Select Language:

The Impact of War and Sanctions on Syria’s Economy and International Trade

Overview of Syria’s Economic Downturn

Since the outbreak of the Syrian civil war in 2011, the nation’s economy has experienced a devastating decline. The World Bank highlights striking figures: Syria’s GDP plummeted from $61.39 billion in 2010 to a disheartening $23.6 billion in 2022. This stark reduction represents a loss of over two-thirds of the country’s economic value in just over a decade. As a direct consequence of the war and the accompanying sanctions, unemployment has surged from 8.6% to 13.3%, while inflation has followed a similarly alarming trajectory, skyrocketing from 4.4% in 2010 to 47.7% in 2016. Though it decreased to 13.4% in 2019, the figure remains notably high.

Declining International Trade

Total Export Value Collapse

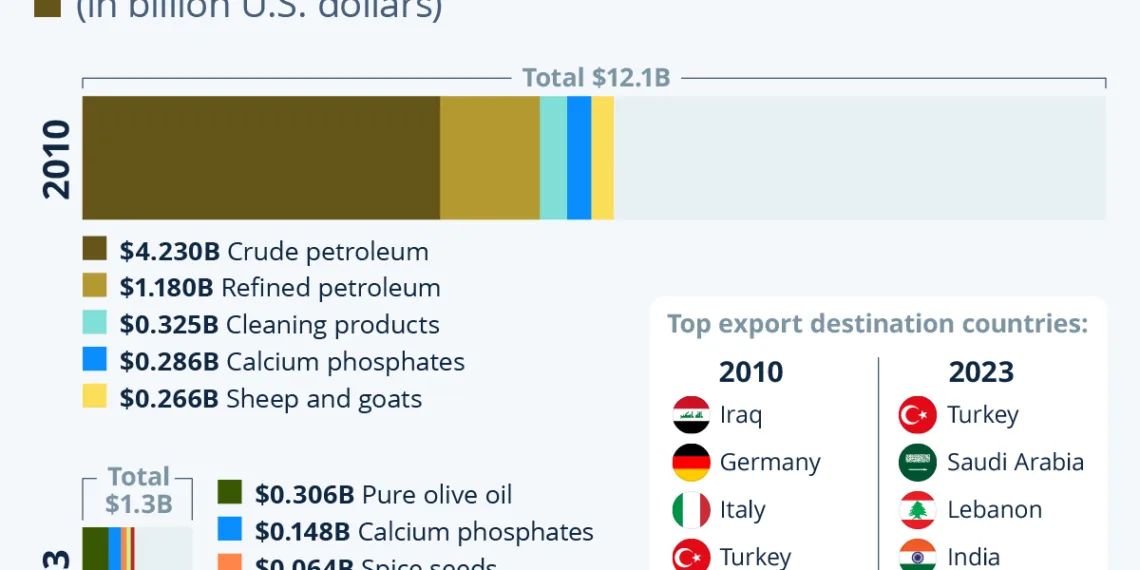

One of the most telling indicators of Syria’s economic struggles is the collapse of its international trade. Data from the Observatory of Economic Complexity (OEC) reveals a stark contrast in export values: Syria’s total exports diminished dramatically from $12.1 billion in 2010 to a mere $1.3 billion by 2023. This severe reduction has had far-reaching implications for the nation’s economic health and overall stability.

Changing Trade Partners

The landscape of Syria’s trade partners has undergone a substantial transformation in the wake of war and sanctions. In 2010, European countries such as Germany and Italy were significant destinations for Syrian exports, along with France and the United States. At that time, a significant portion of Syrian exports consisted of petroleum, with the U.S. importing $415 million of refined Syrian oil.

By 2023, however, Turkey emerged as the dominant destination for Syrian exports, accounting for 28.7% of the total. Other notable trade partners shifted to include Saudi Arabia, Lebanon, India, and the UAE. Although the U.S. and some European countries still engage in purchasing a limited range of goods from Syria—totaling $11.3 million in 2023—this trade primarily encompasses niche products like spice seeds, building stone, antiques, pickled foods, and coffee.

Shifts in Export Commodities

From Petroleum to Olive Oil

Historically, Syria’s economy relied heavily on petroleum exports, both crude and refined. Prior to the civil war, these exports were valued at over $5.3 billion. However, the imposition of sanctions on Syrian oil has rendered it nearly impossible for the country to legally sell its oil on the international market. This dramatic shift has necessitated a change in the export profile of the nation.

As sanctions have shaped the economic landscape, pure olive oil has now taken the lead as Syria’s primary export product. Other significant exports include calcium phosphate, spice seeds, and raw cotton. This transition highlights the challenges faced by Syrian farmers and producers as they adapt to an increasingly restrictive market environment.

Recent Changes in Sanctions

EU’s Suspension of Sanctions

In a recent development, the European Union announced the suspension of wide-ranging sanctions against Syria, particularly in the energy sector, to facilitate economic recovery and the country’s reconstruction efforts. This decision aims to provide a glimmer of hope for a nation that has faced extraordinary hardships over the past decade. The EU has stated its intention to closely monitor the situation within Syria to determine whether these suspensions are still suitable and beneficial for the country’s recovery.

Conclusion

As Syria continues to navigate the challenges posed by war and sanctions, understanding the transformative impacts on its economy and international trade is crucial for grasping the current state of affairs. The evolution of trade dynamics and shifting export products encapsulates the resilience of the Syrian people amidst adversity.