Select Language:

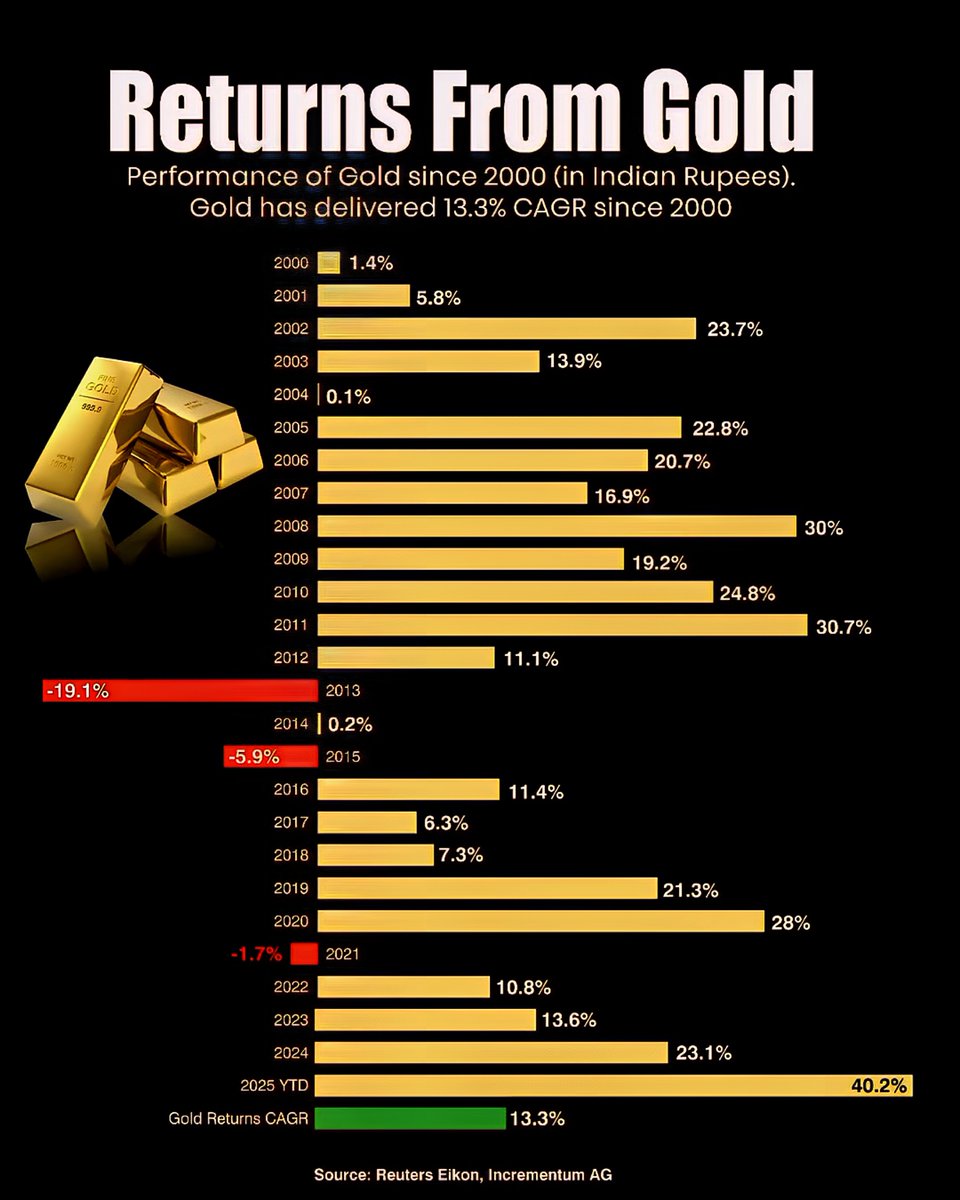

A Look Back at Gold Returns from 2000 to 2025

Gold has long been a symbol of wealth, stability, and investment security. Over the past quarter-century, its value has experienced significant fluctuations, reflecting broader economic trends, geopolitical tensions, and changes in financial markets. Here’s a detailed look at how gold has performed from 2000 to 2025, highlighting key moments and insights for investors and enthusiasts alike.

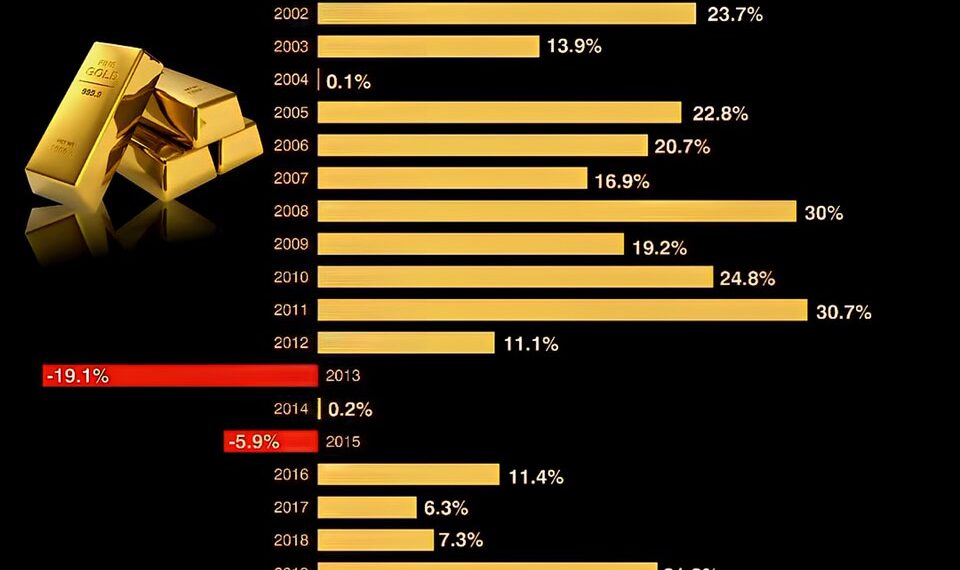

1. The Early 2000s: A Stable Start Amidst Uncertainty

At the dawn of the new millennium, gold prices hovered around $250-$300 per ounce. The early 2000s marked a period of relative stability, despite the dot-com bubble burst and the subsequent economic downturn. Investors viewed gold as a safe haven amid the turbulence, gradually increasing their holdings. By 2005, gold had climbed to approximately $500, driven by fears of a looming recession and the fallout from global conflicts.

2. The 2008 Financial Crisis: Gold as a Safe Haven

The financial turmoil of 2008 catapulted gold into the spotlight. As stock markets plummeted and currency values wavered, investors flocked to gold, pushing prices above $1,000 per ounce for the first time in nearly three decades. The crisis underscored gold’s role as a reliable store of value, with many seeing it as a shield against economic instability. The years immediately following saw continued growth, reaching around $1,700 by 2011.

3. Post-Recovery Period: Fluctuations and Market Sentiments

From 2012 to 2015, gold prices experienced a rollercoaster. Concerns about tapering of quantitative easing policies by the Federal Reserve and geopolitical tensions kept prices volatile. Gold hit a high of approximately $1,900 in 2012 but then declined sharply to roughly $1,050 by 2015, reflecting a strengthening dollar and rising interest rates. This period underscored the complex factors influencing gold’s value beyond mere economic instability.

4. The Impact of Geo-Political Events: 2016-2020

Between 2016 and 2020, gold experienced a significant rally, fueled by global uncertainties such as trade wars, Brexit, and the COVID-19 pandemic. The pandemic’s onset in 2020 ignited a gold boom, with prices soaring past $2,000 per ounce for the first time in history. Governments worldwide injected massive fiscal stimulus packages, and fears of inflation further drove demand for gold as a hedge.

5. The 2021-2025 Surge: Record Highs and Sustainable Growth

From 2021 onward, gold prices remained elevated, oscillating between $1,800 and $2,000, reflecting ongoing economic challenges, inflation concerns, and geopolitical tensions. By 2025, gold’s role has solidified as a key component of diversified investment portfolios. Notably, in 2025, gold surpassed its previous all-time high, hitting around $2,100 per ounce, driven by rising inflation and currency devaluations across multiple economies.

6. Key Takeaways for Gold Investors

- Gold remains a reliable hedge against inflation: Throughout 2000-2025, periods of rising inflation often correlated with gold price increases.

- Geopolitical tensions significantly impact gold prices: Conflicts, trade disputes, and political instability tend to boost demand for the precious metal.

- Interest rates and dollar strength influence value: When interest rates rise or the dollar appreciates, gold prices typically decline, and vice versa.

- Long-term perspective is crucial: Despite short-term volatilities, gold has demonstrated consistent growth over the past 25 years, reinforcing its status as a safe investment.

7. The Future Outlook of Gold

Looking ahead, experts predict that gold will continue to be a vital asset, especially amidst potential economic uncertainties and geopolitical risks. With advancements in technology and globalization, gold’s strategic importance in diversified portfolios is expected to grow. Analysts suggest maintaining a balanced allocation of gold to hedge against inflation, currency fluctuations, and market volatility as we move further into 2025 and beyond.

The history of gold from 2000 to 2025 reflects resilience, adaptability, and its enduring appeal as a store of value. As global dynamics evolve, gold’s significance in personal and institutional investment strategies remains as relevant as ever.