Select Language:

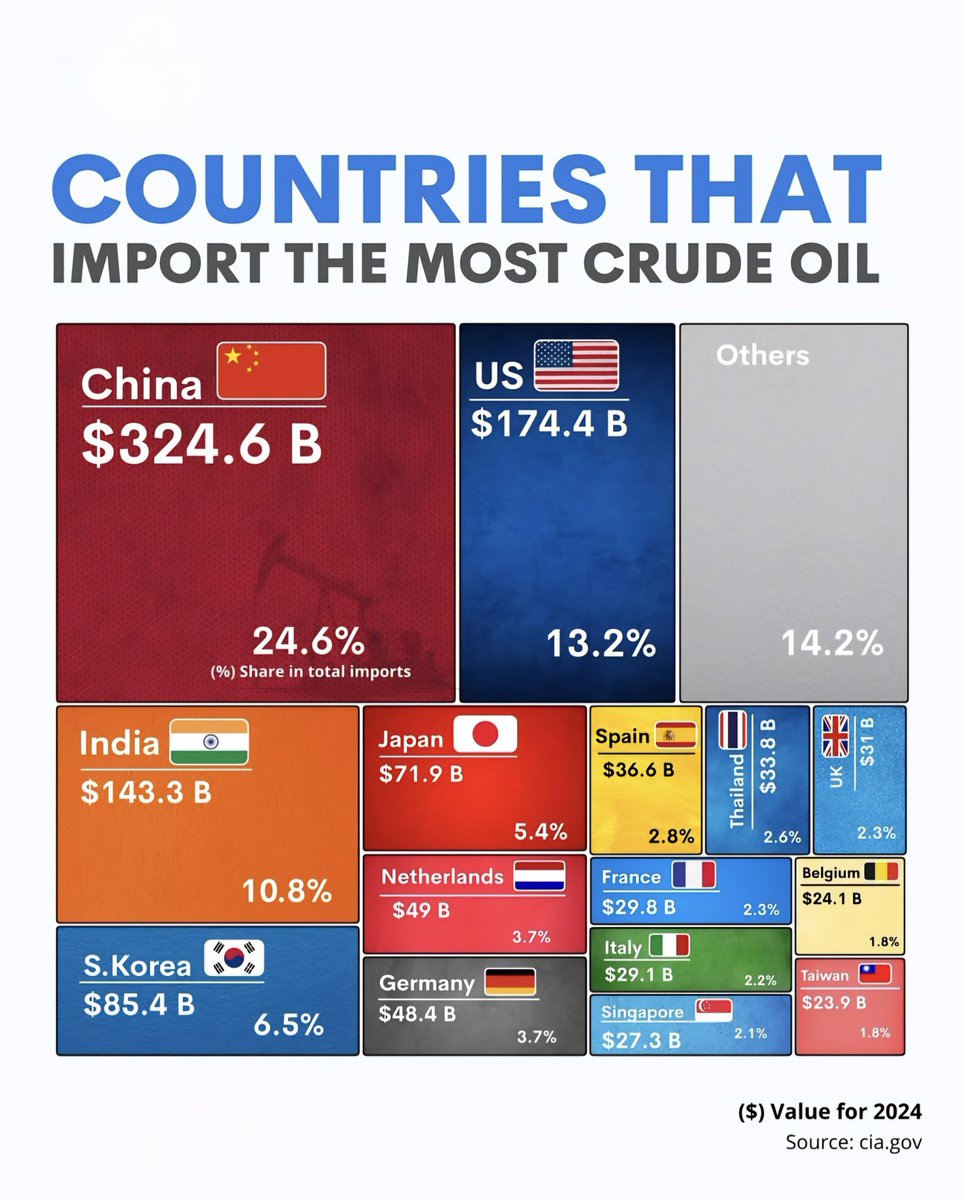

United States Leading in Crude Oil Imports

In 2024, the United States maintained its position as the largest importer of crude oil, importing approximately 9.2 million barrels per day. This surge was driven by increased domestic energy consumption and the ongoing demand from industrial sectors. Despite significant domestic oil production, the US continues to rely heavily on imports from other countries to meet its energy needs. The strategic geographical location and well-established oil infrastructure make it the primary destination for crude oil imports in North America. The imports primarily come from Canada, Mexico, and Venezuela, with Canada accounting for nearly 55% of total US crude oil imports.

China’s Steady Rise as a Major Oil Importer

China remains the second-largest importer of crude oil, with imports reaching about 8.5 million barrels daily in 2024. This continued growth reflects China’s expanding economy and its ongoing pursuit of energy security. China imports a significant portion of its crude from the Middle East, notably Saudi Arabia, Iraq, and Iran. The country’s strategic stockpiling efforts and investments in refining capacity also contribute to increasing its import volume, positioning China as a critical player in global oil markets.

India’s Rapid Expansion in Oil Imports

India has seen a sharp increase in crude oil imports, averaging around 6.8 million barrels per day in 2024. The nation’s rapid urbanization and economic development drive the demand for energy. India sources a considerable amount of its crude from Iraq, the United Arab Emirates, and Nigeria. Efforts to diversify supply sources and build strategic petroleum reserves have become priorities as India seeks to reduce dependency on specific regions and bolster its energy security.

Japan’s Dependence on Imports Continues

Japan remains heavily reliant on imported crude oil to sustain its energy needs, importing approximately 3.4 million barrels daily in 2024. The country’s limited domestic energy resources mean it imports mostly from the Middle East, especially Saudi Arabia, the United Arab Emirates, and Kuwait. Japan’s focus on diversifying energy sources with nuclear and renewable energy remains, but imports continue to play a crucial role in Japan’s energy strategy.

South Korea’s Consistent Oil Demand

South Korea’s oil import volume stayed steady around 2.6 million barrels a day in 2024. With a highly industrialized economy, South Korea depends on imports from the Middle East and Southeast Asia. The country’s refining industry is one of the most advanced globally, making South Korea a vital hub for re-exporting refined petroleum products.

Europe’s Largest Importers

European nations, collectively, imported substantial amounts of crude oil. Among them, Greece imported approximately 1.2 million barrels daily in 2024. Europe’s reliance on oil imports is largely from Russia, the Middle East, and West Africa. The European Union’s push for lower carbon emissions influences future demand, but oil remains a critical primary energy source for many countries in the region.

Brazil’s Growing Oil Dependency

Brazil’s oil imports increased to about 600,000 barrels daily, reflecting expansion in energy-intensive industries and ongoing domestic exploration efforts. The country sources oil mainly from West Africa, the Middle East, and neighboring Venezuela. Brazil’s efforts to balance domestic production with imports continue to shape its energy landscape.

Middle Eastern Oil Exporters

While Middle Eastern countries are typically known as exporters, several nations like Iraq and Iran are significant importers of crude oil for internal refining and re-export purposes. Iraq, for instance, imported over 600,000 barrels daily in 2024 to meet domestic demands amid ongoing geopolitical shifts.

African Countries’ Oil Imports

Countries such as Nigeria and South Africa are notable African importers. Nigeria imports approximately 300,000 barrels daily, primarily from the Middle East, to support its refining sector. South Africa imports roughly 400,000 barrels daily, mainly from Iran and the Middle East, for industrial and energy needs.

Mexico’s Continuing Oil Trade Relationship

Mexico imported about 1 million barrels daily in 2024, mostly from the United States and Central American countries. Its refining capacity and existing trade relationships position Mexico as a consistent player in global oil import patterns.

Southeast Asian Oil Dynamics

Countries like Indonesia and Vietnam are increasingly importing crude oil, with Indonesia importing nearly 270,000 barrels daily. These nations seek to meet growing energy demands and develop domestic refining capabilities, often sourcing from the Middle East and Australia.

Australia’s Slight Increase in Oil Imports

Australia’s oil imports edged up to around 350,000 barrels a day in 2024, mainly from the Middle East. Given its large economy and considerable transportation sector, Australia continues to rely on imports to sustain its energy needs, despite efforts to boost domestic oil exploration.

Canada’s Export-Focused Oil Strategy

While Canada is among the top exporting nations, it also imports crude oil, mainly for processing and refining purposes. Canada imports approximately 300,000 barrels daily from the US to refine in its domestic facilities, supporting both domestic consumption and exports.

Venezuela’s Oil Trade Challenges

Venezuela, despite its vast oil reserves, imported about 150,000 barrels daily in 2024. Political and economic challenges have constrained its production and export capabilities, forcing Venezuela to import some crude and refined products to satisfy domestic demands.

Conclusion

The global landscape of crude oil imports in 2024 highlights shifting geopolitical dynamics, economic growth in emerging markets, and the persistent demand for energy worldwide. As nations focus on energy security, diversification, and transitioning to cleaner sources, the patterns of oil imports are expected to evolve further in the coming years.