Select Language:

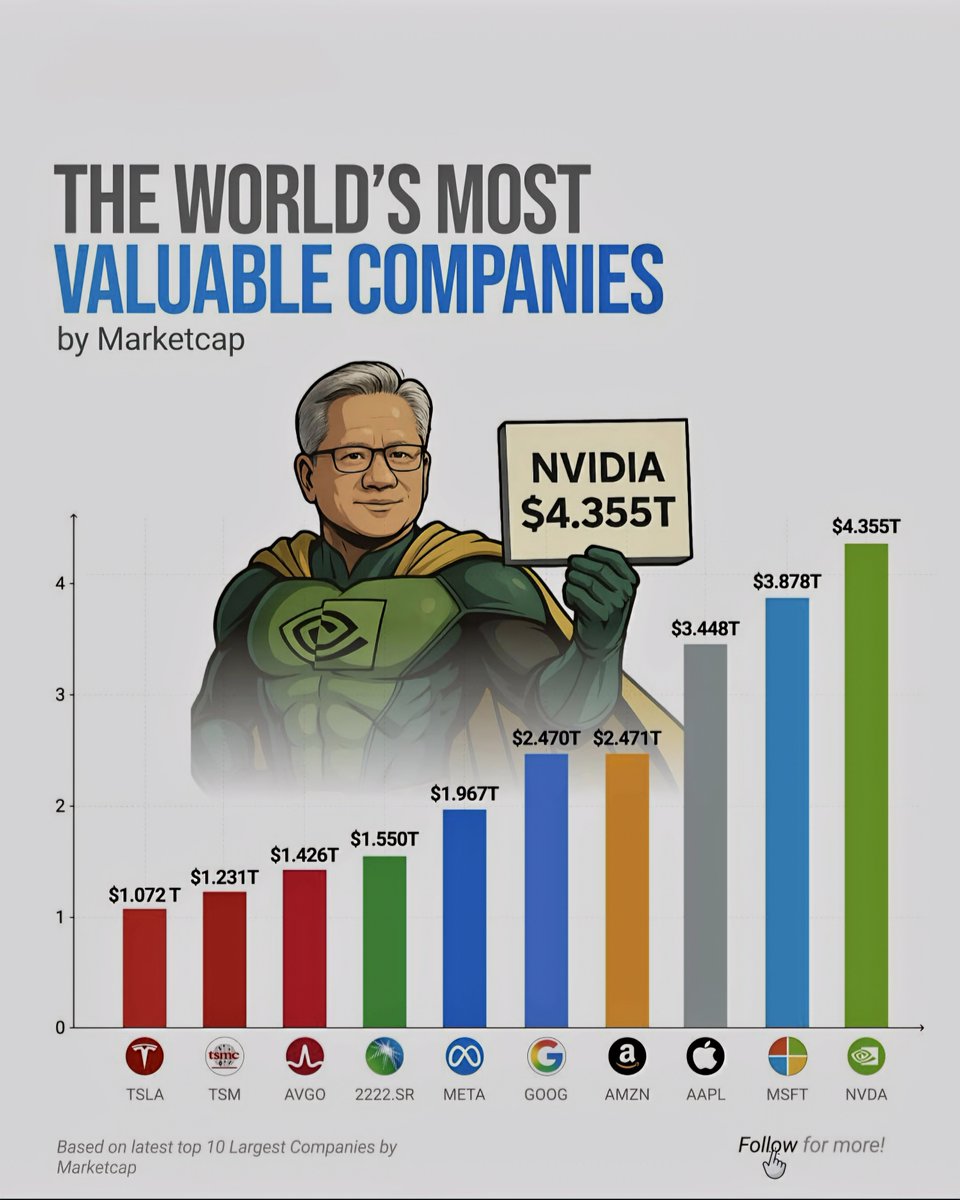

The 10 Most Valuable Companies in the World in 2025

1. Apple Inc.

Apple continues to hold its position as the most valuable company globally in 2025. Valued at over $3.2 trillion, Apple’s dominance is driven by its innovative products, expanding ecosystem, and strong brand loyalty. The company has seen growth in its services sector, including iCloud, Apple Pay, and the App Store, which now contributes significantly to its revenue. Apple’s focus on sustainability and electric vehicle development is expected to further boost its market value.

2. Microsoft Corporation

Microsoft remains a tech giant with a valuation surpassing $2.8 trillion in 2025. Its diversification into cloud computing, AI, and enterprise solutions has solidified its position. The company’s Azure cloud platform continues to lead in the industry, with enterprise clients nationwide adopting its productivity tools like Microsoft 365 and Teams. The acquisition of major gaming companies has also amplified its revenues, making Microsoft a dominant player across multiple sectors.

3. Saudi Aramco

The national oil company of Saudi Arabia has experienced a resurgence, reaching a valuation of approximately $2.1 trillion. As the energy transition accelerates, Saudi Aramco has diversified into renewable energy projects, hydrogen production, and technology for carbon capture. Its vast oil reserves and strategic investments in global energy infrastructure maintain its place among the most valuable firms.

4. Amazon.com Inc.

Topping $1.9 trillion in market value, Amazon’s global influence continues to grow in 2025. The e-commerce giant has expanded its logistics network and pushed further into healthcare, grocery, and entertainment services. Its Amazon Web Services (AWS) remains the #1 cloud platform worldwide, driving a significant chunk of its income. Continual innovation in drone delivery and artificial intelligence keeps Amazon at the forefront of e-commerce.

5. Alphabet Inc.

As the parent company of Google, Alphabet has achieved a valuation above $1.8 trillion, primarily driven by artificial intelligence, digital advertising, and emerging technology investments. Its recent advancements in quantum computing and self-driving car technology have garnered considerable attention. Despite regulatory scrutiny, Google’s dominance in search, video content, and mobile platforms continues to propel its valuation upward.

6. Tesla, Inc.

Tesla’s valuation has soared past $1.4 trillion in 2025, reaffirming its status as a leader in electric vehicles and clean energy solutions. The company’s expansion into international markets and advancements in battery technology have positioned Tesla as a global automotive powerhouse. With new models and advancements in autonomous driving, Tesla’s influence on sustainable transportation remains unmatched.

7. Alibaba Group

Despite regulatory challenges, Alibaba remains one of the world’s most valued tech conglomerates, with a valuation exceeding $950 billion. Its dominance in e-commerce, cloud services, and digital payments in Asia has kept its position strong. The company is investing heavily in AI, logistics, and new commerce sectors to fuel future growth.

8. Tencent Holdings

Tencent’s valuation has crossed $850 billion as it continues to lead in social media, gaming, and cloud computing. Its flagship gaming franchises and popular messaging apps like WeChat remain central to its revenue stream. Tencent’s strategic investments in AI startups and international gaming collaborations are expected to sustain its growth.

9. Facebook (Meta Platforms)

Meta continues to hold a strong position with a valuation around $800 billion, riding the wave of innovations in virtual reality and the metaverse. Its flagship apps, Instagram and Facebook, remain critical platforms for advertising. The company’s push into immersive digital experiences is expected to expand its revenue sources beyond traditional social media.

10. Berkshire Hathaway

Warren Buffett’s conglomerate continues to be a symbol of stability, with a valuation near $750 billion. Berkshire Hathaway’s diverse portfolio includes insurance, utilities, transportation, and manufacturing. Strategic investments and acquisitions remain key to maintaining its high valuation in an ever-changing market landscape.

As of 2025, these companies exemplify innovation, strategic growth, and adaptation to emerging technologies and global shifts.