Select Language:

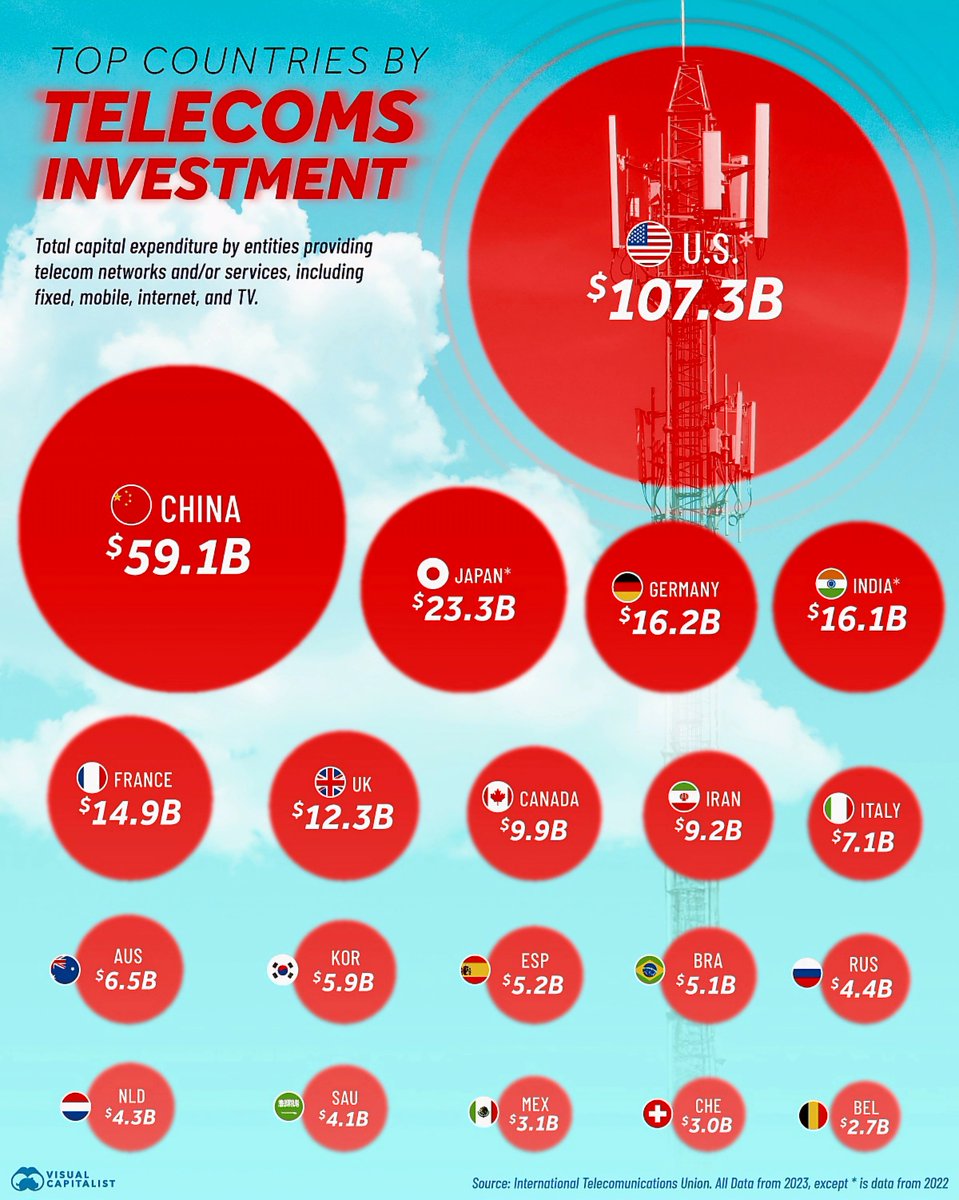

Top 20 Countries Investing Most in Telecom Infrastructure in 2022

United States Leads the World with Over $107 Billion in Telecom Spending

The United States continues to dominate the global telecom investment landscape, pouring in a staggering $107.3 billion last year. This massive investment reflects the country’s ongoing push for 5G network expansion, fiberoptic broadband rollout, and upgrading existing infrastructure to meet consumer and industry demands. The US’s significant expenditure underscores its commitment to maintaining technological dominance and improving connectivity nationwide.

China’s Strategic Investment of Nearly $60 Billion

China ranks second, with approximately $59.1 billion invested in telecommunications infrastructure in 2022. The nation’s focus remains on building out 5G networks, expanding internet coverage in rural areas, and modernizing its digital economy infrastructure. China’s investments are pivotal in supporting its rapid technological advancements and economic growth.

Japan and India’s Growing Telecom Budgets

Japan follows with about $23.3 billion invested, prioritizing 5G deployment and smart city initiatives. Meanwhile, India’s telecom expenditure reaches roughly $16.1 billion, part of its broader plan to increase internet penetration and digital services across its vast population. Both countries exemplify significant focus on upgrading networks to support emerging technologies and services.

European Countries Making Steady Investments

Germany allocates $16.2 billion towards telecom infrastructure development. France invests nearly $14.9 billion, emphasizing expanding fiber-optic networks and 5G. The United Kingdom dedicates roughly $12.3 billion to improve national connectivity. These investments aim to bolster economic growth, improve communications, and maintain Europe’s competitive edge in digital technology.

Canada, Iran, and Italy Spotlighted in Telecom Spending

Canada’s telecom investment reaches close to $9.9 billion, supporting nationwide broadband expansion. Iran invests approximately $9.2 billion, focusing on digital infrastructure growth amidst regional challenges. Italy’s $7.1 billion investment highlights efforts to improve urban connectivity and modernize rural telecommunication networks.

Australia, South Korea, and Spain Focus on Innovation

Australia deploys around $6.5 billion in telecom projects, enhancing 5G coverage and broadband access. South Korea invests roughly $5.9 billion, in line with their reputation for cutting-edge telecom technology and innovation. Spain allocates $5.2 billion toward the expansion of its digital infrastructure, aiming to support tourism and business sectors.

Emerging Markets and Smaller Economies Making Their Mark

Brazil invests approximately $5.1 billion in telecom infrastructure, aiming to bridge urban-rural divides. Russia commits about $4.4 billion, focusing on modernizing its communications system. The Netherlands, with a $4.3 billion investment, continues to develop its high-speed networks, emphasizing smart city projects.

Significant Investments in the Middle East and Latin America

Saudi Arabia directs around $4.1 billion toward telecom upgrades, supporting Vision 2030 initiatives for economic diversification. Mexico allocates $3.1 billion to expand connectivity in underserved regions. Switzerland and Belgium don’t lag far behind, investing $3.0 billion and $2.7 billion respectively to strengthen their digital infrastructure.

Key Takeaways

- The global telecom investment landscape remains robust, with wealthier nations leading the charge but emerging economies progressively increasing their budgets.

- 2022 saw significant breakthroughs in 5G deployment, fiber optic expansion, and smart city projects.

- Countries investing heavily in communications infrastructure aim to foster economic growth, improve public services, and remain competitive in an increasingly digital world.

Source: International Telecommunications Union, 2023

Note: Data marked with an asterisk () refers to figures from 2022.*