Select Language:

The Growing Challenge of Affording a Single Bitcoin in 2025

As Bitcoin continues to mature and gain mainstream acceptance, the financial hurdles for individual investors to acquire even one full Bitcoin have grown significantly. Here’s a detailed breakdown of what it currently takes to afford a Bitcoin in 2025, along with some crucial insights into the evolving crypto landscape.

1. Escalating Bitcoin Prices Reflect a Bullish Market Trend

In 2025, Bitcoin has seen unprecedented surge, with the price often surpassing $50,000. The rapid appreciation over the past few years has made Bitcoin an asset primarily accessible to high-net-worth individuals and institutional investors. For everyday investors, accumulating this digital gold requires considerable time and financial planning. It can take years of disciplined savings, especially considering the current price volatility and market fluctuations.

2. The Power of Compound Savings: A Long-Term Strategy

To afford one Bitcoin today, an average investor might need to save a substantial portion of their income annually. For instance, if Bitcoin is valued at $50,000 and an individual manages to save $10,000 per year, they would need five years of dedicated savings, assuming they do not invest further or see additional increases in Bitcoin’s value. This long-term strategy emphasizes the importance of disciplined saving, investment diversification, and a keen eye on market trends.

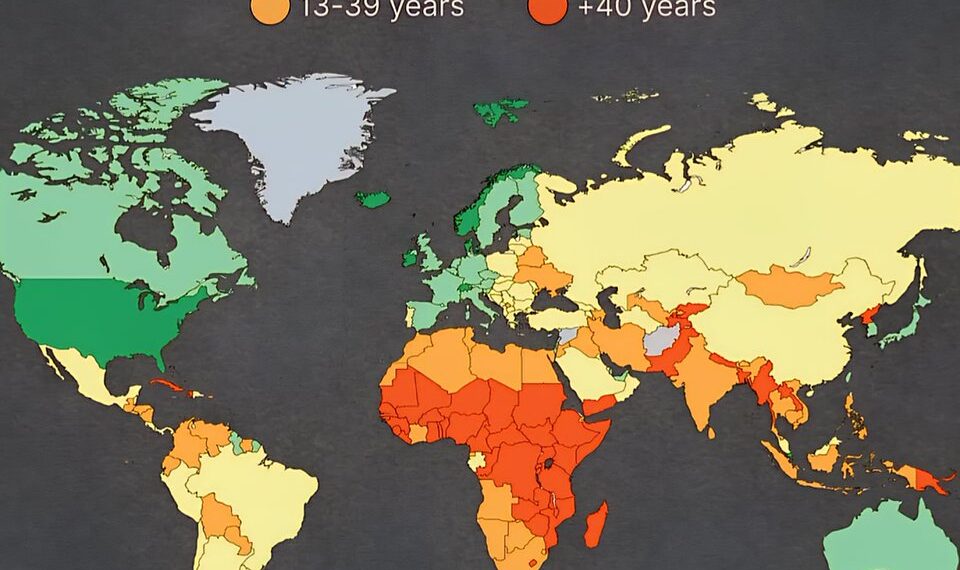

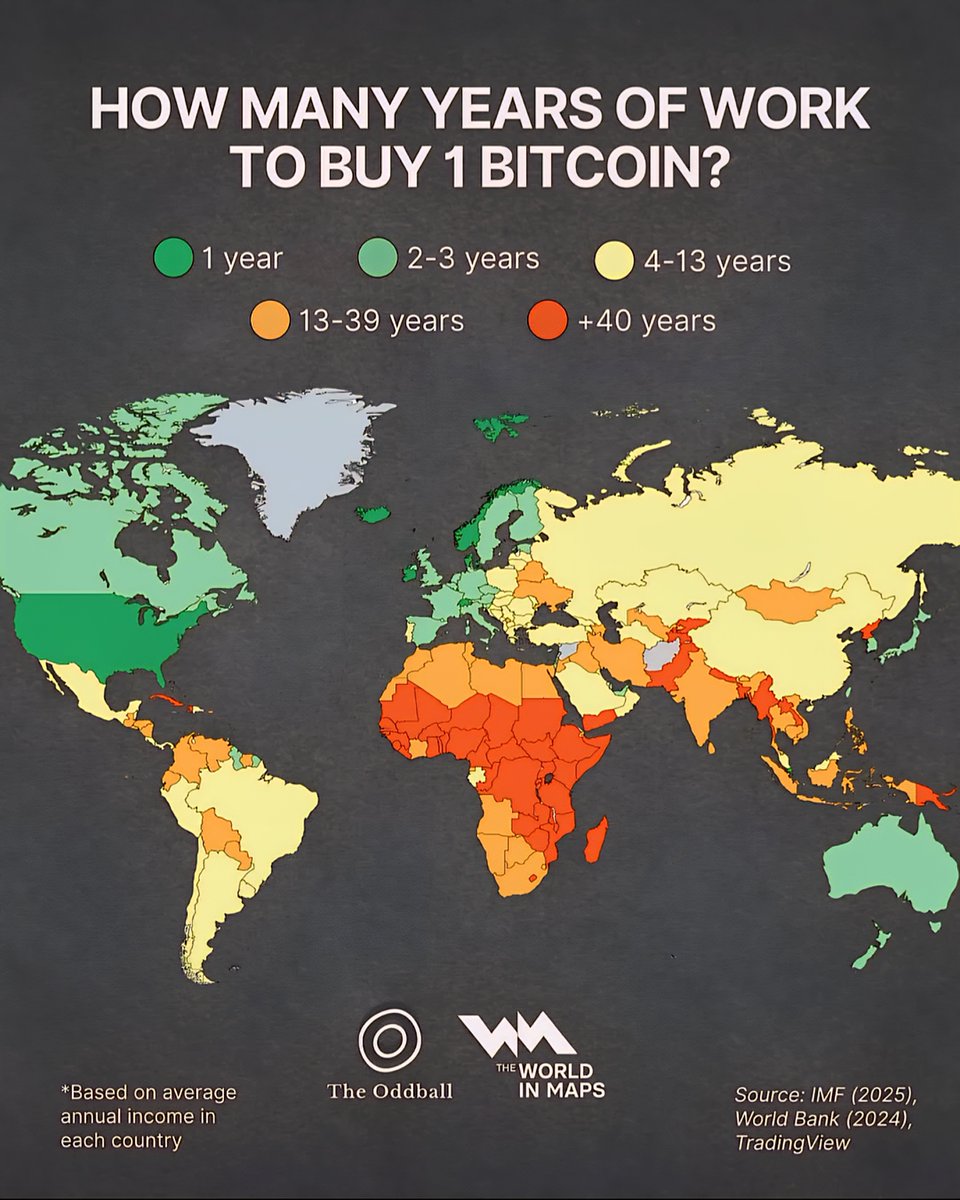

3. Income Levels and Socioeconomic Disparities

The reduction of Bitcoin prices or fluctuations over the next few years could influence how easily average Americans can afford to buy Bitcoin. For individuals earning median incomes, reaching the necessary savings could extend beyond a decade, especially amidst rising living costs. This economic disparity underscores the growing gap between investors who can afford to buy Bitcoin early and those who are still trying to break into the market.

4. The Role of Cryptocurrency Exchanges and Investment Platforms

Cryptocurrency exchanges have significantly lowered entry barriers, allowing fractional investments in Bitcoin. The ability to buy small portions—like sats (satoshis)—means investors don’t need to wait years to accumulate a full Bitcoin. In 2025, many platforms offer micro-investments, allowing users to buy as little as $5 worth of Bitcoin, making this digital asset more accessible. Nevertheless, the goal of owning a whole Bitcoin remains a long-term achievement for most.

5. Economic Factors and Regulatory Changes Impacting Bitcoin Holdings

While Bitcoin’s price trend remains bullish, various factors could influence future affordability. Regulatory crackdowns, tightening of financial policies, or macroeconomic shifts could temporarily depress Bitcoin prices, making them more affordable. However, such changes also introduce risks, which investors need to consider carefully. Keeping an eye on global economic policies and regulatory environments is crucial for prospective Bitcoin investors.

6. The Significance of Investment Diversification

Given the high cost of a full Bitcoin, experts recommend diversifying investments into various assets, including cryptocurrencies, stocks, and bonds. This approach reduces risk exposure and creates more opportunities for wealth growth over time. Investors interested in Bitcoin should consider setting aside regular savings, leveraging fractional investments, and maintaining a diversified portfolio tailored to their risk tolerance.

7. Future Outlook: Will Bitcoin Become More Affordable?

By 2025, Bitcoin’s future affordability will depend on multiple factors—market demand, technological advancements, regulatory policies, and macroeconomic stability. While its value continues to rise, some analysts believe that innovations like Bitcoin ETFs and institutional investments could stabilize prices or even trim costs, making Bitcoin more accessible for the average investor over time.

With Bitcoin’s value soaring in 2025, the journey to owning a whole coin remains a complex, long-term challenge for most. Still, through disciplined savings, fractional investments, and ongoing market shifts, investors can strategically position themselves for potential ownership of digital gold in the coming years.