Select Language:

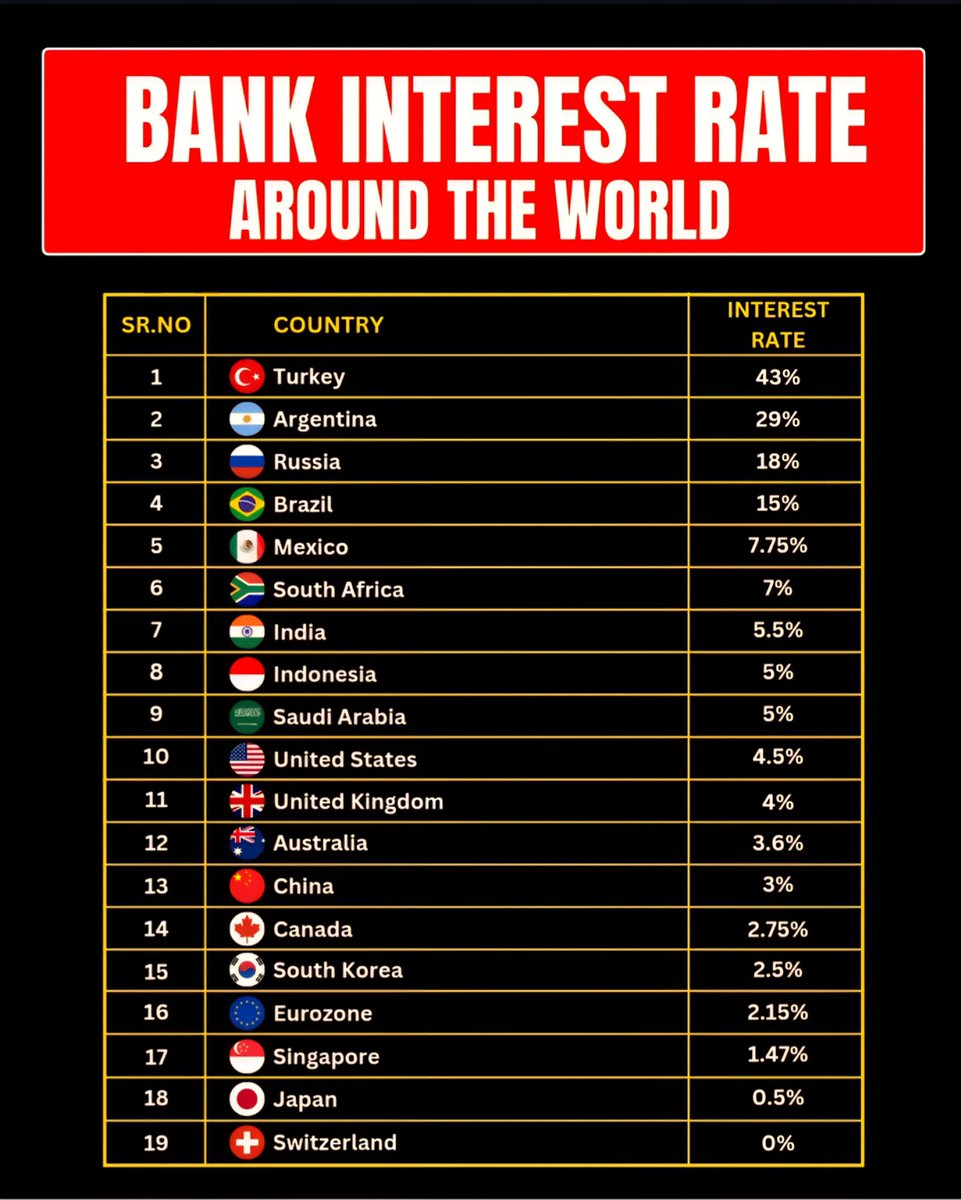

Interest Rates Around the World in 2025 📈

1. U.S. Federal Reserve Maintains Stable Rates Amid Economic Uncertainty

The United States has opted to keep interest rates steady at 4.75% following several hikes over the past year. Despite global economic turbulence and persistent inflation, the Federal Reserve emphasizes its cautious stance, aiming to prevent overheating while supporting ongoing recovery efforts. Market analysts are closely watching for any signals indicating potential rate hikes or cuts later in the year, especially as the economy navigates challenges such as labor market fluctuations and international trade tensions.

2. Europe’s Central Bank Holds Off on Rate Changes

The European Central Bank (ECB) has announced its decision to hold interest rates at 2.5%, citing signs of slowing inflation but remaining concerned about continued economic fragility across member nations. With several Eurozone economies facing sluggish growth, policymakers are balancing inflation control with the need to stimulate economic activity. The ECB’s cautious approach reflects a broader trend among global central banks prioritizing stability in uncertain times.

3. Bank of England Lowers Rates to Spur Growth

In a strategic move, the Bank of England reduced its main interest rate from 4.2% to 3.8% in early 2025. The decision aims to boost consumer spending and investment amidst sluggish UK economic growth. Amid concerns over Brexit-related uncertainties and global headwinds, the central bank is betting that lower borrowing costs will invigorate the economy without reigniting inflation concerns. The move also signals confidence in the UK’s economic resilience despite ongoing geopolitical challenges.

4. Japan’s Zero-Interest Policy Continues

Japan’s central bank persists with its ultra-low interest rate policy, maintaining a target of -0.1%. The goal remains to combat long-standing deflationary pressures and support the country’s fragile economic recovery post-pandemic. With a focus on quantitative easing and other monetary tools, the Bank of Japan shows little sign of shifting away from its accommodative stance, emphasizing the importance of nurturing sustained growth and price stability.

5. Emerging Markets Navigate Diverging Interest Rate Trends

Emerging market economies are experiencing a diverse range of interest rate adjustments in 2025. Countries like Brazil and India have increased rates to combat inflation, which remains stubbornly high due to supply chain disruptions and currency devaluations. Conversely, nations such as South Africa and Indonesia are lowering rates to stimulate economic activity amid slowing growth and external pressures. This divergence underscores the complex global landscape where developing economies are adjusting strategies to suit their unique circumstances.

6. Global Debt and Inflation Spark Rate Policy Adjustments

With global inflation rates averaging 5% in 2025, many central banks are carefully calibrating their monetary policies. Rising debt levels, combined with geopolitical uncertainties, have prompted cautious rate adjustments worldwide. Countries are aiming to strike a delicate balance—curbing inflation without stifling economic growth. This includes implementing targeted rate hikes or maintaining low rates to support recovery efforts, reflecting an ongoing trend of adaptive monetary strategies.

7. The Impact of Geopolitical Events on Interest Rate Decisions

Recent geopolitical tensions and conflicts, notably in Eastern Europe and the South China Sea, influence central banks’ decisions on interest rates. Elevated uncertainty tends to lead to cautious or dovish policies, with some nations opting to keep rates steady to avoid exacerbating economic instability. Conversely, countries with stable political environments tend to pursue more proactive rate adjustments aligned with domestic economic goals.

8. Looking Ahead: Will Interest Rate Trends Continue?

Analysts predict that interest rate trends in 2025 will continue to reflect a cautious approach by central banks worldwide. As economic recovery progresses unevenly across regions, policymakers remain vigilant to signs of overheating or recession. The possibility of future rate hikes or cuts hinges on inflation trajectories, geopolitical developments, and global economic resilience. Markets are poised to react swiftly to any shifts, maintaining a high level of vigilance on monetary policy cues.

In the current year of 2025, global interest rate patterns demonstrate a nuanced landscape, balancing inflation control, economic growth, and geopolitical stability. As nations adjust their monetary policies, understanding these trends provides insight into the broader economic health of the world.

<|IMAGE|>