Select Language:

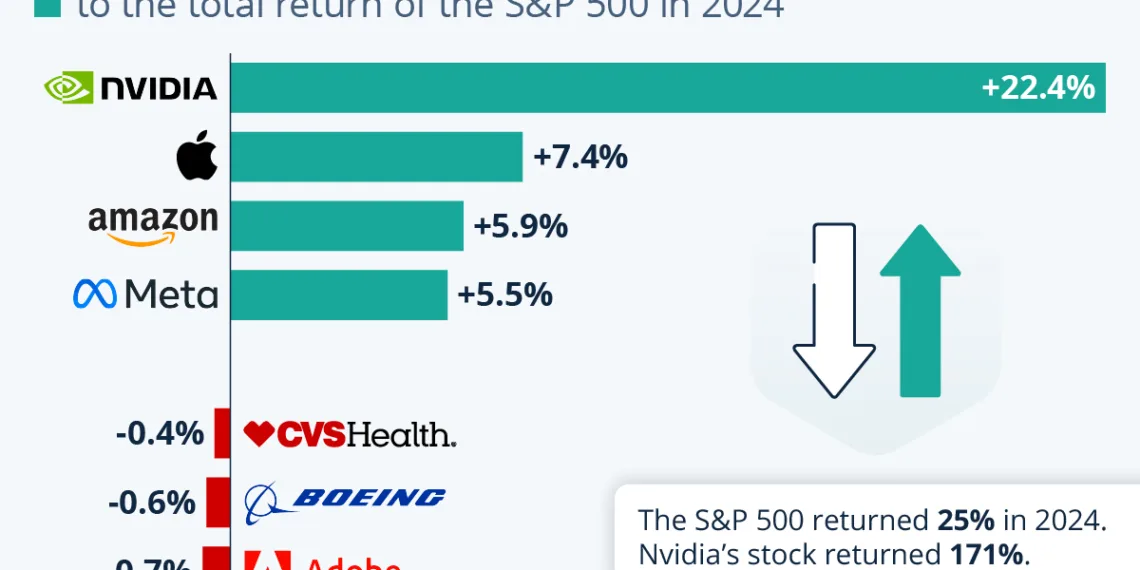

Nvidia’s Astounding Surge and Its Influence on the S&P 500 in 2024

Introduction to the Market Dynamics

The stock market typically reacts to advancements and trends in technology, and the year 2024 has been no exception. As artificial intelligence (AI) continues to revolutionize industries, the excitement surrounding this technology significantly impacted the performance of the S&P 500 index, with Nvidia emerging as a standout player.

Nvidia: The Powerhouse of the AI Revolution

Nvidia has positioned itself as a critical enabler of the AI transformation. The company’s stock experienced a jaw-dropping increase of 171 percent in 2024, a testament to its pivotal role in AI technology. Whether it’s powering data centers or providing GPUs necessary for machine learning, Nvidia has become synonymous with high-performance computing in the AI landscape.

Market Cap Weighting and Its Implications

The S&P 500 is a market-cap-weighted index, meaning companies with larger market capitalizations have a more substantial impact on the index’s performance. This structure highlights the significance of mega-cap companies like Nvidia, Apple, and Microsoft in influencing market trends. With their extensive reach and systemic importance, these companies often dictate overall market movement.

The Major Players Contributing to the S&P 500

Nvidia’s Dominance

According to Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices, Nvidia alone contributed over 22 percent to the S&P 500’s overall return in 2024 due to its explosive share price growth. This massive contribution underscores how one company can tilt the scales in the performance of a broad market index.

Apple’s Resilience

Following Nvidia’s lead, Apple emerged as the second-largest contributor to the index’s total return. While its stock price increased by a more modest 31 percent, Apple’s massive market capitalization ensured that its performance still made a notable difference in the S&P 500’s overall returns.

Other Notable Contributors

In addition to Nvidia and Apple, several other tech giants played a role in the index’s performance in 2024:

- Amazon: Contributed 7.4 percent to the index.

- Meta: Added 5.5 percent to the overall returns.

- Microsoft: Although not specified in the initial statistics, it generally plays a significant role in the performance of the index.

The Downside: Companies Dragging the Index Down

While Nvidia and Apple propelled the S&P 500 to new heights, several companies faced challenging market conditions:

Intel: The Largest Negative Contributor

Intel was notably the largest detractor from the index’s performance, with a staggering share price drop of around 60 percent. Despite its major loss, due to its smaller market weight relative to giants like Nvidia and Apple, its negative impact was somewhat mitigated.

Other Underperformers

Other companies that struggled included:

- Adobe: Share price decreased by 25 percent.

- Boeing

- CVS Health

- Nike

Aggregate Effects on the S&P 500

Collectively, the companies noted for their poor performance dragged down the index’s overall returns by 0.83 percentage points, despite the robust contributions from the leading companies. This phenomenon illustrates the dynamic nature of market indices, where a few mega-caps can drive performance while smaller players can detract from it.

The 2024 Reality Check

The contrasting fortunes of leading companies highlight the volatile nature of the stock market, driven largely by the tech sector’s performance. With AI reshaping business landscapes and consumer behavior, both optimism and disappointment have been evident in equal measure. The 2024 market landscape thus serves as a potent reminder of the delicate balance of power within the S&P 500, where a few key players can shape the narrative for investors and analysts alike.

Market Outlook

The dynamics witnessed in 2024 suggest a future where investments in technology and AI-related companies could become even more pronounced as they continue to define market trends. As companies evolve and adapt, investors must remain vigilant to shifts in market sentiment influenced by innovations and global events.

With such fluctuations relentlessly shaping the market, understanding the key players and their contributions becomes crucial for both seasoned investors and newcomers looking to navigate the complexities of the S&P 500 index.