Select Language:

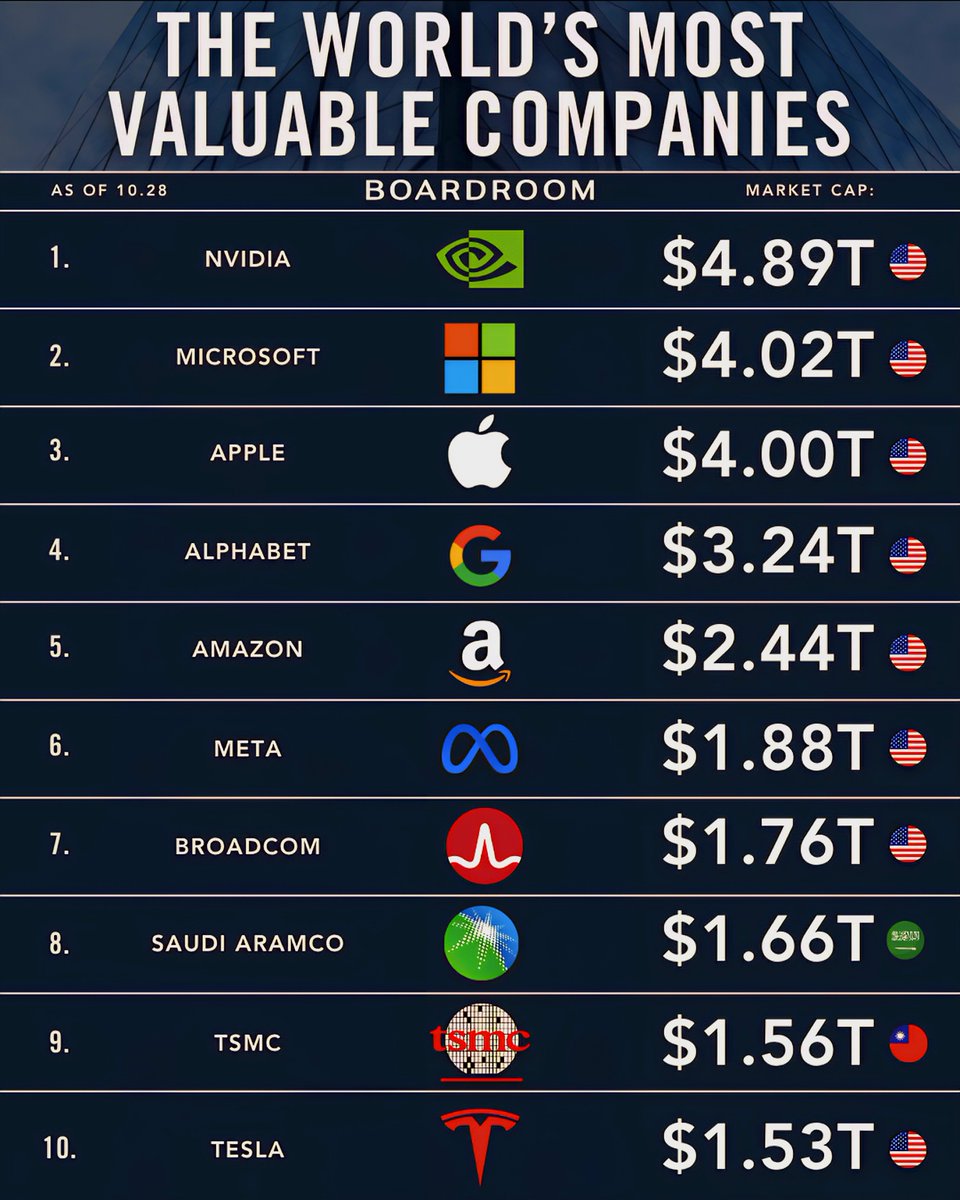

The Most Valuable Companies in the World in 2025

1. Apple Inc.

Leading the chart once again, Apple remains the most valuable company globally in 2025, with a market capitalization surpassing $3.1 trillion. Its consistent innovation in consumer electronics, particularly the latest iPhone models, and expansion into services like AR/VR and healthcare have cemented its position as a tech giant. Apple’s ecosystem, including devices, software, and services, continues to drive its valuation, fueling significant revenue streams and investor confidence.

2. Saudi Aramco

The Saudi Arabian national petroleum and natural gas company, Saudi Aramco, secures the second spot. Its valuation has hit approximately $2.7 trillion this year, driven by robust global oil demand and strategic investments in sustainable energy. Despite the push toward renewable energy, Aramco’s dominance in traditional energy markets keeps it firmly among the top players, and its recent ventures into hydrogen fuel are expected to bolster long-term prospects.

3. Microsoft Corp.

Microsoft’s strategic focus on cloud computing and enterprise solutions has paid off significantly. Valued at over $2.6 trillion in 2025, the software giant continues to evolve by integrating AI across its platforms, including Azure, Office 365, and gaming via Xbox. Its acquisitions of growing tech startups have further bolstered its market share in the digital transformation era.

4. Amazon.com Inc.

Amazon maintains its place among the top 4 with a valuation exceeding $1.9 trillion. The company’s diversification into healthcare, logistics, and artificial intelligence solutions has propelled its growth. Its extensive global supply chain and the continued popularity of Amazon Web Services (AWS) serve as major revenue catalysts. Innovations in drone delivery and autonomous logistics are promising future developments.

5. Alphabet Inc.

The parent company of Google, Alphabet, is now valued at approximately $1.8 trillion. Its dominance in internet search, digital advertising, and video content through YouTube remains unmatched. The expansion into artificial intelligence, quantum computing, and autonomous vehicle research signals its commitment to technological advancement and sustained growth.

6. Tencent Holdings Ltd.

Tencent, a Chinese multinational conglomerate, has grown impressively to reach nearly $600 billion in valuation. Its extensive portfolio includes social media, gaming, cloud services, and fintech. Popular gaming titles like PUBG and its WeChat ecosystem have become integral parts of daily life in China and beyond. Its strategic foreign investments continue to expand its global footprint.

7. Tesla Inc.

Tesla’s innovative approach to electric vehicles and clean energy has driven its valuation over $900 billion. The company’s latest models and expansion into energy storage solutions have attracted considerable investor enthusiasm. Tesla’s autonomous driving technology and potential new manufacturing plants are expected to further accelerate its growth trajectory.

8. Samsung Electronics Co.

South Korea’s Samsung Electronics holds the eighth position with a valuation close to $560 billion. Leading in memory chips, smartphones, and consumer electronics, Samsung’s diversified portfolio keeps it resilient amid global market fluctuations. Its ongoing investment in semiconductor fabrication facilities aims to secure its market leadership for years to come.

9. Meta Platforms, Inc.

Meta, formerly Facebook, has recovered from previous setbacks and now boasts a valuation nearing $530 billion. The company’s focus on building the metaverse has attracted significant investor interest, alongside its continued dominance of social media advertising. Its metaverse platforms and virtual reality devices, such as Oculus, aim to transform digital interaction.

10. Taiwan Semiconductor Manufacturing Company (TSMC)

Completing the list, TSMC is valued at around $550 billion, benefiting from its leadership in semiconductor manufacturing. As demand for chips in AI, 5G, and electric vehicles skyrockets, TSMC’s advanced manufacturing processes and global client base ensure sustained profitability. The company’s investments in new fabrication units signal a bright outlook for the industry.

In 2025, these corporations continue to shape the global economic landscape through innovation, strategic expansion, and technological leadership. As industries evolve, their dominance underscores the importance of adaptability and forward-thinking in maintaining market value.