Select Language:

Understanding the Pension Prospects for Freelancers: A Global Overview

The world of freelancing offers flexibility and independence, but it comes with certain risks, especially when it comes to pension prospects. As self-employed individuals navigate their careers, understanding their retirement benefits is crucial. This blog delves into the key findings from the OECD Pensions at a Glance 2023 report, highlighting the stark differences in pension outcomes for self-employed versus employed workers across various countries.

The Pension Landscape for Self-Employed Workers

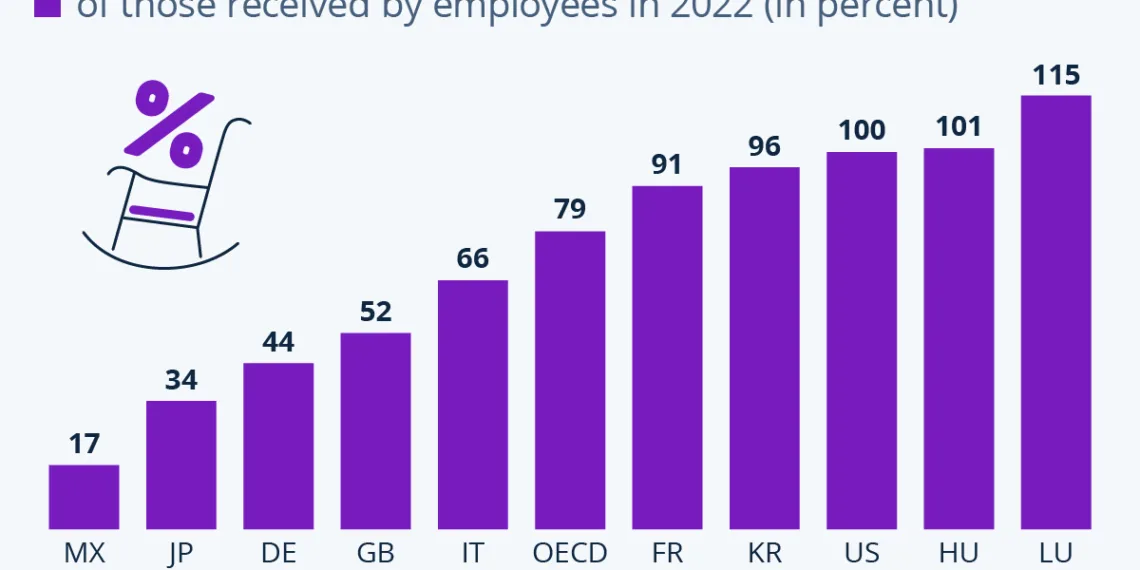

Freelancers across OECD countries face significant challenges compared to their employed counterparts regarding old-age pensions. The average pension for self-employed individuals stands at only 79% of what employed people earn in the OECD. However, this figure masks substantial variations across different nations, with some countries demonstrating particularly alarming statistics.

Extreme Variations Among Countries

- Mexico: Self-employed workers are at a severe disadvantage, receiving merely 17% of the pension that employed individuals earn.

- Germany: The situation is slightly better but still concerning, with self-employed individuals earning only 44% of their employed peers’ pensions.

- United Kingdom: The self-employed can expect to receive 52% of the pension of those in traditional employment.

Such wide disparities underscore the complex relationship between self-employment and pension contributions in varying countries.

Factors Influencing Pension Contributions

The difference in pension outcomes can be largely attributed to the policies of individual countries regarding pension contributions for self-employed workers. Some nations have made it mandatory for self-employed individuals to contribute to earnings-related pension schemes, while others have not.

Categories of Pension Contribution Systems

The OECD categorizes countries based on how they require contributions from self-employed individuals:

-

Mandatory Employee-like Schemes: In 13 countries, including Canada, the United States, and Luxembourg, self-employed workers are required to contribute the same combined amount as employees. This provides a more equitable path to retirement benefits.

-

Limited Coverage with Reduced Contributions: In 12 countries, such as France and Italy, self-employed workers can choose to make reduced contributions, impacting their overall pension prospects.

-

Flat-Rate Lower Contributions: Nations like Colombia and Spain fall into this category, where self-employed individuals pay a flat-rate, which is generally lower than what employed individuals contribute.

-

Mandatory Basic Pension Contributions Only: Some countries, including Ireland and the Netherlands, require contributions to basic pensions only, leaving gaps in earnings-related pensions for the self-employed.

- No Mandatory Contributions: Countries like Australia and Mexico do not have mandatory contributions for self-employed individuals, further exacerbating the pension predicament for freelancers.

Suggested Strategies for Enhanced Pension Security

For self-employed individuals, understanding one’s pension rights and obligations is vital. Here are a few strategies that freelancers can consider to improve their pension prospects:

Voluntary Contributions

Freelancers should consider making voluntary contributions to their pension schemes, particularly if their country allows it. This can compensate for lower mandatory contributions and secure a better retirement income.

Consultation with Financial Advisors

Seeking guidance from financial advisors who understand the nuances of pension schemes in different countries can provide personalized strategies for maximizing retirement savings.

Exploring Alternate Pension Schemes

In some countries, freelancers may have access to alternative pension schemes or retirement savings accounts designed for self-employed individuals. Understanding these options can lead to better financial health in retirement.

The Role of Policy in Shaping Pension Outcomes

The findings from the OECD report highlight an urgent need for reevaluation of policies impacting self-employed pension contributions. Countries that currently offer less favorable conditions for freelancers may need to consider reforms to ensure more equitable treatment in retirement benefits.

By addressing the disparities and creating frameworks that encourage adequate pension contributions, nations can significantly improve the financial security of their self-employed workforce.