Select Language:

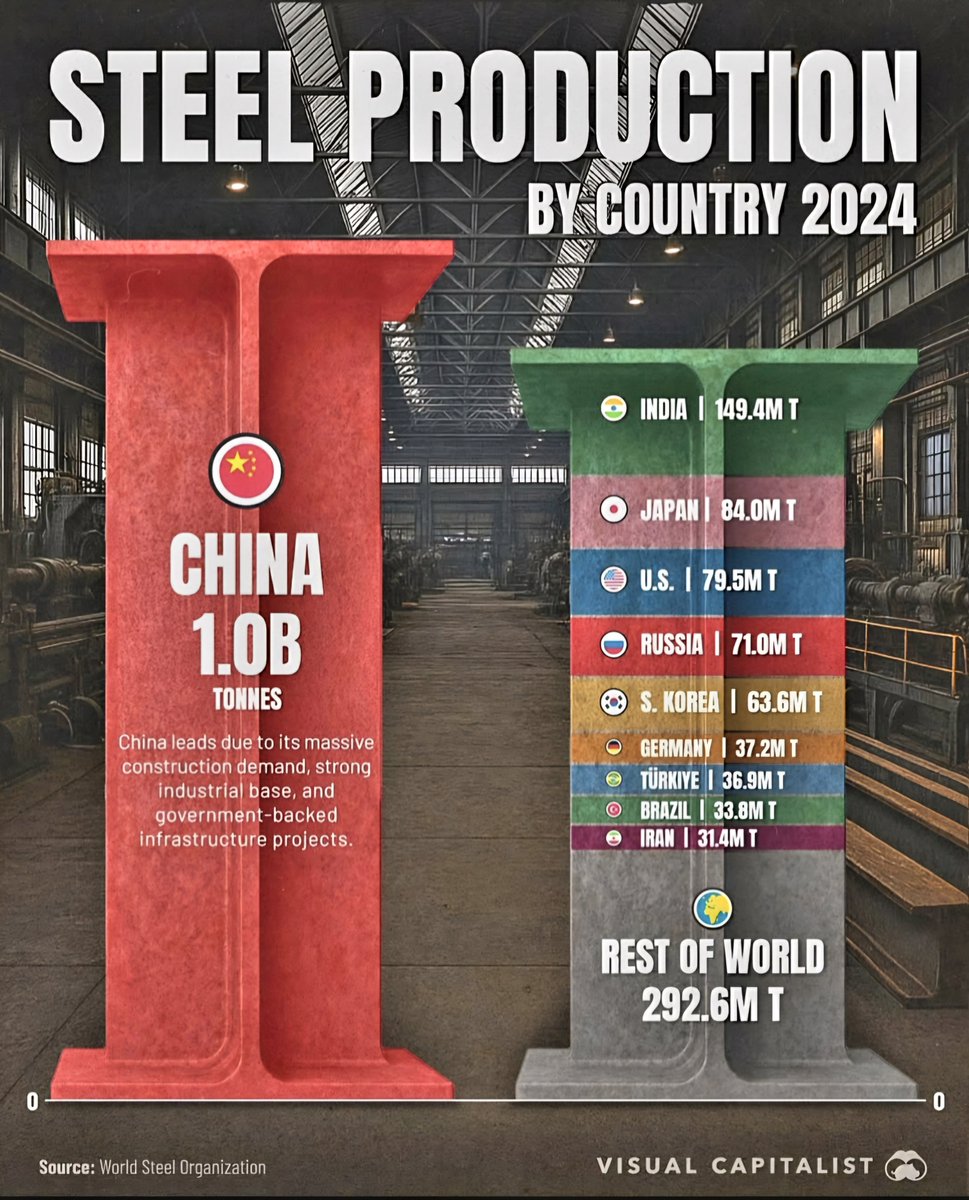

The World’s Biggest Steel Producers in 2024: A Closer Look

1. China Continues to Dominate Global Steel Production

China holds the top spot globally, manufacturing approximately 1 billion tonnes of steel this year. This staggering figure underscores China’s immense industrial capacity, driven by ongoing infrastructure development and urban expansion. The nation’s government remains a key supporter of steel-producing industries to sustain its economic growth, which heavily relies on large-scale construction projects, manufacturing, and export activities.

2. India Secures its Position as a Major Player in Steel Manufacturing

India’s steel output reached nearly 150 million tonnes in 2024, solidifying its second-place ranking worldwide. With a burgeoning population and rapid urbanization, demand for steel in infrastructure, automotive, and other manufacturing sectors has surged. Indian steel companies are investing heavily in new facilities and technology to meet domestic needs and increase export competitiveness.

3. Japan’s Steady Steel Production Demonstrates Resilience

Japan produced about 84 million tonnes of steel this year, maintaining its position among the top producers globally. Despite facing economic challenges, Japan continues to manufacture high-quality steel, especially for automotive, machinery, and construction sectors. Its advanced technology and efficient production methods help sustain its global export footprint.

4. The United States Maintains its Steel Industry Strength

The US produced roughly 79.5 million tonnes of steel in 2024, reflecting ongoing industrial activity and infrastructure renewal projects. The country’s steel industry benefits from a combination of domestic demand and strategic trade policies designed to protect and grow local manufacturing capabilities amid global market fluctuations.

5. Russia’s Steel Output Remains Prominent

Russia produced around 71 million tonnes, leveraging its extensive natural resources and established industrial base. The country supplies steel for its domestic construction, automotive, and defense sectors, with ongoing investments aimed at modernizing its facilities and expanding production capacity.

6. South Korea’s Steel Manufacturing Powerhouse

South Korea’s steel production reached about 63.6 million tonnes, a testament to its advanced manufacturing and technology sectors. Key industries such as shipbuilding, automotive, and electronics are vital consumers of South Korean steel, incentivizing continuous innovation and efficiency improvements in steelmaking processes.

7. Germany’s Steel Industry Stays Robust

Germany produced approximately 37.2 million tonnes of steel, underscoring its role as Europe’s industrial leader. The country’s focus on high-quality, specialized steel products caters to the automotive, machinery, and aerospace industries. Germany’s commitment to sustainability and technological innovation shapes its steel sector’s growth strategy.

8. Turkey Rises as an Emerging Steel Power

Turkey’s steel output hits about 36.9 million tonnes, driven by infrastructure upgrades, urban development, and the manufacturing sector’s expansion. The nation’s strategic geographic location and economic policies foster a vibrant steel industry centered on both domestic consumption and export markets.

9. Brazil’s Steel Production Enhances Latin America’s Standing

Brazil produced around 33.8 million tonnes of steel this year, strengthening its position as Latin America’s leading steel producer. A growing construction industry, along with expanding mining and automotive sectors, fuels investments in new steel plants and modernization efforts.

10. Iran’s Steel Industry Grows Despite Challenges

Iran contributed approximately 31.4 million tonnes to global steel production, demonstrating resilience amid geopolitical and economic hurdles. Its steel industry plays a pivotal role in domestic infrastructure projects and regional trade, supported by government initiatives aimed at expanding capacity.

Global Perspective: Steel Production Outside the Top Ten

The rest of the world collectively produced about 292.6 million tonnes of steel in 2024. Countries across Africa, Southeast Asia, and Eastern Europe contribute to this total, with emerging markets increasingly investing in expanding their steel industries to support infrastructure, urbanization, and manufacturing growth.

Summary of Key Drivers Behind Global Steel Trends

China’s dominance is driven by its enormous infrastructure projects, urbanization, and export-oriented policies. India’s booming construction and auto industries fuel its rapid growth. Traditional steel giants like Japan and Germany focus on high-quality products and technological innovation. Meanwhile, countries like Turkey and Brazil are growing as regional steel hubs, filling increasing domestic and international demand. Despite geopolitical uncertainties, the global steel industry continues to evolve, shaping the development of economies worldwide.

Source: World Steel Organization