Select Language:

The Depths of the Chinese Property Crisis: A Closer Look at Country Garden’s Losses

A Major Announcement from Country Garden

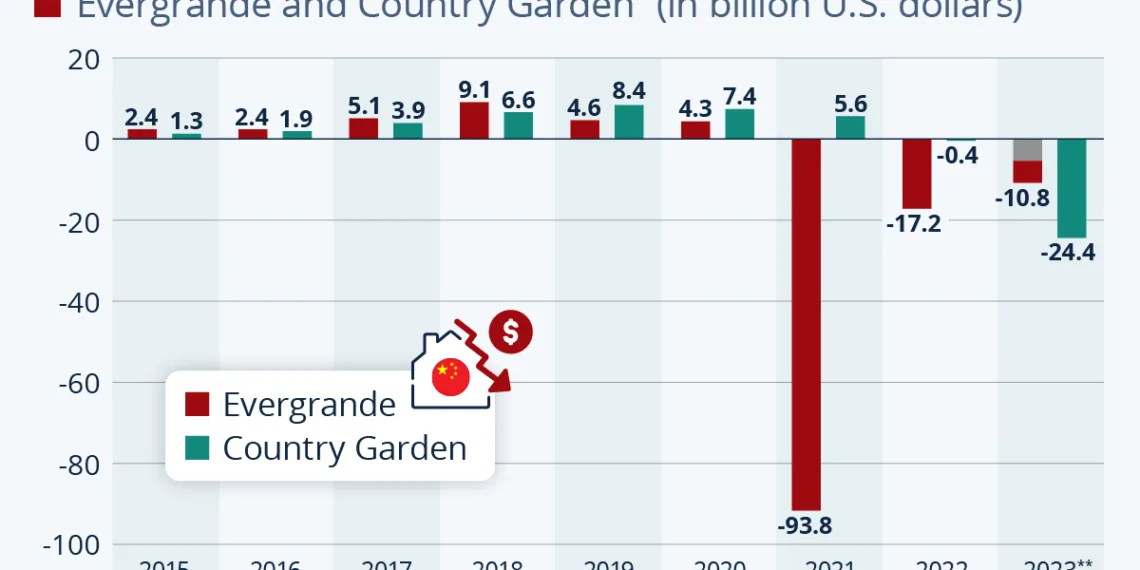

In recent developments, Country Garden, a prominent player in the Chinese real estate market, disclosed its financial figures for the year 2023 after an extended delay. The numbers revealed are staggering, showcasing an annual loss exceeding $24 billion. This loss is recorded as the second most significant decline in the history of China’s property sector, trailing only behind Evergrande’s devastating loss of nearly $94 billion in 2021. This alarming trend highlights the ongoing turmoil within the real estate market that is significantly impacting the Chinese economy.

Evergrande: The Face of the Property Collapse

Evergrande’s collapse has become a symbol of the broader crisis affecting the Chinese property market. The company, known as a mega-developer, reported staggering losses of nearly $94 billion in 2021. Following this catastrophic event, the company continued to face financial struggle, with reported losses of $17.2 billion for 2022 and an additional $5.4 billion in the first half of 2023.

The Current State of Affairs for Country Garden

While Country Garden reported substantial losses this year, the company anticipates smaller losses in its next financial update. This is a strategic assertion in light of investor concerns and the ongoing pressure from creditors. Despite these anticipated improvements, the reality remains that the damage from the property crisis has widespread ramifications.

The Legal Tangles: Liquidations and Court Orders

Evergrande’s situation worsened in August 2023 when it filed for bankruptcy in the U.S. Additionally, a Hong Kong court ordered the company’s liquidation in January 2024. However, it’s essential to note that most of Evergrande’s assets are located on the Chinese mainland, complicating the liquidation process as these properties fall outside the jurisdiction of U.S. and Hong Kong courts.

Country Garden faces similar challenges, having been first petitioned for liquidation in February 2024. A pivotal court date is set for May 26, where the company will once again confront the possibility of liquidation. Amidst these challenges, both companies are striving to restructure their debts, which have reached staggering amounts.

The Ripple Effect on the Chinese Economy

The effects of these property giants’ failures extend beyond their balance sheets. Evergrande’s debt has reached a level that is ten times its annual revenue, significantly impacting China’s GDP, accounting for 1.8%. The Chinese government’s regulations aimed at capping developers’ debt-to-cash, debt-to-assets, and debt-to-equity ratios in 2020 inadvertently triggered the property sector’s collapse, revealing flaws in the market’s foundation.

Prolonged Uncertainty for Creditors and Homebuyers

Experts predict that restructuring a giant like Evergrande may take an entire decade. This prolonged uncertainty leaves various stakeholders, including creditors and homebuyers, in a state of limbo. The fallout from the property crisis is not isolated, impacting various related sectors and diminishing overall economic health.

Reflecting Economic Lag and Consumer Confidence

The ongoing struggles within the Chinese real estate sector are manifestly indicative of a sluggish economy and a decline in domestic demand for goods and services. This scenario further complicates consumer sentiment, as the spectacular nature of the property collapse discourages spending and investment.

A Shift in Foreign Investment Dynamics

The implications of this crisis are also evident in foreign direct investment (FDI) trends. For the first time in 2023, FDI into China has seen a significant decline, raising alarms about a growing crisis of confidence among international investors. This decline may reflect broader apprehensions regarding China’s economic stability and the viability of its real estate market.

The Broader Implications of the Crisis

While the Chinese economy has not succumbed entirely to the property crisis, the repercussions are profound. As the property sector continues to face challenges, other business sectors are also reporting decreased revenues, showcasing an intricate web of interdependencies within the economy. The stabilization of the real estate market is crucial not only for recovery but also for restoring consumer confidence and ultimately bolstering economic growth.