Select Language:

The Growing Demand for Data Centers: A Global Overview

As the world increasingly embraces digital transformation, the demand for data center capacity is on the rise. This trend is particularly amplified by the recent boom in artificial intelligence (AI) technologies, which are driving a significant increase in computing needs. According to a report by the International Energy Agency, data center power demands are projected to more than double by 2030, underscoring the critical role these infrastructures play in our digital economy.

The Data Center Landscape in North America

Northern Virginia: The Data Center Epicenter

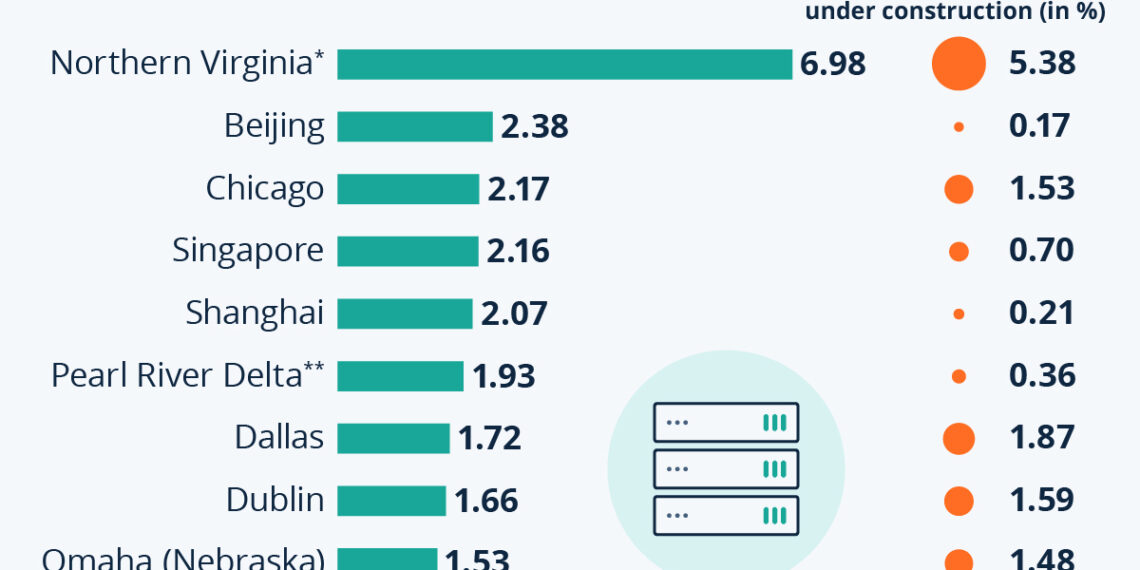

Northern Virginia stands out as a leading region for data center capacity in the United States. With nearly 7 gigawatts (GW) of installed capacity anticipated by 2024, it has become a magnet for major tech companies and service providers. Key factors contributing to this concentration include:

- Tax Incentives: Local and state governments offer significant tax breaks for data center operators, making it an attractive investment area.

- Superior Connectivity: The region boasts extensive fiber optic networks and robust telecommunications infrastructure that facilitate high-speed data transfer and connectivity.

- Resource Suitability: Northern Virginia’s physical environment is well-suited for large server farms, which require specific conditions for optimal performance and sustainability.

According to insights from Rob Faktorow, vice chairman of the real estate service provider CBRE, Northern Virginia’s infrastructure is expected to grow even more in the coming years. Approximately 5% of the world’s data center capacity is currently under construction in this region.

Other Key U.S. Data Center Markets

Beyond Northern Virginia, other notable U.S. locations include:

- Chicago: Known for its central location and robust infrastructure.

- Dallas: Attracts data centers due to its economic environment and minimal natural disaster risk.

- Omaha, Nebraska: Offers data centers favorable energy costs and a growing tech ecosystem.

The combined capacity of Northern Virginia, Chicago, Dallas, and Omaha is expected to reach around 12.4 GW in 2024, representing over 10% of the global capacity that is currently under construction.

Asia: A Rapidly Expanding Market

Key Regions of Data Center Capacity

Following North America, Asia emerges as the second-largest region in terms of data center power capacity. Major cities such as Beijing, Singapore, and Shanghai are at the forefront, demonstrating substantial installed capacities:

- Beijing: A driving force in China’s tech industry, hosting several large-scale data centers.

- Singapore: Recognized for its advanced infrastructure and regulatory framework that support data center operations.

- Shanghai and the Pearl River Delta: Key contributors to Asia’s data center capacity, with a combined total of 8.5 GW forecasted for 2024.

In addition to their current capacity, these regions have over 1.44% of global data center capacity under construction, indicating a healthy growth trajectory.

Europe: Emerging Data Center Hubs

Major Players: London and Dublin

Europe also plays a vital role in the global data center market, with significant capacities reported in key cities:

- London: Anticipated to have 1.45 GW of installed capacity by 2024, it continues to attract investment due to its strategic location and business landscape.

- Dublin: With a slightly higher capacity of 1.66 GW, Dublin is bolstering its reputation as a tech hub, aided by a favorable business environment and investment in infrastructure.

Both cities are planning further expansions to meet the rising demand for data center services in Europe.

The Future Demand for Data Centers

Projections for 2024 to 2030

The global appetite for data centers is set to grow substantially between 2024 and 2030. According to projections, global demand is expected to increase by an astounding 530 terawatt-hours (TWh). This demand trajectory surpasses the growth expected in sectors such as:

- Space and Water Heating: 454 TWh

- Heavy Industry: 403 TWh

However, the needs for cooling and electric transport are forecasted to be even higher, emphasizing the rapidly changing dynamics of energy consumption.

As the digital landscape evolves, so too will the requirements for infrastructure that can support emerging technologies and consumer demands. The robust development of data centers across various global regions is a testament to the pivotal role they play in shaping the future of technology and connectivity.