and wind energy. As India strives for energy independence, its evolving power sector is poised to become one of the most dynamic in the world.

Russia’s Consistent Growth

Russia’s electricity output increased from 877.76 TWh to 1,211.32 TWh, reflecting steady growth driven by abundant natural resources and extensive hydroelectric and nuclear plants. Russia’s energy sector benefits from its vast geographical resources, making it a key energy supplier for Europe and beyond. Its focus on optimizing existing infrastructure and developing new energy projects continues to shape its status as an influential energy producer.

Japan’s Slight Decline and Recovery

Japan produced 1,099.67 TWh in 2000 but experienced a slight decline to 1,022.30 TWh in 2024. Despite challenges from natural disasters, nuclear shutdowns, and energy policy shifts, Japan maintains a robust energy system with substantial nuclear and renewable assets. The country is actively seeking to diversify its energy sources to ensure sustainable and resilient power supply.

Brazil’s Steady Rise

Brazil’s electricity generation climbed from 348.93 TWh to 745.26 TWh, largely due to its extensive hydroelectric resources. The country remains committed to renewable energy, with hydroelectricity forming the backbone of its power grid, complemented by growing wind and solar capacities. Brazil’s focus on clean energy has made it a leader in sustainable power generation in Latin America.

Canada’s Stable yet Growing Capacity

Canada increased its electricity output from 603.82 TWh to 627.18 TWh. Its vast natural resources, especially hydroelectric power, serve as the foundation for its clean energy profile. Investments in upgrading infrastructure and expanding renewable projects continue to bolster Canada’s energy resilience and sustainability goals.

South Korea’s Rapid Modernization

South Korea experienced significant growth in power generation, from 290.45 TWh to 622.03 TWh, driven by industrial expansion and urban demand. Its strategic investments in nuclear, natural gas, and renewable sources aim to reduce reliance on imported fuels. South Korea’s proactive energy policies focus on technological innovation and energy efficiency.

France’s Stable Nuclear Power

France’s electricity generation increased modestly from 532.56 TWh to 557.73 TWh, with nuclear power remaining a dominant source. The country continues to optimize its nuclear fleet while exploring renewable energy options to diversify its energy mix and meet climate commitments.

Germany’s Transition Challenges

Germany saw a decline from 568.95 TWh to 476.87 TWh, attributed to its energy transition away from coal and nuclear toward renewables. The country faces the complex challenge of balancing energy security, economic stability, and environmental sustainability during this transition.

Middle East’s Growing Energy Footprint

Saudi Arabia and Iran exhibit impressive growth, with Saudi Arabia climbing from 138.69 TWh to 454.64 TWh and Iran from 119.35 TWh to 387.78 TWh. Their investments aim to diversify economies traditionally reliant on oil exports, emphasizing renewable energy projects and expanding capacity to meet domestic needs.

Southeast Asia’s Rapid Development

Indonesia, Vietnam, Thailand, and Malaysia are experiencing rapid growth, driven by burgeoning economies and urbanization. Indonesia’s power generation jumped from 98.04 TWh to 375.11 TWh, while Vietnam’s rose from 26.56 TWh to over 306 TWh. These countries are increasingly investing in solar, wind, and hydro energy to accommodate their expanding populations and industries.

The United Kingdom and Spain: Revisions in Power Output

The UK’s electricity generation declined from 377.06 TWh to approximately 281.33 TWh, reflecting a shift towards energy efficiency and a transition to renewable sources. Spain’s generation increased slightly, with a move towards diversified renewables, reaching 280.39 TWh in 2024.

Australia’s Renewable Focus

Australia’s output grew from 216.83 TWh to nearly 280 TWh, signaling significant investments in solar and wind power. Its vast land area and natural resources make it an ideal candidate for scaling renewable energy projects.

Italy and South Africa’s Evolving Energy Profiles

Italy’s power generation saw a minor decline, whereas South Africa experienced modest growth, reflecting efforts to balance traditional coal reliance with renewable and nuclear energy sources.

Egypt and Thailand’s Growing Power Needs

Egypt and Thailand have substantially increased their electricity production, from around 73.32 TWh and 95.52 TWh in 2000 to 235.41 TWh and 199.55 TWh in 2024, respectively. Their expanding economies and populations push for more their push in renewable initiatives and grid modernization.

Malaysia’s Steady Growth

Malaysia’s electricity generation increased from 69.90 TWh to 198.22 TWh, primarily driven by urbanization and industrial growth, with renewed focus on harnessing renewable energy sources.

Total global electricity production has soared over the past two decades, driven largely by rapid economic growth in developing nations and a global shift toward renewable energy sources. As nations continue to adapt their energy strategies, the landscape of power generation remains dynamic and pivotal in shaping a sustainable future.

Source: Ember, Energy Institute – Statistical Review of World Energy 2024