Select Language:

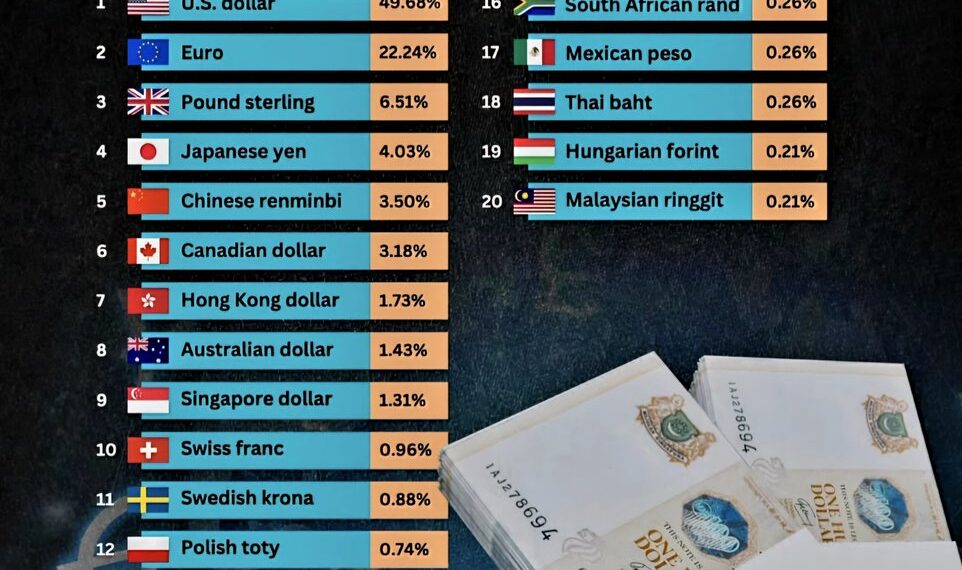

The Power Players in Global Finance: Top 20 Currencies of 2025

1. U.S. Dollar Dominance Continues

Leading the pack is the U.S. dollar, accounting for nearly half of all currency transactions worldwide at 49.68%. This dominance highlights America’s economic influence and the dollar’s role as the primary reserve currency. Despite fluctuations, the dollar remains essential for international trade, investment, and financial stability.

2. Euro Solidifies Its Position

The euro takes the second spot with 22.24% of global currency dealings. As the official currency of 20 European nations, it continues to serve as a key player in regional and international finance. The euro’s stability and the strength of the European economy underpin its significance in global markets.

3. The Pound Sterling’s Resilient Status

The British pound sterling maintains its third-place spot with 6.51%. Britain’s financial sector, London’s status as a global financial hub, and ongoing economic policies strengthen the pound’s position, making it a vital currency for trade and investment.

4. The Japanese Yen’s Steady Influence

Holding the fourth position at 4.03%, the Japanese yen reflects Japan’s robust economy and its role as a major trading partner worldwide. The yen is often considered a “safe-haven” currency during times of global uncertainty.

5. Rise of the Chinese Renminbi

The Chinese renminbi (Yuan) advances to fifth place with 3.50%, showcasing China’s expanding influence in international finance. Increased use in global trade, especially within Asia and the Belt and Road Initiative, has propelled the renminbi’s importance.

6. Canadian Dollar’s Growing Role

Accounting for 3.18%, the Canadian dollar benefits from Canada’s stable economy, rich natural resources, and strong banking system. It is a popular currency for commodities trading and investment.

7. Hong Kong Dollar’s Strategic Importance

The Hong Kong dollar (1.73%) remains a pivotal currency, serving as a financial gateway between China and the world. Its close ties to the Chinese economy make it a key currency in Asian markets.

8. Australian Dollar Maintains Its Market Share

With 1.43%, the Australian dollar reflects Australia’s resilient economy, mineral exports, and trade links with Asian countries. It is often used in currency baskets and international investments.

9. Singapore Dollar’s Financial Hub Status

Holding 1.31%, the Singapore dollar underscores Singapore’s prominence as a global financial hub, with a reputation for stability, transparency, and strong economic fundamentals.

10. Swiss Franc’s Steadfast Position

Representing 0.96%, the Swiss franc stands as a symbol of stability and security, often considered a safe haven during market turbulence, thanks to Switzerland’s sound financial policies.

11. The Swedish Krona’s Niche

At 0.88%, Sweden’s currency is notable for its technological innovation, robust economy, and high standard of living, making the krona a stable regional currency.

12. The Polish Zloty’s Growing Influence

The Polish zloty accounts for 0.74%, reflecting Poland’s strong economic growth within the European Union and its increasing integration into global markets.

13 & 14. Scandinavian Currencies on the Rise

Both the Norwegian krone and Danish krone hold 0.39% each, demonstrating their stable economies, rich natural resources, and prudent fiscal policies that attract investors.

15. New Zealand Dollar’s Resilience

The New Zealand dollar’s share of 0.33% highlights its role in the Asia-Pacific region, driven by agricultural exports and a robust financial services sector.

16-19. Emerging and Developing Market Currencies

South Africa, Mexico, Thailand, and Hungary each hold around 0.21-0.26%, representing their growing role in regional trade, natural resources, and economic reforms.

20. Malaysian Ringgit’s Steady Presence

The Malaysian ringgit, at 0.21%, benefits from Malaysia’s strategic location and diversified economy, evolving as a regional trading currency.

Note: The data source is SWIFT, 2025.

This snapshot illustrates how the global currency landscape continues to evolve, with traditional powerhouses maintaining influence while emerging markets steadily gain ground.