Select Language:

The Battle Over Russian Oil Revenue: Sanctions and Shadow Fleets

The ongoing geopolitical landscape has once again placed Russian oil at the center of international contention, with the latest sanctions targeting the shadow fleet that has been responsible for transporting Russian fossil fuels. As we navigate this complex situation, key developments are unfolding, particularly regarding Russian oil imports and the strategies employed to circumvent restrictions.

Understanding the Shadow Fleet

The term "shadow fleet" refers to a network of tankers that operate with obscured ownership structures, making it challenging for authorities to track their activities. These vessels have been identified as integral to the transportation of Russian oil, especially as sanctions mount from the West. Amid efforts to isolate Russia economically, this fleet represents a significant challenge for policing international waters and enforcing compliance with sanctions.

The Sanctions Landscape

Recent sanctions intensify the pressure on the Russian oil industry. The U.S. has sanctioned over 150 tankers, which notably includes 68 vessels categorized within the shadow fleet. Such measures are designed to limit Russian oil shipments, particularly those sold above price caps established by the EU, G7, and Norway. This coalition has sought to restrict the cargo transport of Russian fossil fuels to instances that comply with the price cap, thereby aiming to reduce Russia’s revenue from oil exports.

The Impact on Global Oil Supply

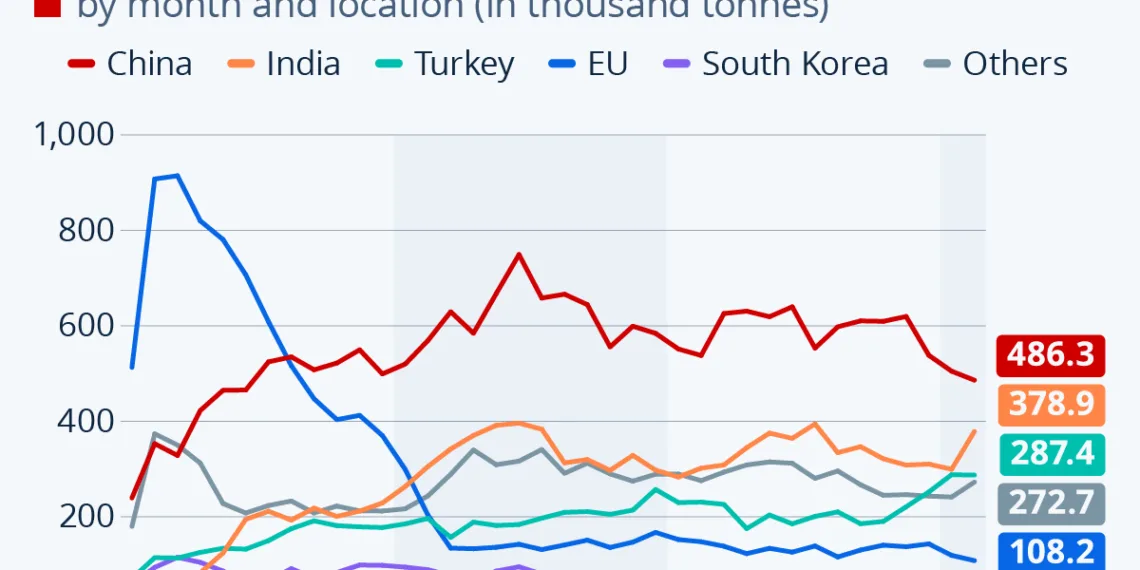

As sanctions loom, the immediate effect has been a notable uptick in Russian oil shipments, particularly to India. Reports from CREA highlight that, in the first ten days of February, Russian exports to India surged. However, this increase stands in stark contrast to declining delivery rates to China. Once a major consumer of Russian oil, China appears to be adapting by replacing Russian supplies with imports from Angola and Brazil, reflecting broader shifts in international oil trade dynamics.

The Strainer Effect on Shipping Networks

The imposition of tanker-specific sanctions has highlighted the disarray within the shipping sector. Many vessels believed to be in violation of Western sanctions have now idled and anchored away from scrutiny. The visible shift away from accepting these tankers in harbors owned by major economies, such as India and China, suggests a tightening grip on the maritime routes previously exploited for Russian oil transport.

Challenges of Compliance and Enforcement

Compliance with sanctions remains an uphill battle, particularly as Russia has developed strategies to obscure the ownership and operation of its tankers. While buying new vessels has been one way to circumvent existing sanctions, this strategy raises questions of sustainability. The shadow fleet’s aging nature and the depletion of global shipyard stocks indicate that there are limits to this approach.

The Role of Insurance and Market Dominance

Another crucial aspect lies in the impact of insurance services linked to the shipping industry. Only vessels adhering to the established price caps can access these vital services. This requirement places additional strain on the shadow fleet, which often operates without substantial insurance. The economic implications of these regulatory measures serve not only to limit the operational capabilities of the Russian oil industry but also to reshape global oil trade patterns.

Conclusion

As we witness these developments unfold, the tense landscape of global oil trading continues to evolve, with sanctions acting as a formidable force altering traditional supply chains. The intricacies of the shadow fleet’s operations and the broader implications of maritime sanctions demand close attention as countries navigate this complex issue. The battle over Russian oil revenue is far from over, and its repercussions will likely reverberate throughout the global economy for months to come.