Select Language:

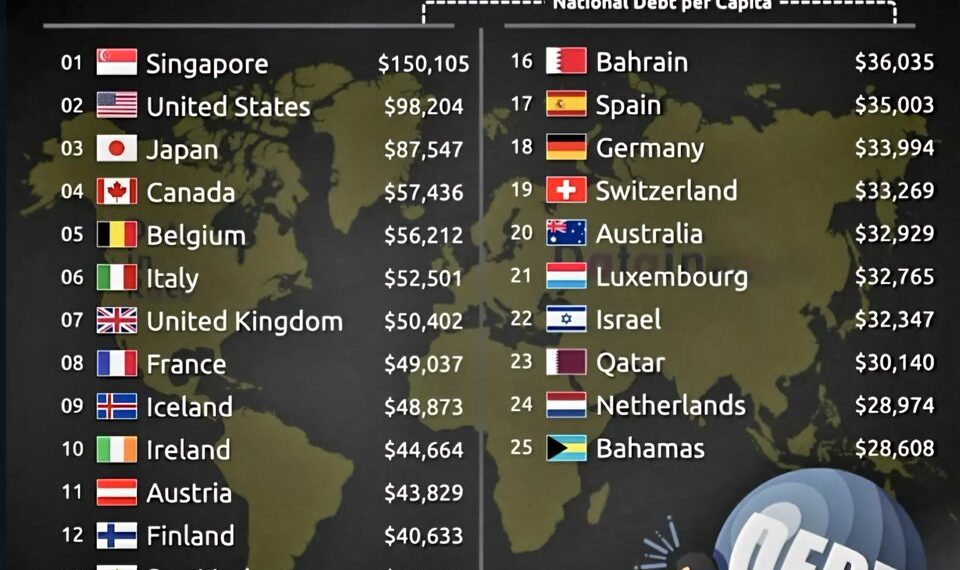

Top 25 Countries with the Highest National Debt per Capita

When evaluating the economic stability of nations, one significant metric that often comes into play is national debt per capita. This statistic illustrates the average amount of debt each citizen would theoretically carry if the nation’s total debt were divided evenly among its residents. The implications of high national debt can be broad, impacting everything from economic policy to individual financial security.

In this article, we will dive into the top 25 countries with the highest national debt per capita, revealing not only the staggering numbers but also the potential effects of such debt levels on their economies and citizens.

1. Singapore – $150,105

With a national debt that towers above the rest, Singapore finds itself in an unusual position where its high debt is often tied to its robust financial sector. The country’s government has implemented strategic debt management practices, making the situation sustainable.

2. United States – $98,204

The U.S. national debt has often been a topic of fierce debate, particularly as it continues to rise. With so many governmental responsibilities, from defense to healthcare, the debt reflects the costs of maintaining the world’s largest economy.

3. Japan – $87,547

Japan’s staggering debt is largely a result of a prolonged economic stagnation and significant public spending. The country has managed its debt through low-interest rates, but the long-term implications for its economy remain uncertain.

4. Canada – $57,436

Canada’s debt per capita has seen increases due to pandemic-related spending. However, the nation’s financial situation remains stable, thanks in part to its diverse economy and strong banking system.

5. Belgium – $56,212

Belgium’s high national debt is influenced by extensive social security programs and an aging population. The government’s expenditures weigh heavily on its overall financial health, but its high GDP helps balance the debt.

6. Italy – $52,501

Italy struggles with high debt levels attributed to economic challenges and significant public expenditures. The nation’s debt is often viewed through the lens of its historical economic vulnerabilities, including low growth rates.

7. United Kingdom – $50,402

The UK’s national debt has escalated partly as a result of measures taken during the COVID-19 pandemic to support businesses and individuals. The economic recovery will determine how this debt affects future policies.

8. France – $49,037

France has a high national debt largely due to extensive social welfare programs and public sector employment. Economic reforms are continually discussed to manage this debt responsibly.

9. Iceland – $48,873

Iceland’s national debt rose following the 2008 financial crisis. While the country has seen significant recovery since that time, managing national debt remains a crucial priority.

10. Ireland – $44,664

Ireland’s debt escalated dramatically during the banking crisis of the late 2000s. The country has since seen economic growth, yet its debt levels are still a challenge to navigate.

11. Austria – $43,829

Austria’s debt is characterized by a solid economy that is capable of managing its liabilities. The country’s commitment to a balanced budget could shape its future debt landscape.

12. Finland – $40,633

Finland enjoys a high standard of living, but its national debt per capita reflects extensive welfare expenditures. Sustainability remains key as the government navigates fiscal challenges.

13. San Marino – $40,401

Despite being a small nation, San Marino’s debt is significant in per capita terms. Given its size, financial management becomes even more critical.

14. Greece – $38,700

After undergoing a severe debt crisis, Greece has made strides in addressing its financial troubles. However, the debt remains noteworthy as it grapples with economic recovery.

15. Norway – $38,477

Norway’s high national debt is somewhat counterbalanced by its wealth from oil revenues. Investment strategies help ensure that the country remains financially strong.

16. Bahrain – $36,035

With a rapidly changing economy and growing social demands, Bahrain’s national debt reflects the need for significant investment despite its economic resources.

17. Spain – $35,003

Spain’s national debt surged due to the financial crisis a decade ago. Efforts to reduce that burden focus on increasing economic growth and reducing public expenditures.

18. Germany – $33,994

Germany, as Europe’s largest economy, faces the challenge of maintaining its strong fiscal status while dealing with rising debt levels amidst various social obligations.

19. Switzerland – $33,269

While Switzerland has a reputation for strong financial health, its national debt reflects the costs of maintaining its high standard of living and public services.

20. Australia – $32,929

Australia’s debt grew during the pandemic, but its strong economy and diverse industries have allowed for effective management strategies to cope with rising obligations.

21. Luxembourg – $32,765

Luxembourg’s high debt per capita is primarily due to its financial services sector, where both public and private debt levels are substantial relative to its population.

22. Israel – $32,347

Israel’s national debt has increased alongside its significant military and social expenditures. Managing this debt in light of regional tensions is critical moving forward.

23. Qatar – $30,140

For Qatar, a wealthy nation with vast energy resources, high debt levels are manageable but still necessitate careful consideration as it seeks to diversify its economy.

24. Netherlands – $28,974

The Netherlands faces challenges with rising debt levels due to social welfare obligations, but its strong economy provides a buffer against potential risks.

25. Bahamas – $28,608

The Bahamas’ national debt reflects challenges related to tourism dependence, hurricane-related expenses, and economic recovery efforts, making future financial health a priority.

Understanding these figures is crucial not only for policymakers but also for citizens looking to grasp the fiscal realities that their respective nations face. As national debt continues to be a central topic in global economics, the implications of these numbers resonate well beyond local borders.