Select Language:

Iranian Rial Plummets as Inflation Continues to Surge: A Closer Look at the 2025 Trends

Over the past decade and into 2025, Iran’s economy has witnessed a relentless depreciation of its currency against the US dollar, accompanied by persistent inflationary pressures. The relentless decline of the Iranian Rial (IRR) underscores the ongoing financial turmoil that has affected millions of Iranians. Below, we break down the key trends shaping Iran’s monetary landscape over the years, leading up to 2025.

1. Explosive Rise in the Rial’s Exchange Rate

Since 2010, the Iranian Rial has been on a steep slide, reflecting economic struggles that have accelerated dramatically in recent years:

- 2010: At the turn of the decade, USD was equivalent to approximately 10,300 IRR, with inflation at 12.4%, marking a relatively stable period.

- 2017: The currency had devalued to about 59,500 IRR, alongside inflation hovering around 9.6%. This was largely due to international sanctions impacting Iran’s oil exports and financial system.

- 2020: A significant spike occurred, with the exchange rate soaring to approximately 254,000 IRR per USD, coupled with inflation at 36.4%. Economic pressures intensified amidst renewed sanctions and internal economic policies.

- 2023: The Rial hit approximately 500,000 IRR against the dollar, with inflation maintaining a high level at 44%. Economic instability remained pervasive, affecting everyday life for citizens.

- 2024: The currency further deteriorated to roughly 770,000 IRR per USD, with inflation easing slightly to 35%, signaling ongoing but somewhat stabilizing inflation trends.

- 2025: The Rial’s value fell to nearly 1,420,000 IRR per USD. The currency’s collapse underscores the severity of ongoing economic challenges, with inflation at 44%. This level represents a near-permanent devaluation, eroding purchasing power and savings.

2. Persistent Inflationary Challenges

Inflation has remained a core issue for Iran, fluctuating but generally trending upward since 2010:

- Early 2010s: Inflation was relatively contained, at 12.4% in 2010, but quickly accelerated.

- Mid-2010s: Inflation doubled to over 30% by 2012, reaching 34.7% in 2013, driven by economic sanctions, internal mismanagement, and currency devaluation.

- Late 2010s: 2018 saw inflation spike to over 31%, with 2019 marking an even sharper rise to 41.2%. These periods reflected financial instability and increased cost of living.

- 2020-2025: Inflation has remained persistently high, with figures around 36-45%, influenced by ongoing economic sanctions, declining oil revenues, and domestic economic policies.

3. The Economic Impact on Daily Life

The unrelenting devaluation of the Rial has had direct consequences on Iranian citizens:

- Rising Cost of Goods: As the currency loses value, prices for everyday essentials—food, fuel, and housing—skyrocket, squeezing household budgets.

- Savings and Wealth: Devaluation erodes savings, making it challenging for Iranians to preserve wealth or plan for future stability.

- Foreign Travel and Investment: With the deteriorating currency, international travel becomes prohibitively expensive, and foreign investment dwindles amid economic uncertainties.

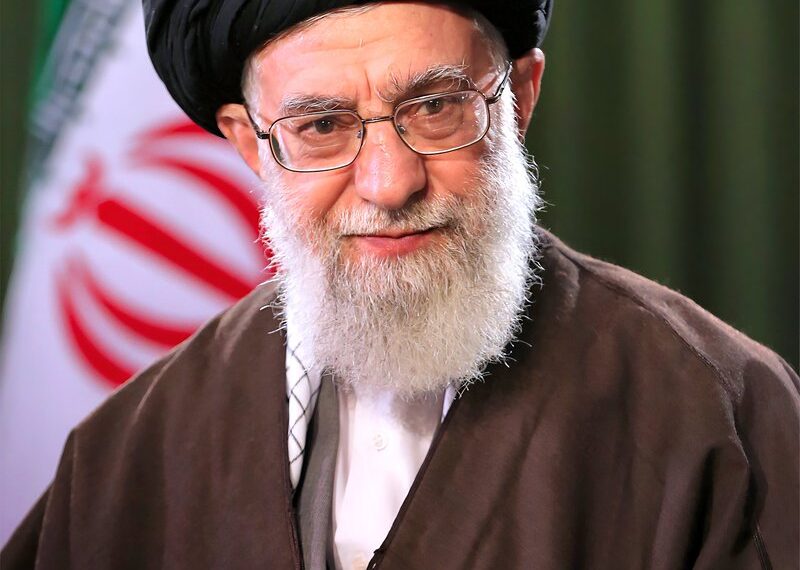

4. Political and Economic Responses

Iran’s government has attempted various measures to stabilize the currency and curb inflation:

- Currency Controls: Efforts to restrict currency exchanges and control the black market have had limited success.

- Monetary Policy Adjustments: Central Bank interventions and attempts at monetary tightening often fall short due to external sanctions and internal economic pressures.

- International Negotiations: Diplomatic efforts to lift sanctions could potentially bolster the Rial, but geopolitical tensions persist, limiting tangible results.

5. The Road Ahead: What to Expect in 2026 and Beyond

While the data suggests ongoing economic volatility:

- Potential Stabilization: If diplomatic breakthroughs occur and sanctions are eased, the Rial could stabilize somewhat, but this is uncertain given the geopolitical climate.

- Continued Inflation: Without significant policy reforms or external relief, inflationary pressures are likely to persist into 2026 and beyond.

- Economic Resilience: Despite these challenges, Iran’s large domestic market and strategic resources offer some resilience, but economic recovery remains a long-term prospect.

As of 2025, Iran’s economic trajectory remains precarious. The currency’s historic decline and high inflation continue to challenge everyday life for millions. Whether hope for stabilization will materialize depends heavily on international diplomacy and internal reforms—factors that are yet to be realized.

Note: All figures are approximations based on available data up to 2025, and economic conditions remain fluid.