Select Language:

Inflation Trends: An Ongoing Challenge

Overview of Recent Inflation Data

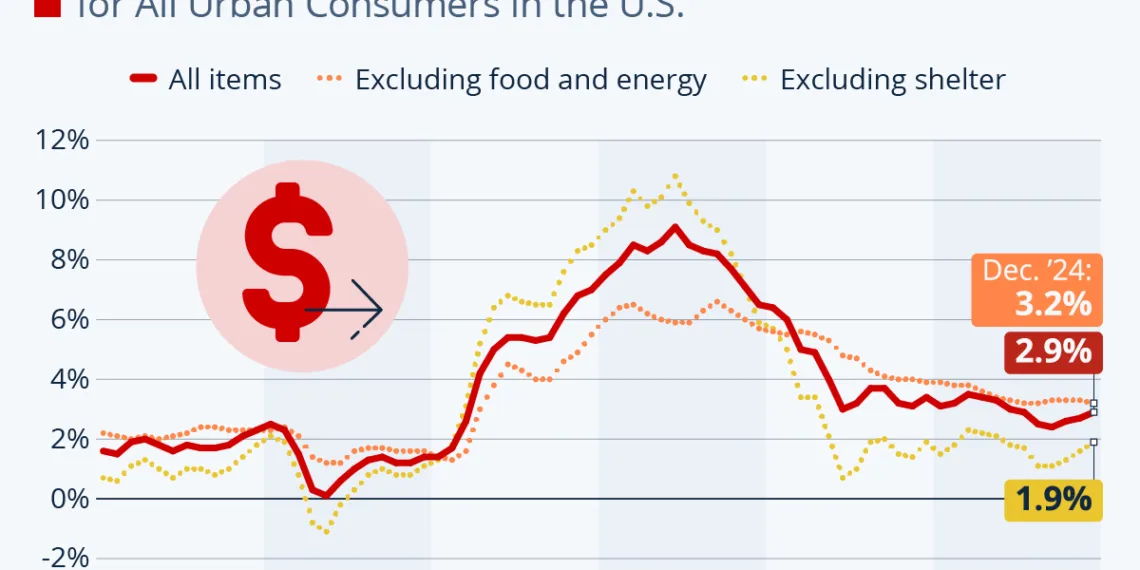

As we enter what is poised to be a significant political period in the United States, recent inflation data brings to light the complexities of the current economic landscape. Released by the Bureau of Labor Statistics, the latest Consumer Price Index report indicates a noteworthy increase of 2.9 percent in inflation over the past year, notably rising for the third consecutive month. This uptick comes shortly before the inauguration of Donald Trump for his second term, highlighting a continuing battle against inflation that remains critical for policymakers and citizens alike.

The Core Inflation Rate Dynamics

While the overall inflation rate has captured headlines, core inflation figures have also shown intriguing trends. The core inflation rate, which filters out the volatility attributed to food and energy prices, has been recorded at 3.2 percent in December. This figure represents the first decline in core inflation since July, adding layers of complexity to the inflation narrative. Understanding these core metrics is essential, as they provide insight into persistent underlying inflationary pressures that transcend seasonal or cyclical fluctuations.

The Impact of Housing Costs on Inflation

One significant factor contributing to the rising inflation figures is the cost of shelter. As a major component of the Consumer Price Index, housing costs continue to exert upward pressure on overall inflation. Recent reports indicate that rents surged by 4.3 percent and owner-equivalent rents by 4.8 percent in December alone. This marks the 56th consecutive month of increasing shelter costs, underscoring how vital housing expenses have become in determining inflationary trends.

Without the contributions of shelter costs, inflation would have remained at or below the Federal Reserve’s target level of 2 percent for the majority of the past 19 months. This sharp contrast illustrates how housing, despite various economic shifts, has emerged as the most obstinate driver of inflationary concerns.

Federal Reserve’s Response to Inflation

In light of the recent inflation metrics, the Federal Reserve’s forthcoming decisions are watched closely by analysts and investors alike. Based on the latest insights, there appears to be a strong consensus that the Fed will pause any further rate cuts at its upcoming January meeting, following a series of cuts totaling 100 basis points in late 2023. The CME FedWatch Tool suggests a remarkable 97 percent likelihood that rates will remain unchanged in January, with a 74 percent chance of similar inaction at the March meeting.

The anticipation of maintaining rates during these pivotal meetings signals the Fed’s cautious approach amid a backdrop of variable economic indicators. Observers have noted a potential timeline for future cuts to commence in June, which will heavily depend on the economic policy decisions made by the incoming Trump administration. Proposed policies, including the potential for increased tariffs and stringent immigration measures, could exacerbate inflationary pressures further complicating the economic outlook.

Historical Context of Inflation

To comprehend the trajectory of inflation today, it’s essential to reflect on its recent historical context. In spring 2021, alarming inflation rates were primarily attributed to the “base effect,” a phenomenon resulting from the steep price decreases experienced at the pandemic’s onset. With demand plummeting, year-over-year comparisons revealed artificially inflated inflation figures. However, by the end of 2021, the inflation narrative shifted dramatically, fueled largely by external shocks such as geopolitical tensions stemming from Russia’s invasion of Ukraine. This conflict has caused unprecedented spikes in both food and energy prices, leading to sustained inflationary challenges.

As the conflict in Ukraine persists, inflating pressures are now measured against already elevated price levels, complicating the path toward stabilizing inflation. The slow progress observed in reducing inflation in the latter part of 2023 illustrates the entangled nature of these economic conditions, drawing from a complex interplay of both local and global factors.

Conclusion

[Content omitted as per the instruction for no conclusion]