Select Language:

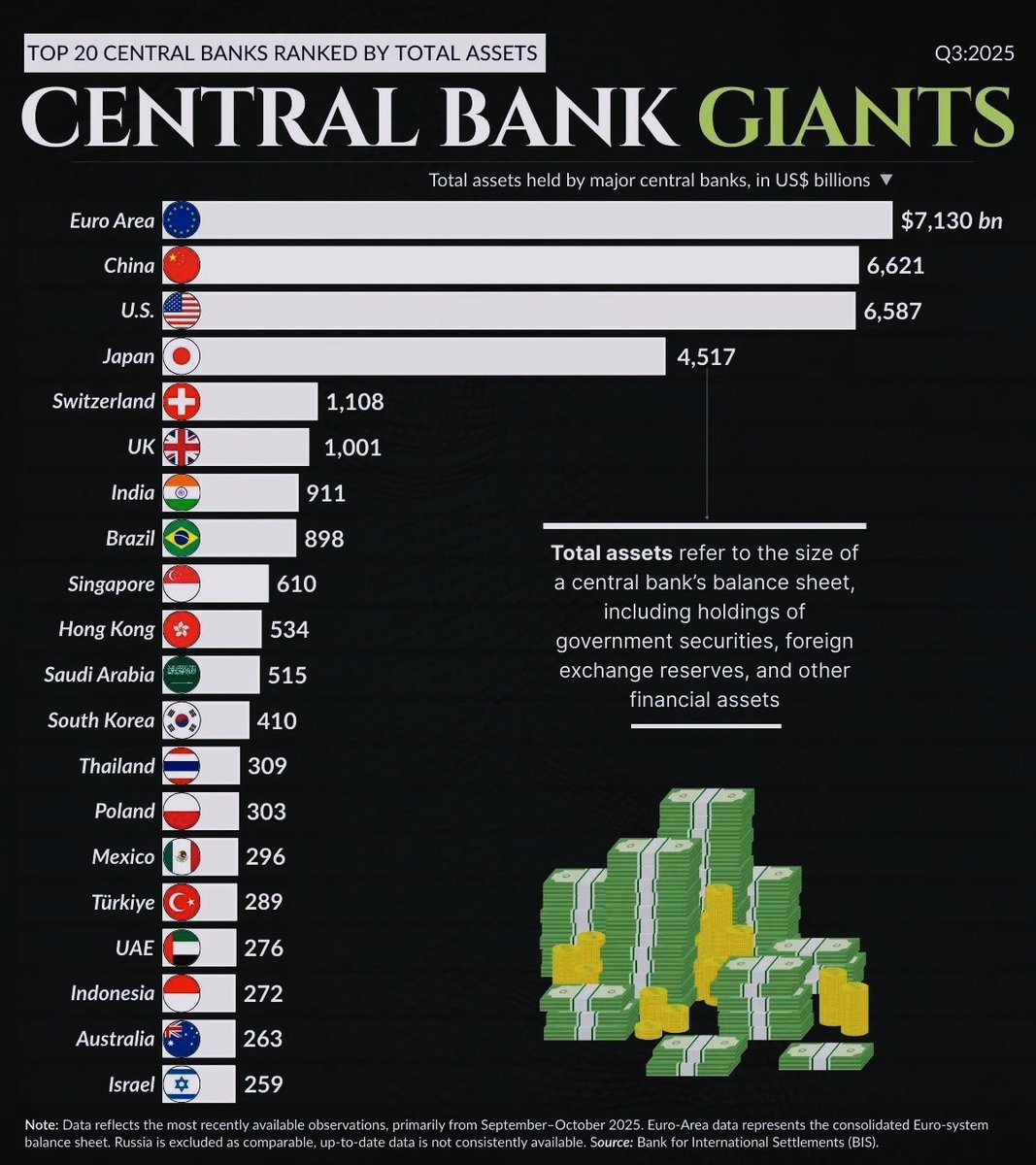

The Largest Central Banks in the World as of 2025: A Detailed Look

1. Euro Area – $7.13 Trillion

The European Central Bank (ECB) continues to hold the position as the largest central bank globally, with assets totaling approximately $7.13 trillion. This significant size reflects the euro area’s commitment to maintaining monetary stability across its member nations. The ECB’s expansive balance sheet is driven by its extensive asset purchase programs and crisis response measures, showcasing its pivotal role in steering the region’s economy during volatile times.

2. China – $6.62 Trillion

China’s central bank, the People’s Bank of China, ranks second with assets valued at about $6.62 trillion. China’s rapid economic growth over the past decade has contributed to this sizable reserve. The PBOC employs a combination of monetary policies and foreign exchange interventions to manage the world’s second-largest economy’s stability amid global uncertainties, emphasizing China’s strategic financial influence.

3. United States – $6.59 Trillion

The U.S. Federal Reserve remains a dominant force with assets approximately $6.59 trillion. Its expansive balance sheet underpins numerous initiatives, including quantitative easing and financial market stabilization efforts. The Fed’s role during economic fluctuations continues to underscore its stature in both domestic and global finance.

4. Japan – $4.52 Trillion

Japan’s central bank, the Bank of Japan (BOJ), manages assets worth nearly $4.52 trillion. The BOJ’s aggressive bond-buying strategies have been instrumental in curbing deflation and supporting economic growth, reflecting its active monetary policy stance and influence on regional financial stability.

5. Switzerland – $1.11 Trillion

The Swiss National Bank (SNB) holds around $1.11 trillion in assets. Known for its currency interventions and maintaining a stable financial environment, the SNB’s substantial reserves highlight Switzerland’s robust banking system and its key role in global finance.

6. United Kingdom – $1 Trillion

The Bank of England maintains assets close to $1 trillion, reflecting its efforts to manage economic resilience post-Brexit. The bank’s balance sheet supports monetary policy decisions aimed at fostering economic growth amid ongoing geopolitical shifts.

7. India – $911 Billion

India’s Reserve Bank of India (RBI) manages nearly $911 billion in assets. Its focus on inflation control, currency stability, and economic expansion underpins its growing influence in Asia’s financial landscape.

8. Brazil – $898 Billion

Brazil’s Central Bank oversees assets approximately $898 billion. Its monetary policy remains geared toward combating inflation and stabilizing the real amid fluctuating commodity prices and geopolitical challenges.

9. Singapore – $610 Billion

Singapore’s Monetary Authority of Singapore (MAS) maintains a formidable reserve of about $610 billion. The country’s strategic monetary policies and open trade stance empower it as a financial hub in Southeast Asia.

10. Hong Kong – $534 Billion

The Hong Kong Monetary Authority (HKMA) holds assets valued at roughly $534 billion. Its unique position as a gateway to China’s vast market reinforces Hong Kong’s vital role in regional and global finance.

Note: The data references the most recent observations from September-October 2025. The Euro-area figures reflect the consolidated Euro-system balance sheet. Russia is excluded due to inconsistent, up-to-date data availability.

Source: Bank for International Settlements (BIS)

This list highlights the evolving landscape of central banking in 2025, reflecting economic shifts, monetary policies, and regional influences shaping today’s global economy.