Select Language:

The Biggest Steel Producers in 2025: A Closer Look at Global Leaders

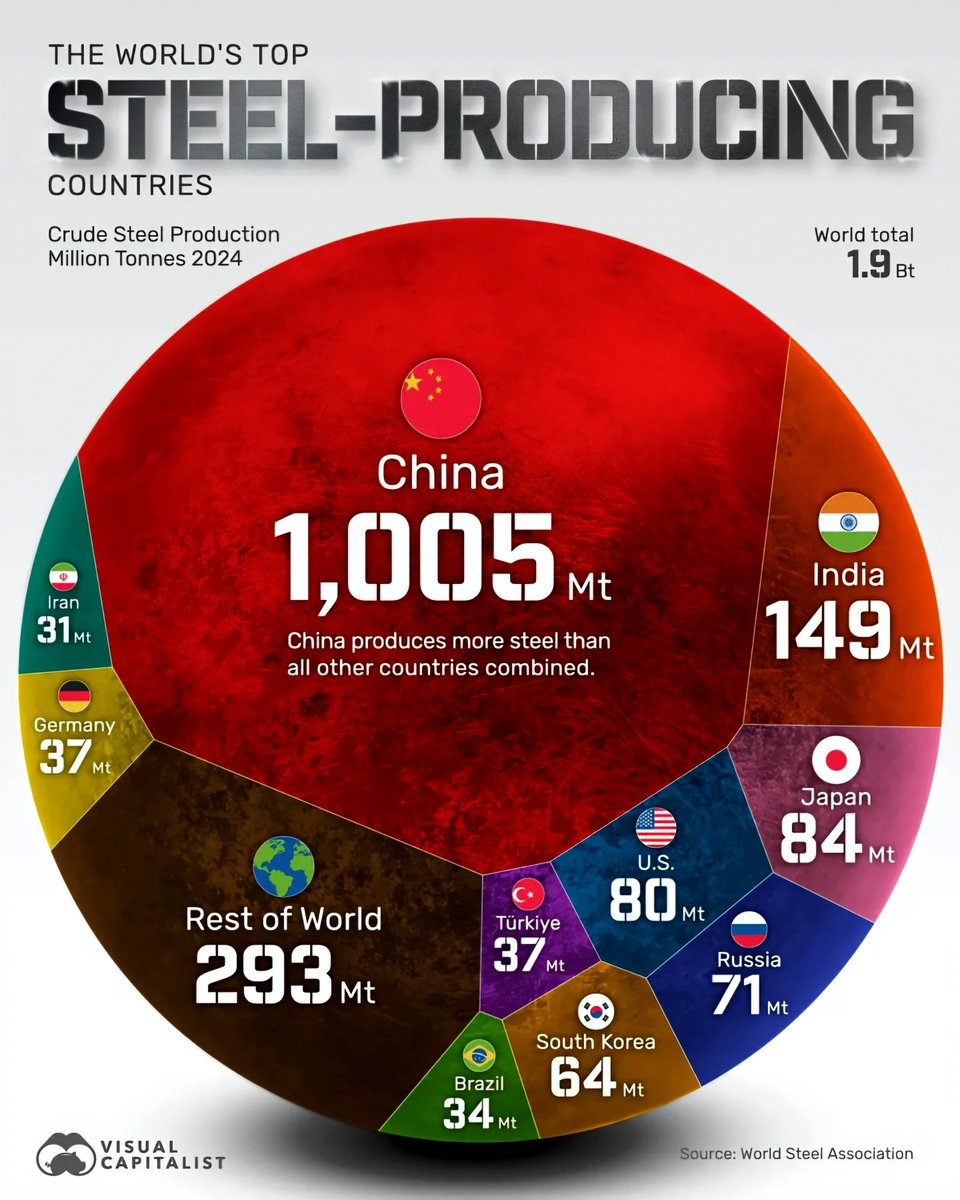

1. China Continues to Dominate the Steel Industry

China remains the undisputed king of steel production, accounting for nearly 60% of the world’s total output in 2025. With its massive industrial base and ongoing infrastructure development, China produced over 1.2 billion metric tons of steel last year. The country’s investment in advanced manufacturing technologies and government policies aimed at economic growth continue to fuel its leadership in this sector. Despite environmental concerns, China’s steel industry shows resilience, adapting with greener production processes and stricter regulations.

2. India Rises to Second Place

India has solidified its position as the world’s second-largest steel producer, surpassing Japan and South Korea in 2025. The country’s steel output reached approximately 130 million metric tons, driven by increased domestic demand and large infrastructure projects like urban development, transportation, and renewable energy initiatives. Indian steel companies are also expanding their global footprint, investing in new plants abroad to meet both domestic needs and export targets.

3. Japan Maintains Its Third-Place Position

Japan, a longstanding leader in high-quality steel manufacturing, produced around 80 million metric tons in 2025. While its production levels have plateaued compared to previous decades due to economic shifts and environmental policies, Japan continues to innovate in sustainable steel production, focusing on reducing emissions and improving energy efficiency. Its advanced technology and high standards for quality keep it competitive in the global market.

4. United States Strengthens Its Position

The US increased its steel output to roughly 75 million metric tons in 2025, bolstered by government initiatives to support domestic manufacturing. The recent push for infrastructure renewal, defense projects, and a focus on reshoring manufacturing jobs have driven growth in the American steel sector. Companies are investing heavily in automation and environmentally friendly technologies to stay competitive and compliant with evolving regulations.

5. South Korea’s Steady Production

South Korea produced around 70 million metric tons of steel this year. The country remains a key player, especially in specialized steel products such as automotive and shipbuilding steels. South Korea is pushing toward greener production methods, with significant investments in cleaner power sources and recycling techniques to reduce its environmental impact.

6. Germany’s Focus on Innovation and Sustainability

Germany, Europe’s top steel producer, produced approximately 42 million metric tons in 2025. German steel companies are at the forefront of adopting innovative, eco-friendly manufacturing processes. Emphasizing sustainability, many firms have incorporated hydrogen into their production lines to cut carbon emissions, aligning with European Union climate goals.

7. Brazil’s Growing Steel Industry

Brazil has emerged as a notable player in the global steel market, producing around 34 million metric tons in 2025. The country’s vast natural resources, combined with recent investments in new steel plants and infrastructure, provide a strong foundation for growth. The government’s policies to encourage industrialization are also fostering increased steel consumption and export opportunities.

8. Russia Maintains Its Industry Strength

Russia produced approximately 70 million metric tons of steel this year. The country’s vast mineral resources and domestic demand continue to sustain its steel industry, despite international sanctions impacting exports. Russian steel companies are also exploring new markets and investing in modern technologies to enhance efficiency and product quality.

9. Turkey’s Expanding Steel Sector

Turkey has become a regional steel manufacturing hub, producing around 42 million metric tons in 2025. Strategic geographic positioning, affordable energy costs, and government support have fueled the industry’s growth. Turkish steel exports are increasingly popular across Europe, the Middle East, and Africa.

10. Iran and Egypt on the Rise

Iran and Egypt are emerging as notable steel producers, with Iran registering roughly 30 million metric tons and Egypt producing around 20 million metric tons. Both nations are investing in new steel plants as part of broader economic development plans, aiming to meet domestic demand while expanding export capabilities.

As global demand for steel continues to fluctuate amidst economic shifts and eco-conscious initiatives, these top-producing countries play a vital role in shaping the future of the industry by innovating, investing, and adapting to increasingly strict environmental standards. Their ongoing efforts will likely influence global markets for years to come.